Data Point

New-Vehicle Inventory Evaporating on Strong Sales

Wednesday April 14, 2021

Article Highlights

- The total U.S. supply of available unsold new vehicles stood at 2.66 million as of March, a strong sales month, drew to a close.

- The days' supply near the end of March fell to 59, the lowest since October 2020.

- Pickup trucks and large/luxury SUVs had the lowest supplies.

Robust March sales rapidly drew down new-vehicle inventory to the lowest levels in some time just as the spring selling season got rolling, according to a Cox Automotive analysis of vAuto Available Inventory data.

2.66M

Total Inventory

59

Days’ Supply

$39,717

Average Listing Price

The total U.S. supply of available unsold new vehicles stood at 2.66 million as March drew to a close, down from 2.82 million as February ended. Supply has been trending lower since mid-December and is running 25% behind last year and 31% below 2019.

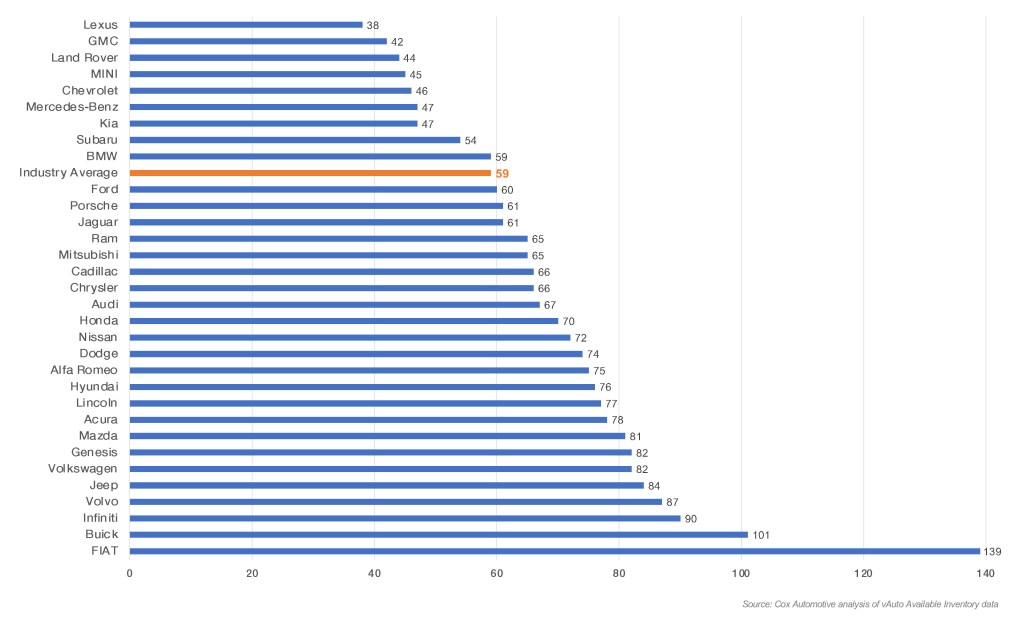

National Days’ Supply by Brand

The days’ supply as March ended plummeted to 59, the lowest days’ supply since October 2020. That compares with 78 at the end of February. March’s days’ supply is 41% below the same week a year ago and 38% below 2019 levels.

Inventory of new non-luxury vehicles was at 58 days’ supply, down from 78 at the end of February. Luxury days’ supply was at 60, down from 79 at the end of February.

The Cox Automotive days’ supply is based on the daily sales rate for the most recent 30-day period. The pace of sales quickened throughout March to the fastest pace since September 2019. Total new-vehicle sales in March soared 60% above year-ago levels, when the nation was largely in a pandemic lockdown. Sales were down 1% from 2019. That put the March SAAR at 17.8 million, the highest monthly SAAR since September and October 2018 following the aftermath of Hurricane Harvey.

“Spring 2021 is going to be difficult for shoppers with supply limited and demand surging,” said Charlie Chesbrough, Cox Automotive senior economist. “Vehicle buying always picks up in the spring. This year has additional tailwinds from rising optimism about the economy and vaccinations along with government stimulus checks.”

Chesbrough sees no let-up in demand and no improvement in supply in the short term. Auto assembly plants continue to be hampered with supply chain disruptions, most notably the global shortage of computer chips. A slowdown in demand to allow production to catch up is unlikely until possibly the fall. Chesbrough predicts the days’ supply in April could fall even further, by as much as 15 days.

Strong demand and low supply mean high prices with little discounting by dealers and automakers. As March closed, the average listing price was $39,717. For luxury vehicles, the average listing price broke through the $60,000 mark – $60,921- up from $59,469 in February. The average non-luxury listing price in March was $36,394, down some from $36,662 in February.

Strong demand and low supply also mean low incentives. Average incentives declined in March to an average of $3,416 per vehicle, down 15% from a year ago. Incentives were a mere 8.3% of the average transaction price that was $40,472 in March. That was the lowest level of incentives since April 2015.

Shoppers may have a tough time finding the exact vehicle they want. They will also have a challenge finding a great deal, noted Chesbrough.

Hardest to find models

The popular Kia Telluride may well be the toughest vehicle to find in the U.S. Nationally, its days’ supply is a scant 14 days, even lower than what it has been. Of the 210 DMAS (designated market areas or media markets), 83% have less than 20 days’ supply of the Telluride so the shortage is widespread. And the tight supply can’t be blamed on production disruptions like the computer chip shortage. Rather, the Telluride is simply a hot-selling vehicle that is outpacing production.

Its cousin, the Hyundai Palisade, was in a bit better shape with 33 days’ supply. The Chevrolet Corvette, which had the lowest days’ supply in February, also had 14 days of supply.

Toyota’s pickup trucks continue to be in extremely tight supply, and the chip shortage is making the situation worse. Toyota purposely slowed the production of the full-size Tundra pickup truck, which will be launched in redesigned form later this year, to reallocate its computer chips to other hot-selling models.

The Tacoma, which dominates the midsize truck market, had only 17 days’ supply for the popular four-wheel-drive model. Almost 70% of the DMAs have less than 20 days of supply. “The supply that does exist isn’t in the right spots,” said Chesbrough. “It is situations like this that suggest tight inventory is likely to limit sales in the second quarter.”

Trucks and large, luxury SUVs in tightest supply

Toyota is not alone in truck shortages. Trucks and SUVs – large, luxury ones – have among the lowest supplies.

Full-size pickup trucks had a below-industry-average inventory 48 days’ supply, down significantly from 61 in February. Chevrolet Silverado had between 33 and 46 days’ supply, depending on the model. GMC Sierra had 20 to 38 days of supply, depending on the model. The Ford F-150, which is being built without the computer chip, parked, and not sold until the chips arrive, was down to a 56 days’ supply. The Super Duty versions had even less. The Ram 1500 had only 61 days of supply, though the Ram 1500 Classic, a favorite with fleets, had 105 days’ supply. The Nissan Titan, which has big incentives on it through early May, had a 100 days’ supply.

Midsize truck inventory was even lower at only 42 days’ supply, down from 55 in February. The Chevrolet Colorado was down to 30 days’ supply. Its GMC counterpart, the Canyon, had a 37 days’ supply. The Honda Ridgeline also was low at 32 days’ supply. The Ford Ranger was in the best shape at 66 days’ supply.

Luxury SUVs had the absolute lowest inventories of any major segment at 38 days’ supply. The Cadillac Escalade and Escalade ESV pulled down the average at 19 and 24 days’ supply respectively.

Large non-luxury SUVs had only 46 days’ supply. GM’s new full-size models – the Chevrolet Suburban and Tahoe and GMC Yukon and Yukon XL – brought the average down with their extremely low inventory.

Midsize SUVs – luxury and non-luxury – each had 53 days’ supply. In addition to the Kia Telluride and Hyundai Palisade, Toyota’s new Highlander had a skimpy supply, as did Toyota RAV4, in the compact category.

Even minivan inventories, bloated not long ago, had days’ supply fall below average to 49. The Chrysler Pacifica is down to 64 days’ supply as the plant in Windsor, Ont., where it is built, has downtime due to the chip shortage.

While other vehicle categories had days’ supply above the industry average, most had declined noticeably from February to March.

Lexus, Toyota, GMC and Kia lowest supplies

Toyota, once again, was the brand with the lowest inventory of mainstream non-luxury brands at 41 days’ supply. Other brands at the low end were GMC at 42; Kia at 47; Subaru at 54; Chevrolet at 58; and Ford at 60.

March was a record-breaking month for luxury vehicle sales, with the race for sales leadership tightening. Mercedes-Benz returned to No. 1, powered by strong demand for its luxury crossovers. But its lead narrowed from a year earlier. Lexus was closer on its heels, and BMW was closing in tighter on Lexus. The 2021 luxury sales crown may well come down to who has the most inventory of what buyers want.

And, once again in March, Lexus had the skimpiest inventory of luxury makers – and most non-luxury brands, at 38 days’ supply. Its three volume products – the ES, RX and NX – were low on stock. Mercedes and BMW both had 47 days’ supply, by no means abundant.

High price, low inventory

It seems the higher the price tag, the lower the inventory. The days’ supply for vehicles priced above $80,000 was 41; between $60,000 and $80,000, 41. Under $20,000 and between $30,000 and $60,000 were in the mid-50 days’ supply. The $20,000 to $30,000 category, dominated by traditional sedans, had the heftiest inventories at 68 days’ supply.

More insights are available from Cox Automotive on new-vehicle inventory, using a 30-day rolling sales methodology to calculate days’ supply.