Data Point

New-Vehicle Inventory Remains Stable, While Days’ Supply Reporting Is Bumpy Due to DMS Outage

Thursday August 15, 2024

Article Highlights

- Inventory stabilized, while days’ supply proved volatile as sales and inventory reporting continued to be inconsistent following the industry disruption in June.

- New model year vehicles hit showrooms, and incentives rise to help move older metal off the lots.

- The average listing price remains high at $47,307, but there are plenty of options for consumers at more attractive prices.

Revised, Sept. 19, 2024 – An industry-wide disruption in June, due to a cyber breach at a widely used dealer management system (DMS) supplier, has created volatility in reporting of sales and days’ supply across Cox Automotive’s data sets. This is revealed in a new-vehicle days’ supply of 70 at the start of August, representing a significant drop of 42% from last month’s report, according to Cox Automotive’s analysis of vAuto Live Market View data.

2.76M

Total Inventory

as of Aug. 1, 2024

70

Days’ Supply

$47,237

Average Listing Price

The Cox Automotive days’ supply is based on the daily sales rate for the most recent 30-day period, which ended August 1.

The impact was initially seen in the July report with inflated days’ supply levels thanks to lower reported sales. That is now unwinding and showing large amounts of variability in the other direction. As our reporting is based on estimates that continue to fluctuate over time, sometimes widely, we do expect the data to continue to normalize over the month of August.

The total U.S. supply of available unsold new vehicles opened August at 2.76 million units. This is down 4.5% month over month, which is representative of the delayed reporting due to the outage. While days’ supply reporting remains bumpy, the inventory numbers have appeared to stabilize and show a decent pace of new-vehicle inventory hitting showroom floors.

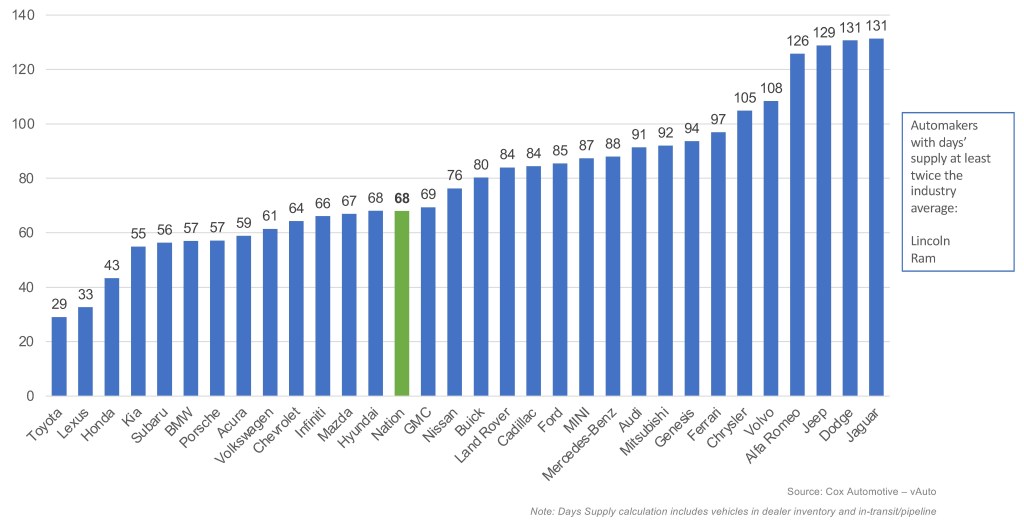

Model year 2025 vehicles are beginning to arrive. MINI, Honda, Genesis, Jaguar, Volvo and Subaru show 40% or more of the current inventory on dealer lots to be MY25 vehicles. On the other end of the spectrum, Stellantis’ brands continue to face surplus inventory challenges. Dodge is holding onto approximately 30% of the previous model year vehicles – MY2023 – impacting their days’ supply, which remains elevated at 131 days, while Chrysler has 14% of prior model year vehicles, with a 105 days’ supply. Ram did appear to sell down some of the previous model year vehicles, which helped to lower its sky-high days’ supply, but Ram continues to carry a days’ supply of inventory at well more than twice the industry average.

JULY DAYS’ SUPPLY OF INVENTORY BY BRAND

Compact and subcompact SUVs such as the Honda CR-V and Chevrolet Trax, as well as sedans like the Toyota Camry and Nissan Sentra, continue to have an average lower days’ supply than the national average. The Ford F-150 is still among the top sellers in the industry. It holds onto an 80 days’ supply, showing that high-priced vehicles are selling, as pickup trucks typically have higher days’ supply measures. The Chevrolet Silverado 1500, with the F-150 on the list of best-selling vehicles in the U.S., had days’ supply at 70 at the start of August.

The average listing price for a new vehicle at the start of August was $47,237, lower by $159 compared to one year ago. Several brands, however, have more attractive average listing prices, such as Honda at $37,210, Mazda at $35,689 and Buick at $31,572.

As incentives increase, deals will continue to help move the older metal on dealership lots. Additionally, as supply in the used-car market tightens, shoppers may increasingly turn to the diverse new-car inventory available.

Erin Keating

Erin Keating is an Executive Analyst and Senior Director of Economic and Industry Insights at Cox Automotive. She has 25 years of experience in marketing and communications, including 10 years with Audi of America, where she also ran Audi Motorsport North America. With a focus on the wider industry, the individual automakers, and consumer shopping and buying behavior for new vehicles, Erin provides analysis and insights leveraging the breadth and depth of data from DRiVEQ, Cox Automotive’s data intelligence engine. Upon joining Cox Automotive, Erin was responsible for Enterprise Data Strategy – Partnerships. Erin is based in Atlanta.