Data Point

New-Vehicle Inventory at Start of December Modestly Higher, as Sales Pace Indicates Santa is Coming

Thursday December 19, 2024

November saw another month of increased sales pace as consumers and dealers alike expressed optimism and confidence in the economy and vehicle availability. Inventory increased by just over 8,700 units through the month of November. Sales increased by 6.5%, with 67,000 more units sold in November compared to October.

3.15M

Total Inventory

as of Dec. 5, 2024

85

Days’ Supply

$48,978

Average Listing Price

According to an analysis of vAuto Live Market View data, the total U.S. supply of available unsold new vehicles has consistently remained higher than 3 million units since the beginning of October. At the start of December, new-vehicle inventory volume in the U.S. stood at 3.15 million units, the highest point in 2024 but 11% lower than the inventory count at the start of December 2019. Days’ supply continues to move downwards, dropping 5.9% month over month to 85 days. Days’ supply from the previous report was revised higher to 90 days.

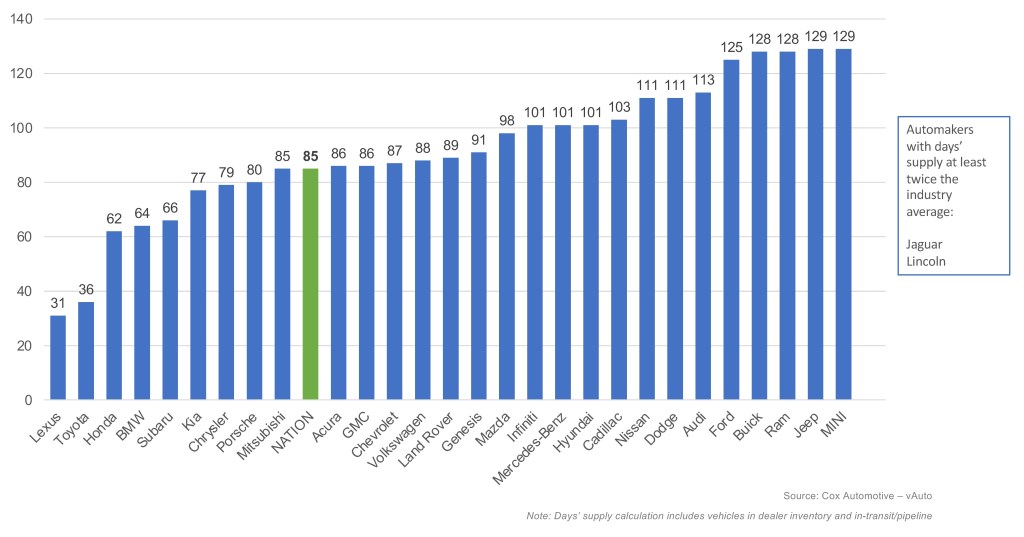

Domestic automakers continue to see some of the highest days’ supply, while the Japanese brands Honda, Toyota and Lexus carry the lowest inventory on the ground. Hybrids, compact cars and compact SUVs are consistently selling at a faster pace. Honda and Toyota have traditionally been strong in these hot segments, and they continue to run low in supply. The Toyota RAV4, Camry and Honda CR-V were three of the top five best sellers in November and have an average supply of 35 days, far below industry average. The average listing price of those three models: $36,716, also well below the industry average.

NOVEMBER DAYS’ SUPPLY OF INVENTORY BY BRAND

With consumer confidence improving and market performance strengthening, the domestic market’s focus on larger SUVs and full-size pick-ups will likely see improvement. The Ford F-150 remains the best-selling full-size pick-up in the market, with the Chevrolet Silverado 1500 close behind. The F-150 and the Silverado 1500 have a combined average listing price of $57,577 and 105 days’ supply. Full-size pickup truck inventory typically runs higher than the industry average, as dealers carry multiple versions and models.

New-Vehicle Pricing’s New Normal

The average listing price for a new vehicle in the latest report was $48,978, up 1.8% from a month earlier and higher by 2.8% compared to last year. Given the cost of producing vehicles in a diverse and complex market like the U.S. shows no sign of easing, 2025 could see more of the same. The good news story is that incentives continue to climb, wages are growing steadily, loan rates are decreasing, signaling that affordability is improving even if prices remain high.

The average transaction price (ATP) of a new vehicle in the U.S. in November, reported earlier this month, was $48,273, up $720 from the month prior and higher year over year by 1.5%, according to Kelley Blue Book. However, industry-average incentive spending continues to rise and was 8% of ATP ($3,914), up from 7.8% in October and well above the 5.3% reported one year ago. Nissan, Stellantis, Volkswagen and Tesla all saw incentive spend as a percentage of ATP over 10%.

Erin Keating

Erin Keating is an Executive Analyst and Senior Director of Economic and Industry Insights at Cox Automotive. She has 25 years of experience in marketing and communications, including 10 years with Audi of America, where she also ran Audi Motorsport North America. With a focus on the wider industry, the individual automakers, and consumer shopping and buying behavior for new vehicles, Erin provides analysis and insights leveraging the breadth and depth of data from DRiVEQ, Cox Automotive’s data intelligence engine. Upon joining Cox Automotive, Erin was responsible for Enterprise Data Strategy – Partnerships. Erin is based in Atlanta.