Data Point

Auto Credit Availability Expands Again in November, Approaches Early 2019 Levels

Friday December 10, 2021

Article Highlights

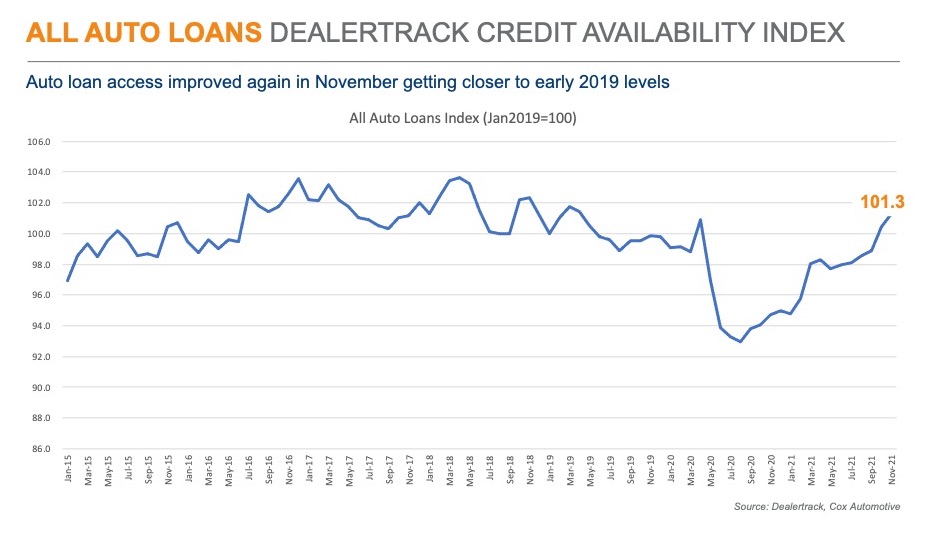

- Access to auto credit expanded again in November, according to the Dealertrack Auto Credit Availability Index for all types of loans.

- The All Loans Index increased 0.8% to 101.3 in November, reflecting that auto credit was easier to get in the month compared to October.

- Access was looser by 6.9% year over year and compared to February 2020, access was looser by 2.1%. The index was last higher in April 2019.

Access to auto credit expanded again in November, according to the Dealertrack Auto Credit Availability Index for all types of auto loans. The All Loans Index increased 0.8% to 101.3 in November, reflecting that auto credit was easier to get in the month compared to October. Access was looser by 6.9% year over year and compared to February 2020, access was looser by 2.1%. The index was last higher in April 2019.

All loan types saw easing in November. Non-captive new loans loosened the least, while certified pre-owned (CPO) loosened the most. On a year-over-year basis, all loan types were easier to get with non-captive new loans having loosened the most.

Credit trends were more varied in November by lender type, as credit unions did not loosen but all other types loosened with captives loosening the most. On a year-over-year basis, all lenders had looser standards with credit unions having loosened the most. In addition, all lender types were also looser compared to February 2020. Compared to February 2020, auto-focused finance companies have loosened the most.

The Dealertrack Credit Availability Index is a monthly index based on Dealertrack credit application data and will indicate whether access to auto loan credit is improving or worsening. The index will be published around the 10th of each month.