Data Point

Wholesale Prices Increased at Slowing Pace in November

Tuesday December 7, 2021

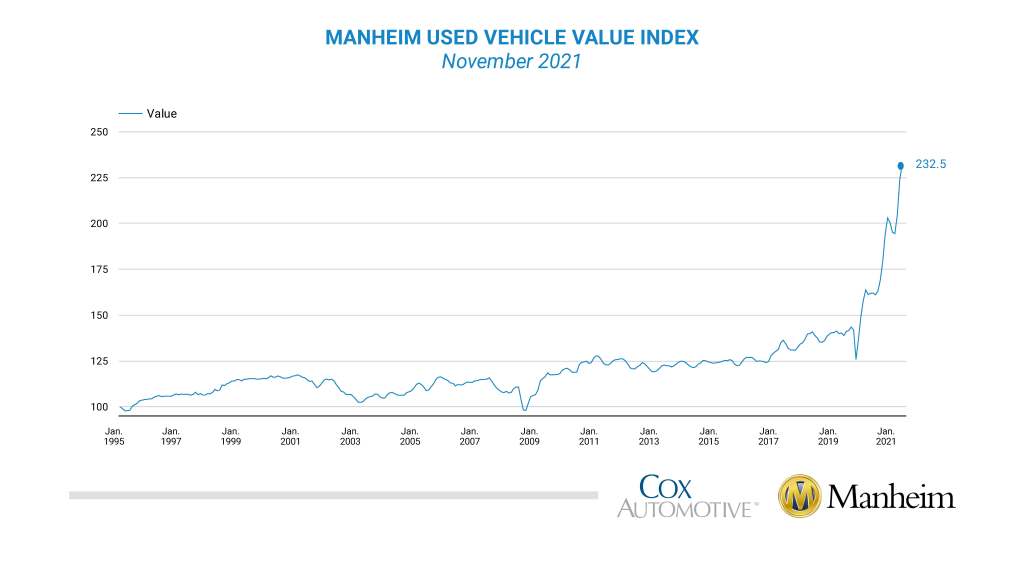

Wholesale used vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) increased 3.9% month over month in November. This brought the Manheim Used Vehicle Value Index to 232.5, a 43.5% increase from a year ago. The non-adjusted price increase in November was 1.9% compared to October and 43.8% year over year.

Manheim Market Report (MMR) values saw weekly price increases decelerate and reverse over the course of November. Over the full four weeks in the month, the Three-Year-Old Index increased a net 1.9%. Over the month of November, daily MMR Retention, which is the average difference in price relative to current MMR, averaged 99.4%, which meant that market prices were behind MMR values. The average daily sales conversion rate also declined in the month to 59%, which remained elevated for the time of year. For example, the sales conversion rate averaged 52% in November 2019. This indicates that buyers remained more aggressive in buying than is typically the case in the fall but were less aggressive than in October.

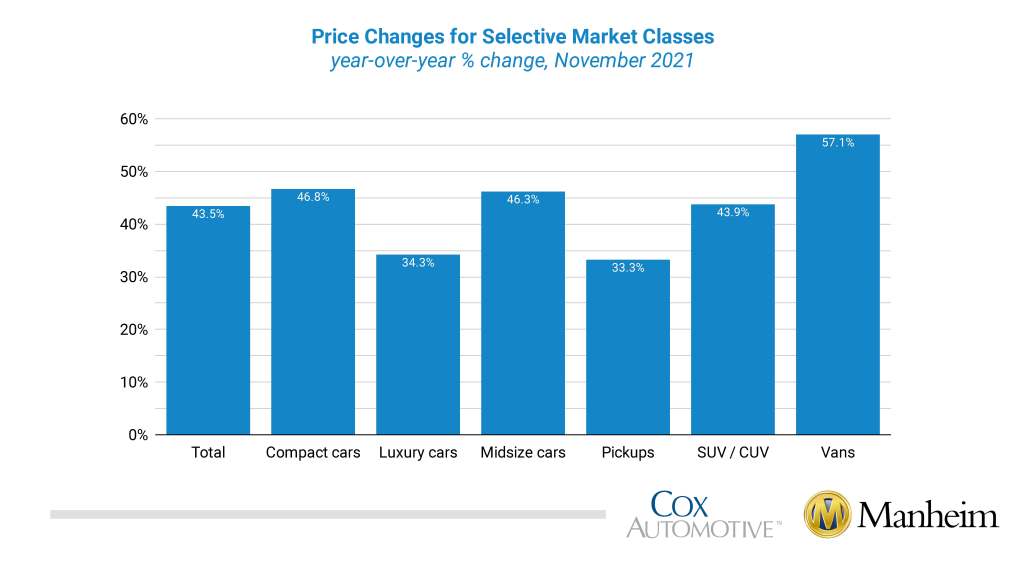

On a year-over-year basis, all major market segments saw seasonally adjusted price increases in November. Vans had the largest year-over-year performance, while the pickup and luxury car segments lagged the overall market. On a month-over-month basis, no segment saw declines, with compact cars outpacing the market and remaining segments.

Vehicle sales continue downward trend. According to Cox Automotive estimates, total used vehicle sales were down 2% year over year in November. We estimate the November used SAAR to be 37.2 million, down from 38.1 million last November and flat compared to October’s 37.2 million SAAR. The November used retail SAAR estimate is 20.4 million, up from 20.2 million last year and flat month over month.

Using a rolling seven-day estimate of used retail days’ supply based on vAuto data, we see that used retail supply peaked at 114 days on April 8, 2020. Normal used retail supply is about 44 days’ supply. It ended November at 49 days, above normal levels. We estimate that wholesale supply peaked at 149 days on April 9, 2020, when normal supply is 23. It ended November at 29 days. The final week of November brought large fluctuations in supply metrics due to the Thanksgiving holiday.

November total new-vehicle sales were down 17% year-over-year, with one more selling day compared to November 2020. Month over month, November new vehicle sales were down 4%. The November SAAR came in at 12.9 million, a decrease from last year’s 15.9 million and November 2019’s 17.1 million rate.

Combined sales into large rental, commercial, and government buyers were down 21% year over year in November and down 1% year to date through November compared to the same time period in 2020. Sales into rental decreased 55% year over year in November and are down 4% year to date through last month compared to the same time period last year. Commercial sales are up 23% year over year in November and are up 12% year to date in 2021 versus 2020. Including an estimate for fleet deliveries into the dealer and manufacturer channel, we estimate that the remaining retail sales were down 15% year over year in November, leading to an estimated retail SAAR of 11.2 million, which was down from 13.5 million last November and down from November 2019’s 13.7 million rate.

Rental risk mileage increases. The average price for rental risk units sold at auction in November was up 46% year over year. Rental risk prices were down 6% compared to October. Average mileage for rental risk units in November (at 76,000 miles) was up 39% compared to a year ago and up 25% month-over-month.

November saw mixed trends with consumer confidence. Consumer Confidence according to the Conference Board declined 1.9% in November, and October’s index was revised down as well. The declines left confidence down 17.4% compared to February 2020. Confidence has declined in four of the last five months and is now at the lowest level since February. The underlying measures of present situation and future expectations both declined with present situation declining the most. Plans to purchase a vehicle in the next six months declined to the lowest level since 2010. Plans to purchase a home also declined to its lowest level since 2010. In comparison, the sentiment index from the University of Michigan reported a 6.0% decline in November, leaving it down 33% since February 2020. The Morning Consult daily index saw modest improvement of 1.1% in November after having declined in every month since April.

The complete suite of monthly MUVVI data for December will be released on Friday, Jan. 7, 2022, the fifth business day of the month as regularly scheduled. If you have any questions regarding the Index, please contact the Cox Automotive Industry Insights team at Manheim.Data@coxautoinc.com.

The next Manheim Used Vehicle Value Index quarterly call is scheduled for Friday, Jan. 7, 2022. Register to attend.