Data Point

November Fleet Sales Recovery Reverses Slightly, Remain Down 29% From Year-Ago Level

Monday December 7, 2020

Article Highlights

- In November, 132,145 total fleet units were sold, compared to 132,560 in October.

- Combined sales into large rental, commercial, and government buyers were down 29% year over year in November.

- Toyota saw its best performing month in fleet sales for year-over-year growth in 2020, attributed mostly to rental performance at a 151% year-over-year growth.

In November, 132,145 total fleet units were sold, compared to 132,560 in October. Combined sales into large rental, commercial, and government buyers were down 29% year over year in November.

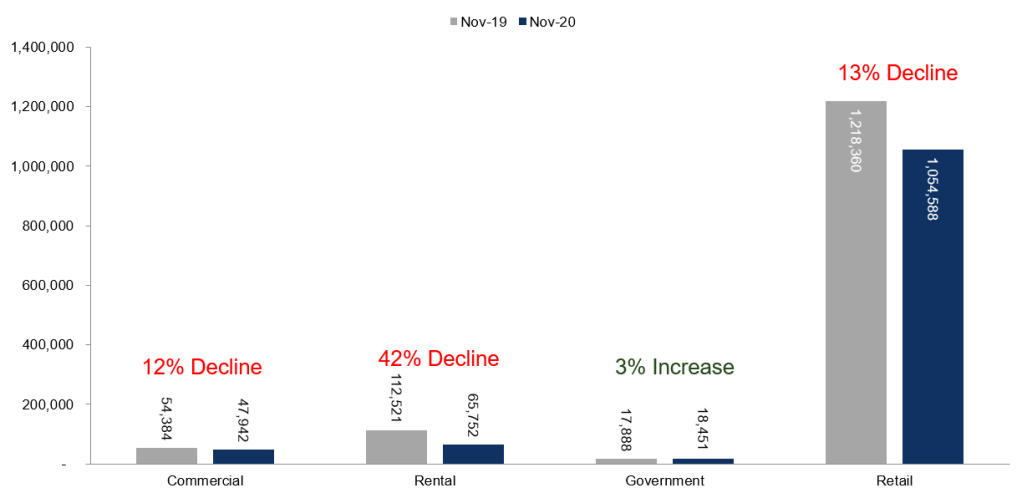

Government units were up 3% year over year, on a small base, while rental units were down 42% year over year in November, an improvement over the 43% year-over-year drop in October. New-vehicle sales into the commercial channel declined 12% year over year in November.

We estimate that fleet sales are down 38% in 2020 through November, while retail sales are down 12%, and the overall new-vehicle market is down 17% so far this year.

Including an estimate for fleet deliveries into the dealer and manufacturer channel, we estimate that the remaining retail sales were down 13% year over year in November, leading to an estimated retail SAAR of 13.5 million, down from 14.4 million last November and down from October’s 14.4 million rate.

November total new-vehicle sales were down 15.4% year over year, with three fewer selling days compared to November 2019. The November SAAR came in at 15.6 million, a decrease from last year’s 17.0 million and down from October’s 16.3 million rate.

Looking at automakers, year-over-year changes in fleet sales ranged from an increase of 122% to a decrease of 49%. Toyota saw its best performing month in fleet sales for year-over-year growth in 2020, attributed mostly to rental performance at a 151% year-over-year growth. General Motors saw the largest decrease in fleet sales in October, according to a Cox Automotive analysis.