Commentary & Voices

Q1 2019 Kelley Blue Book Brand Watch: Non-Luxury Segment

Tuesday May 28, 2019

Article Highlights

- America’s love for SUVs shows no sign of slowing down. Almost two-thirds of new-car shoppers consider an SUV, despite a rising average transaction price (ATP) of $38K for midsize and $29K for compact SUV.

- The pickup truck segment was the only segment posting YoY growth in consideration, thanks to new entries, including the Ford Ranger and Jeep Gladiator that went on sale in the hot midsize truck segment in Q1 2019.

- Affordability jumped in importance by 6%, and Fuel Efficiency by 9% YoY as consumers look for ways to save money.

Kelley Blue Book Brand Watch™ is a consumer perception survey that also weaves in consumer shopping behavior to determine how a brand or model stacks up with its segment competitors on a dozen factors key to a consumer’s buying decision. Kelley Blue Book produces quarterly Brand Watch reports for non-luxury and luxury brands.

Non-Luxury Consideration

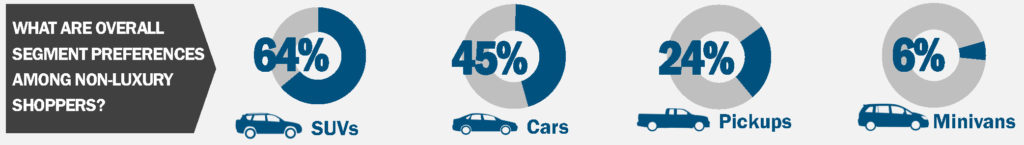

America’s love for SUVs shows no sign of slowing down. Almost two-thirds of new-car shoppers consider an SUV, despite a rising average transaction price (ATP) of $38K for midsize and $29K for compact SUV. In Q1, SUV sales increased 5% year-over-year (YoY). Still, cars are not dead. Despite a decline in consideration and sales, roughly 1 in 2 people put a car on their consideration list.

Overall Non-Luxury Segment Consideration

The pickup truck segment was the only segment posting YoY growth in consideration, thanks to new entries, including the Ford Ranger and Jeep Gladiator that went on sale in the hot midsize truck segment in Q1 2019. The Detroit 3 and Toyota are planning to refresh their offerings to capitalize on the big demands and profitability of trucks from now into early 2020.

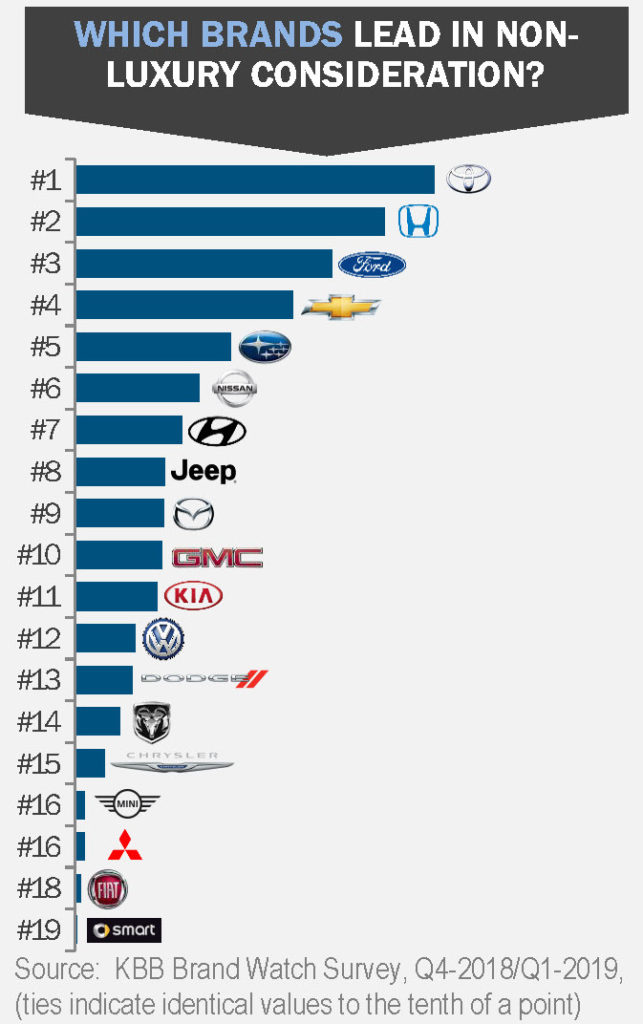

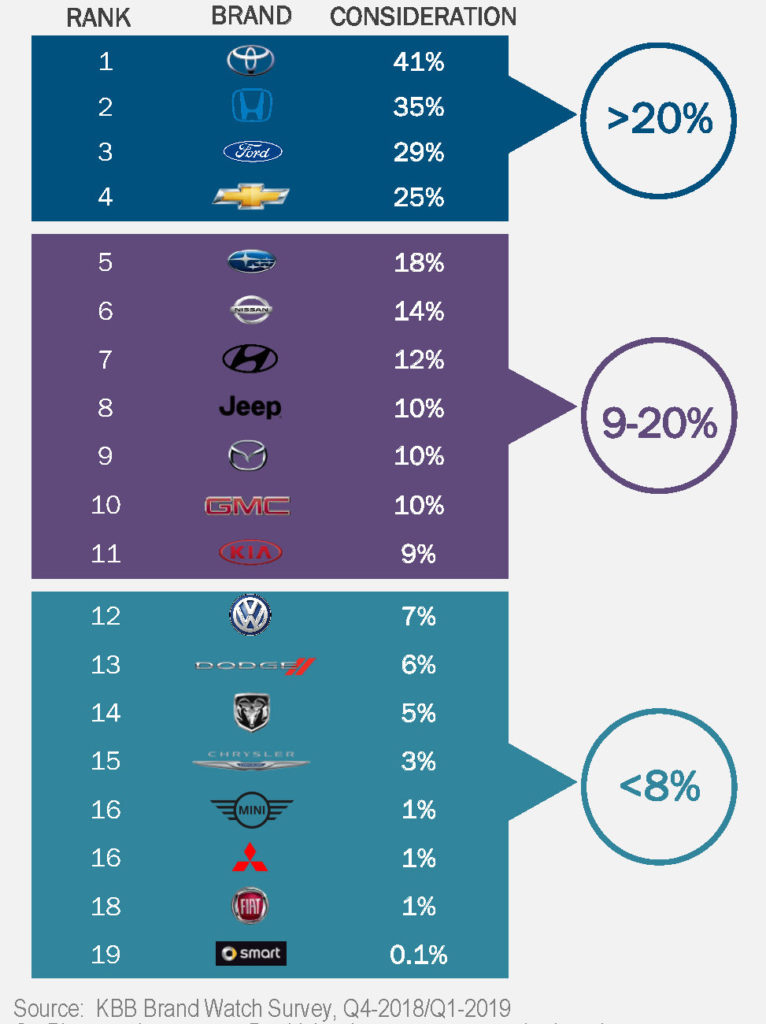

Overall Non-Luxury Brand Consideration

Toyota distanced itself from Honda to hold its 1st place in consideration for 4 quarters in a row. Toyota beat Ford with its 2nd-ever KBB.com Brand Image Award (BIA) for Best Overall Truck. Toyota reduced incentives spend. In fact, over the past year, Toyota’s incentives remained relatively low ($2.000) and comparable to Honda’s ($1700). In contrast, FCA brands have had some of the highest incentives among all non-luxury brands -Chrysler ($5,700), Ram ($5600) & Dodge ($4,300).

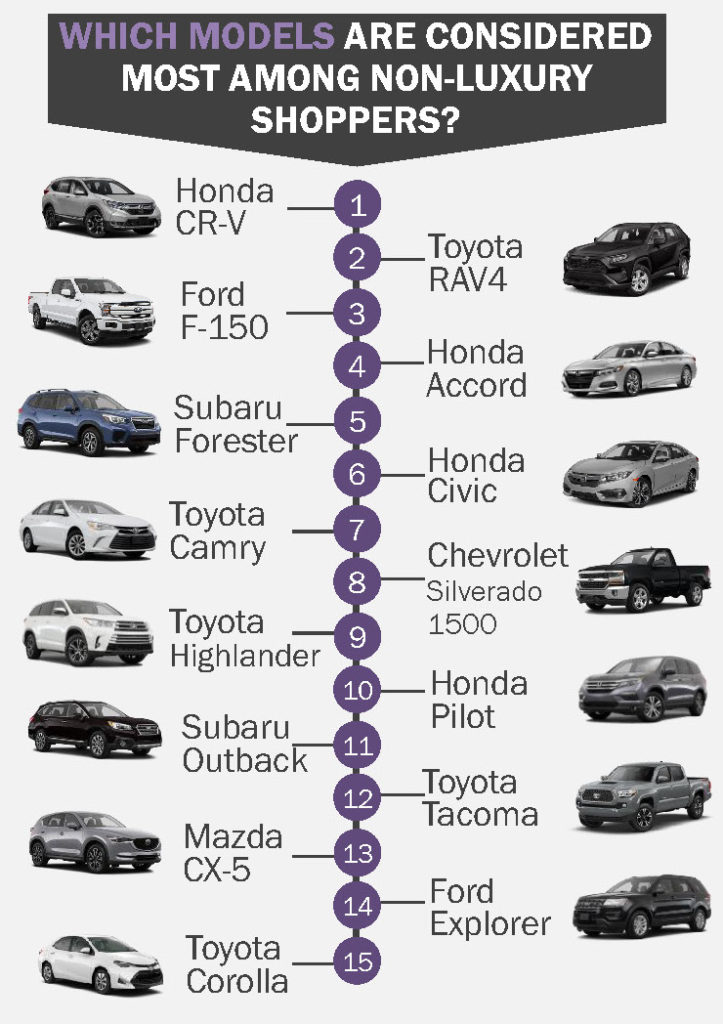

Top Considered Non-Luxury Models Overall

SUVs are still top of mind for new-vehicle shoppers. In Q1, eight of the top 15 vehicles considered was a utility vehicle. Toyota showcased its diverse lineup and consumer appeal with 5 vehicles (RAV4, Camry, Highlander, Tacoma & Corolla) in the top 15. Consumers alsolove Hondas and Subarus. The only domestic brands on the board were Ford and Chevrolet for their iconic full-size pickup trucks.

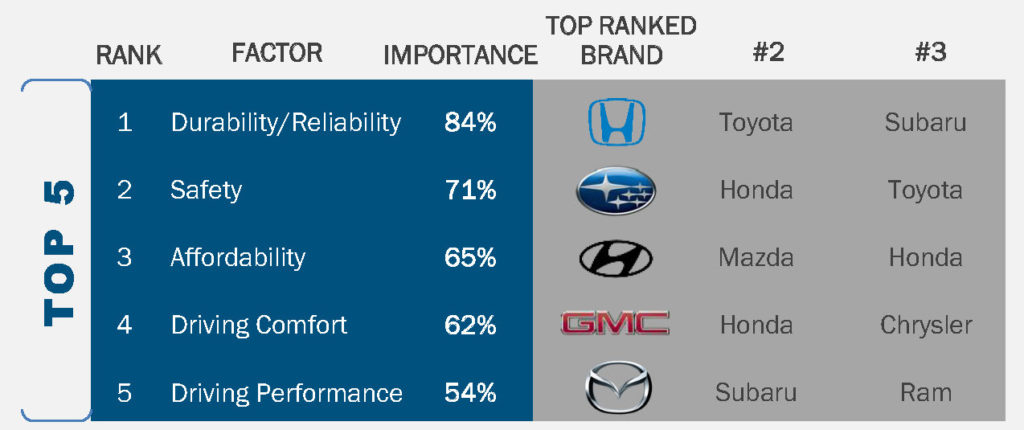

Factors of Importance Driving Non-Luxury Vehicle Consideration

Affordability jumped in importance by 6%, and Fuel Efficiency by 9% YoY as consumers look for ways to save money. As gas prices and ATPs have risen, value brands like Honda and Hyundai are top of mind when people shop for a new car. Emotional factors gainedinimportance for shoppers who value Technology, Exterior Styling, and Prestige/Sophistication.

Download the entire Brand Watch report below.