Commentary & Voices

Q1 2021 Kelley Blue Book Brand Watch Report: SUVs Hit Another Record; Subaru Models Ride the Wave

Wednesday May 5, 2021

Article Highlights

- A record 67% of non-luxury shoppers considered an SUV.

- Subaru Outback, Forester had biggest hikes in shopping consideration.

- Ford lost steam; Ram returned to a winning streak.

SUVs dominated again in the first quarter as Subaru Outback and Forester rode that wave, according to the Kelley Blue Book Brand Watch™ report for Q1 2021. Kia gained more than other brands, Ford lost a bit of steam, and Ram returned to a winning streak in terms of factors important to shoppers.

The Kelley Blue Book Brand Watch report is a consumer perception survey that also weaves in consumer shopping behavior to determine how a brand or model stacks up with its segment competitors on a dozen factors key to a consumer’s buying decision. Kelley Blue Book produces a separate Brand Watch report for non-luxury and luxury brands each quarter.

SUVs Shopping Hits Another Milestone

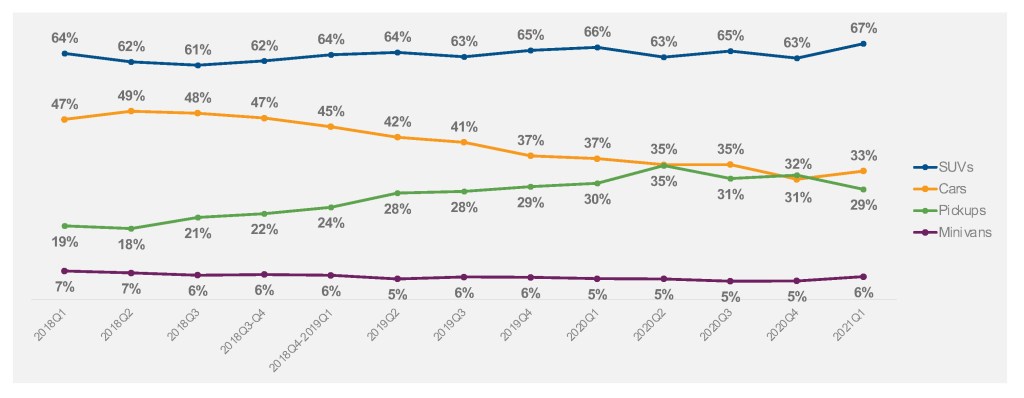

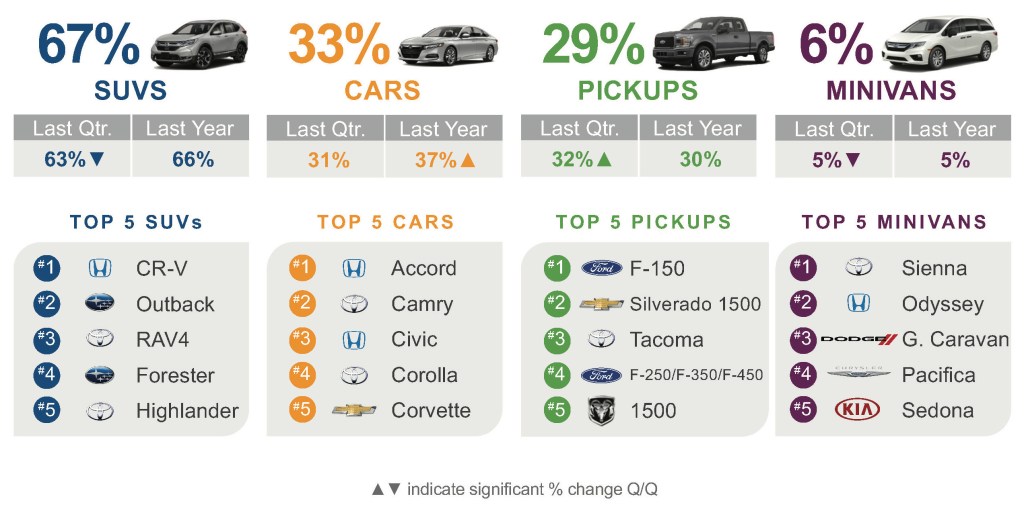

SUVs were the big overall winner in the first quarter. Of all non-luxury vehicle shoppers, a record 67% considered an SUV. That compares with the previous high of 66% in the year-ago quarter and 63% in the final quarter of 2020.

Segment Consideration

Japanese brands dominated SUV shopping. Subaru advanced with significant growth in shopping for the Outback and Forester, both of which were among the Top 5 most-shopped SUVs and Top 10 most-shopped vehicles in total.

The Subaru Outback had the highest increase in shopping consideration of any non-luxury vehicle, up a hefty 34% from the previous quarter. That allowed the Outback to replace Toyota RAV4 as the second most-shopped SUV. The RAV4, which had shopping consideration slip by 5%, dropped to third. The Outback may gain further momentum as Subaru introduces the Outback Wilderness trim package in the second quarter. The Forester had the second-highest increase in shopping consideration, up 18%, which made it the fourth most-shopped SUV.

Honda CR-V, which had a healthy 9% gain in shopping consideration, retained its title of most-shopped SUV. The Toyota Highlander rounded out the Top 5, even though its shopping consideration slipped by 4%. The Ford Explorer, despite much higher sales in the quarter, fell off the Top 5 shopping list.

Pickup Trucks Take a Breather

Shopping for pickup trucks has been taking a bit of a breather lately after hitting record highs in 2020. In the first quarter, 29% of all non-luxury shoppers considered a pickup truck, the lowest level since the fourth quarter of 2019.

Quarterly Non-Luxury Segment Consideration

In the first quarter of 2020, the percentage was 30%. Then the pandemic hit, and manufacturers aggressively promoted zero-percent financing to lure truck buyers out of their pandemic doldrums. Shopping consideration for trucks in the middle of 2020 hit a record of 37% but slipped back to a still-historically high 32% by year-end.

In the first quarter, trucks were particularly affected by the global computer chip shortage that prompted production cuts at numerous plants and led to a hefty drawdown of inventory. Low supply may have scared off prospective truck shoppers.

Despite a 16% decline in shopping consideration, the Ford F-150 reigned again as the most-shopped truck, followed, as usual, by its archrival Chevrolet Silverado, with its 13% decline in shopping. They were followed by the midsize Toyota Tacoma and Ford Super Duty models. Both had lower shopping considerations. Tacoma was down 11%. Ford Super Duty shopping was off 25%.

The Ram 1500 popped onto the Top 5 pickup truck list. It had been pushed to No. 6 by GMC Sierra in the middle of 2020, but Ram rebounded and GMC Sierra lost steam.

Car Shopping Holds Steady for Now

Shopping consideration for traditional cars stopped their freefall, at least for now. Exactly a third of consumers considering a non-luxury vehicle considered a car, up from 31% in the 2020 fourth quarter but well off the 37% from the year-ago quarter. The first quarter may have seen more interest in new cars because used cars were in short supply and prices were soaring to new heights. Credit was cheap and widely available even to subprime borrowers who may have turned to new cars instead of used ones.

The rise in car shopping and the fall in truck shopping meant cars beat trucks by a tad. The fourth quarter of 2020 marked the first time ever that pickup truck shopping surpassed car shopping.

Still, cars generally remain out of favor. Sales of cars are below a quarter of all vehicles sold. For comparison, in 2018, shopping consideration for cars was just shy of 50%. It has been in decline ever since, hitting a low of 31% in last year’s fourth quarter.

Stalwart midsize cars led. The Top 5 most-shopped cars held mostly steady: Honda Accord, which saw a 2% gain in shopping consideration; Toyota Camry; Honda Civic, which launches in the redesigned form in the second quarter; Toyota Corolla; and Chevrolet Corvette, took the No. 5 spot again in the first quarter from Ford Mustang, which has been No. 6 the last two quarters.

Shopping for minivans eked out an increase as 6% of non-luxury shoppers considered minivans compared with 5% in previous quarters. The slight movement likely is due to the launch of the new Toyota Sienna, now available only as a hybrid.

Indeed, the Sienna was the most-shopped minivan, followed by the Honda Odyssey, Dodge Grand Caravan, which is in sell-down mode, Chrysler Pacifica and Kia Sedona, also in sell-down mode to be replaced with the more SUV-looking Carnival.

Brand Rankings Hold Steady

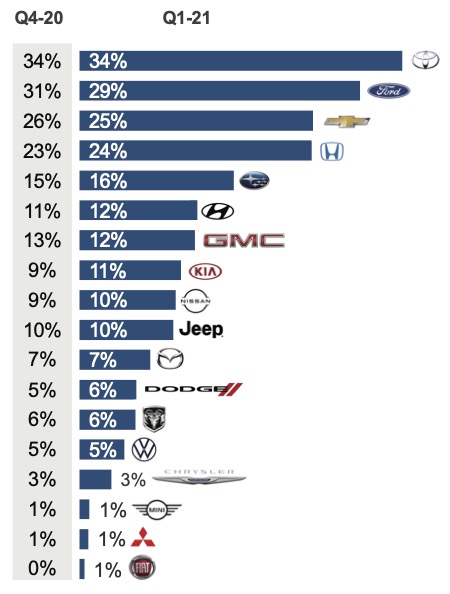

Brand rankings based on shopping consideration remained relatively steady from last year.

Toyota held onto the top spot with 34% of all shoppers considering a Toyota product. The brand held that percentage even though shopping for the Highlander and Tacoma lost traction. The Prius Prime’s popularity, however, was on the rise.

Quarterly Brand Consideration

Ford kept the No. 2 spot, even though its shopping consideration slipped 2 percentage points due to big falls in shopping consideration for its large pickup trucks.

Honda, Subaru, Nissan and Hyundai eked out shopping gains. Hyundai, with the help of Santa Fe and Palisade, matched GMC for sixth place. Kia also gained, thanks to the popularity of the short-in-supply Telluride SUV. Currently neither Hyundai nor Kia had vehicles in the Top 10 list or in the Top 5 list by category, but it could happen.

Nissan’s 1 percentage point gain may be due to the new Nissan Rogue. Nissan could gain some traction as it has numerous new products coming soon, including a freshened Frontier pickup truck and Pathfinder SUV as well as the all-electric Ariya closer to year-end.

A Car Returns to the Top 10 List

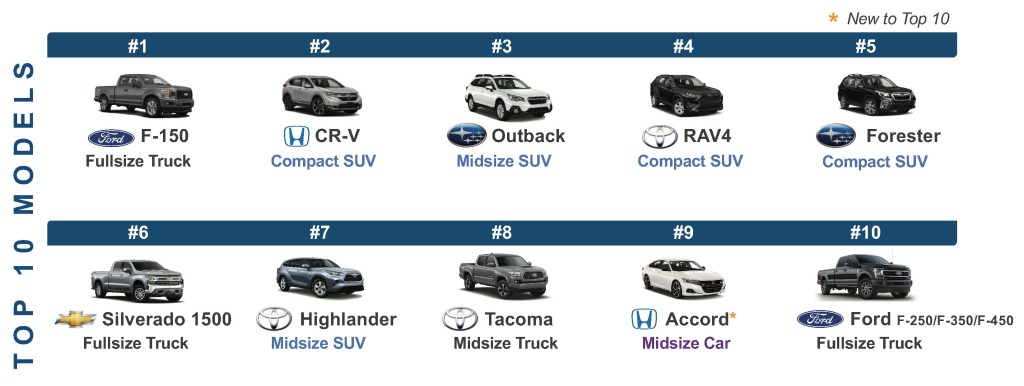

The Top 10 most-considered vehicles represented a good mix of SUVs and pickup trucks with a car returning to the list.

The Ford F-150 was the most-considered vehicle for the fifth consecutive quarter. Its competitor, the Chevrolet Silverado, fell to No. 6 from No. 4 in the previous quarter and No. 3 in the year-ago quarter. As for other pickup trucks on the Top 10 list, Ford’s Super Duty trucks ranked No. 10, falling from No. 5 in 2020’s fourth quarter; they weren’t on the top 10 list a year ago. The midsize Toyota Tacoma slipped to No. 8 from No. 6 in the 2020 fourth quarter.

Top 10 Most-Considered Models

As for SUVs, the Honda CR-V held onto the second most-shopped vehicle, a spot it has held for some time. The biggest movers were from Subaru. The Outback slotted in at No. 3, up from No. 8. The Forester was at No. 5, up from No. 10. Toyota RAV 4 was the fourth most-shopped vehicle, versus third in the previous quarter. Toyota Highlander was No. 7 up from No. 10.

The Honda Accord was the only car on the most-shopped list at No. 9. In the fourth quarter of 2020, not a single car made the Top 10 list for the first time ever.

Toyota, Honda Dominate Electrified Vehicles

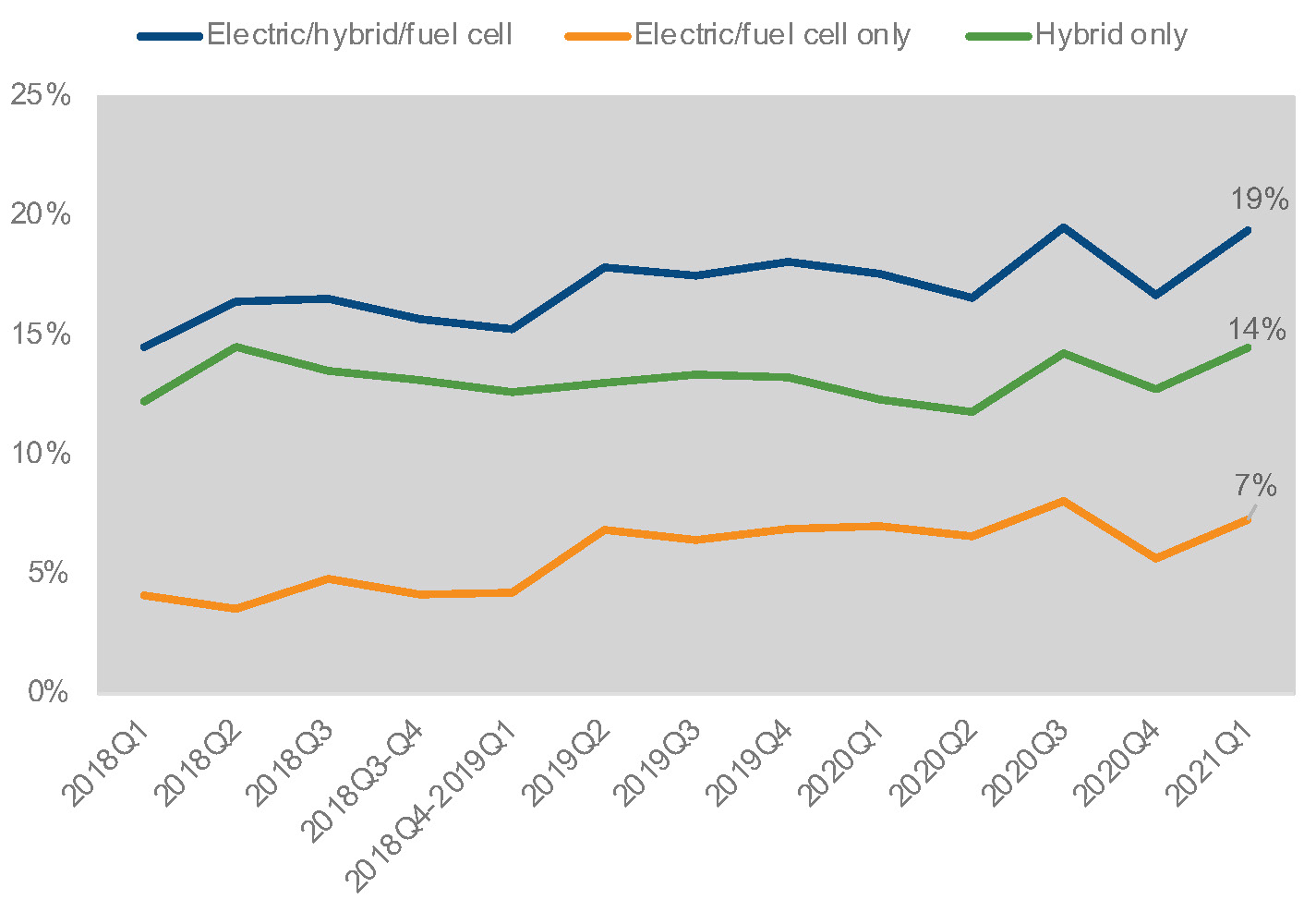

Shopping for electrified vehicles – hybrids, plug-in hybrids, EVs – hit new highs in the first quarter, and sales followed.

Of all shoppers, 19% considered all types of electrified vehicles, just shy of its record of 20% in the third quarter of 2020. The increase was due to more interest in hybrids with 14% of shoppers considering hybrids. The percentage hovered in the 13% to 14% range since the second half of 2020. Among shoppers, 7% considered a pure EV. That number was 6% in the fourth quarter last year after reaching a record high of 8% in the third quarter.

The only EVs on the Top 10 most-shopped electrified list were Tesla vehicles, which fall into the luxury category. The most-shopped EVs were: Model 3, at No. 2; Model Y at No. 5; and Model S at No. 6.

Japanese brands – specifically Toyota and Honda – dominated the rest of the Top 10 list with their hybrids. The Toyota RAV4 hybrid was the most-shopped electrified vehicles followed by Honda CR-V at No. 3, Toyota Highlander at No. 4, Toyota Prius at No. 7, Honda Accord at No. 8, Toyota Camry at No. 9 and Prius Prime at No. 10.

High levels of shopping for electrified vehicles converted into sales with electrified vehicles growing by 81% and hitting 300,000 units for the first time. Of those, pure EVs had a year-over-year gain of 45%, reaching a record of nearly 100,000 sales. Hybrid sales outpaced the overall market and EV sales.

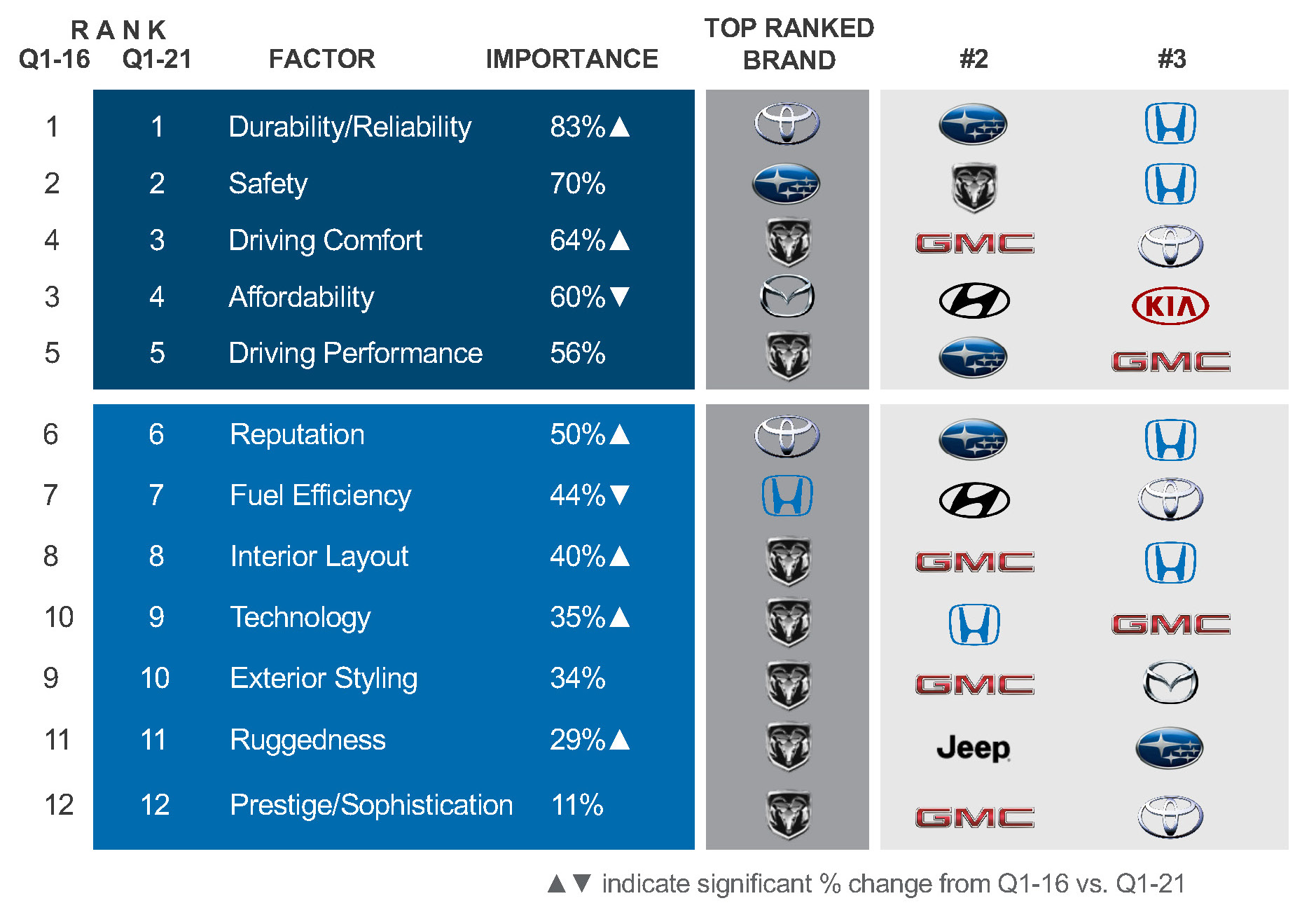

Ram Grabs Top Factor Spots

Rankings for the top eight of 12 factors most important to non-luxury shoppers have remained roughly the same for the past five years. Despite a pandemic recession, Affordability and Fuel Efficiency have become less important over time. Durability/Reliability, Driving Comfort, Reputation, Interior Layout, Technology and Ruggedness remain most important.

Top Factors Most Important to Shoppers

Ram mounted a remarkable comeback in the first quarter. Ram had ranked No. 1 in half of the dozen factors in late 2019 and early 2020 but since then slipped in the ratings.

In the first quarter, Ram jumped from being first in two factors in the fourth quarter of 2020 to being No. 1 in seven categories. Ram took top honors in Driving Comfort, Performance, Interior Layout, Technology, Exterior Styling, Ruggedness, and Prestige/Sophistication. Its pickup trucks and vans stood out for their strength and capability in meeting consumers’ needs.

Subaru lost a bit of momentum in the factors. In 2020’s fourth quarter, Subaru owned two No. 1 spots and held No. 2 spots in eight factors. In the first quarter, Subaru continued to own the Safety space, and held onto three No. 2 spots – Driving Performance, Reputation and Durability/Reliability. Toyota has long owned the most important Durability/Reliability category.

GMC lost its No. 1 rating in Driving Comfort to Ram in the first quarter. However, GMC gained in other categories. It was No. 2 in three factors – Interior Layout, Exterior Styling and Prestige/Sophistication. It was No. 3 in Driving Performance and Technology. GMC may well get a boost in the Technology category when it introduces the all-electric GMC Hummer pickup truck.