Commentary & Voices

Q1 2022 Kelley Blue Book Brand Watch Non-Luxury Report: Toyota Recaptures Top Spot Over Ford, Chevrolet Moves Up

Monday May 9, 2022

Toyota returned as the most considered non-luxury brand after Ford’s brief occupation of the top spot, and Chevrolet closed in on both in the first quarter, according to the most recent Kelley Blue Book Brand Watch Report™.

The Kelley Blue Book Brand Watch Report is a consumer perception survey that also weaves in shopping behavior to determine how a brand or model stacks up with its segment competitors on a dozen factors key to a consumer’s buying decision. Kelley Blue Book produces separate Brand Watch reports for non-luxury and luxury brands each quarter. Beginning in Q1 2022, the methodology includes surveying both mobile and desktop users instead of only desktop users.

Toyota Retakes the Lead

Toyota took back the No. 1 spot as the most-shopped non-luxury brand despite having among the lowest inventories in the industry for months. Toyota had held the spot for nearly four years straight, but Ford nabbed it in the fourth quarter of 2021 for the first time since 2015.

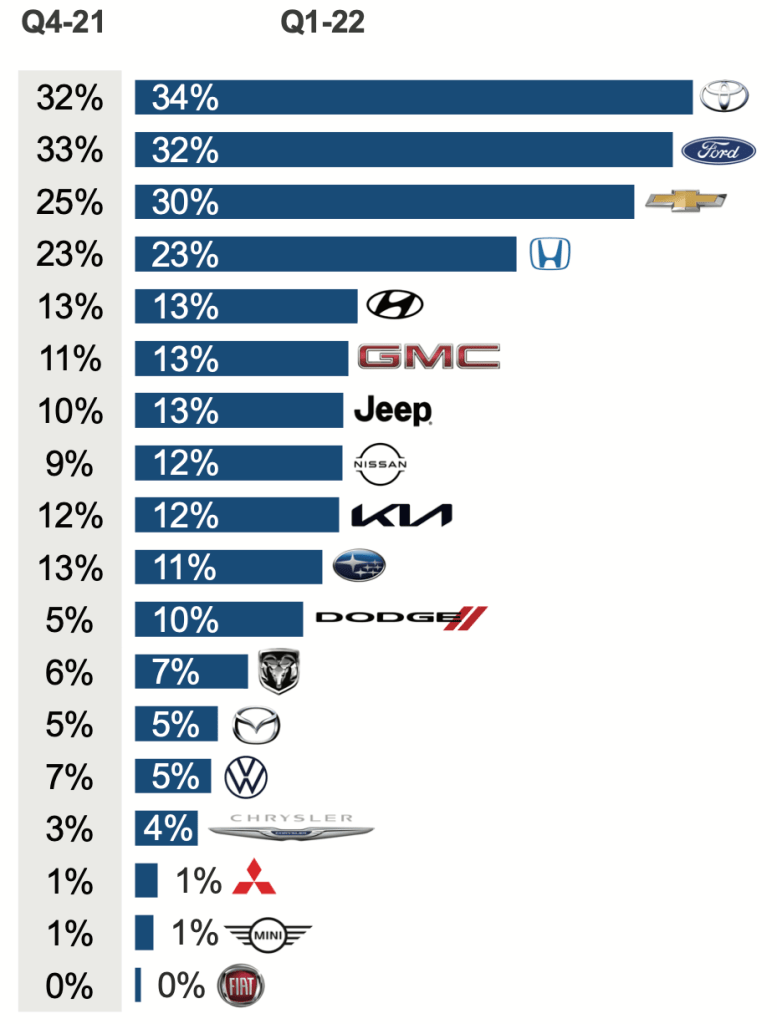

Of non-luxury shoppers, 34% considered a Toyota in the first quarter, up two percentage points from the fourth quarter of 2021. Shopping consideration soared for the Highlander SUV and the Camry, both of which are offered with hybrid powertrains, as spiking gas prices in Q1 sent shoppers looking for more fuel-efficient vehicles. The gains in those models overcame declines in shopping for the RAV4 and Tacoma.

QUARTERLY BRAND CONSIDERATION

While Toyota gained shopping consideration, Ford slipped. Of non-luxury shoppers, 32% considered a Ford, down one percentage point from the previous quarter. Shopping consideration for the Ford F-150 fell 8%, though consideration increased 9% for the bigger Ford Super Duty models.

Chevrolet was one of the biggest gainers in the quarter. Of non-luxury shoppers, 30% considered a Chevrolet, up a hefty five percentage points from the previous quarter. Consideration for the Silverado soared by 33%. The announcement of the electric Silverado, confirmed in Q1 and arriving in a year or so, generated additional activity. Shopping for the larger versions of the Silverado rose even more, up 64%. Tahoe shopping consideration rocketed by 61%.

Dodge was another winner in the quarter. The brand’s shopping consideration doubled, driven mainly by a stunning 187% increase in shopping for the Durango SUV. The Charger and Challenger muscle cars also saw higher shopping consideration.

Other gainers were: Jeep, up 3 percentage points due to new products, including the new Grand Cherokee, Wagoneer and Grand Wagoneer; Nissan, up 3 percentage points; and GMC, up 2 percentage points because of the launch of the GMC Hummer EV. Two other Stellantis brands – Chrysler and Ram – were each up a percentage point.

Decliners were Volkswagen and Subaru, both down 2 percentage points. The rest of the brands held steady.

Gas Prices Boost Car Shopping

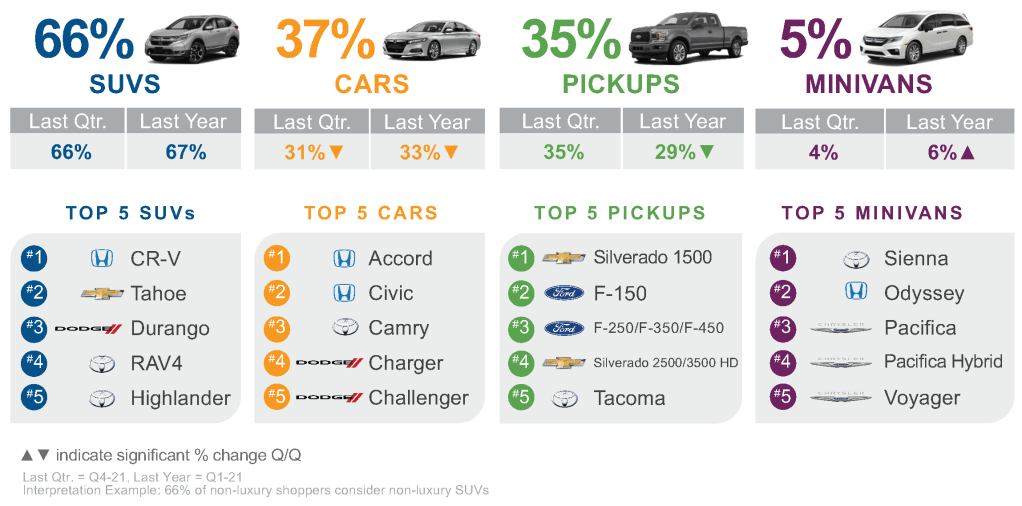

Gas prices spiked to new records in March, and worsening vehicle affordability in the quarter led shoppers to consider cars. Of non-luxury shoppers in the first quarter, 37% considered cars, well ahead of the 31% in the previous quarter.

Honda Accord and Honda Civic topped the list at No. 1 and No. 2 followed by Toyota Camry. The Dodge Charger and Dodge Challenger rounded out the Top Five most-shopped cars.

SUVs remained king of shopping consideration, though. Of all non-luxury vehicle shoppers, 66% considered an SUV, a level that has held steady for some time, while 35% shopped pickup trucks, the same as the end of 2021.

The Honda CR-V topped the list of most-shopped SUVs. The Chevrolet Tahoe and Dodge Durango jumped to No. 2 and No. 3. The Toyota RAV4 and Toyota Highlander rounded out the Top 5 Most-Shopped SUVs.

For the first time, the Chevrolet Silverado – thanks in part to the launch of an EV model – zoomed past the Ford F-150 as the most-shopped pickup truck in the quarter. The F-150 dropped to second, followed by the larger F-Series and larger Silverado trucks. The Toyota Tacoma ranked No. 5.

Of non-luxury shoppers, 5% considered a minivan, up from 4% in the previous quarter. Toyota Sienna and Honda Odyssey topped the list, followed by the various Chrysler Pacifica minivans, including the hybrid.

QUARTERLY SEGMENT CONSIDERATION

Top 10 Shuffle

The first quarter of 2022 saw a shuffling of the order of most-shopped vehicles and some newcomers added to the Top 10 most-shopped list, which represented a good mix of pickup trucks, sedans and SUVs of varying sizes. Chevrolet and Honda had the most models on the list.

The Chevrolet Silverado 1500 overtook the Ford F-150 for the first time as the most-shopped pickup truck. F-150 slipped to No. 2. Four of the top 10 most-shopped models, in fact, were pickup trucks. The larger Ford F-Series Super Duty models and Chevrolet Silverado HD models ranked No. 8 and No. 10, respectively.

Top 10 Models Considered

After being shut out in Q4 2021, three cars – Honda Accord at No. 3, Honda Civic at No. 6 and Toyota Camry at No. 9 – made the most-shopped list because of rising gas prices and affordability challenges.

Rounding out the Top 10 were large, domestic SUVs – the Chevrolet Tahoe at No. 5 and the Dodge Durango at No. 6.

Ram, Dodge Rank High Factors Important to Shoppers

The dozen factors most important to non-luxury shoppers have held mostly steady for the past five years. Factors that have gained in importance were fuel efficiency, driving comfort and driving performance.

Ram took top honors for five factors. They were Safety, Driving Comfort, Interior Layout, Technology and Ruggedness. Dodge maintained the No. 1 spot for Driving Performance and Exterior Styling, driven by its ad campaign focused on these attributes and high ratings for the Challenger and Charger. For the first time, Dodge took top honors for Prestige/Sophistication.

Ram ranked in 10 of the 12 factors. Ram took the top spot in safety from Subaru, helped by the Ram 1500 being named a 2022 Top Safety Pick by the Insurance Institute for Highway Safety.

Honda took two top spots – in Fuel Efficiency and Affordability. Honda was No. 2 in three factors: Durability/Reliability; Safety; and Reputation. It nabbed the No. 3 spots for Interior Layout and Technology.

Toyota held onto the No. 1 spot for the all-important Durability/Reliability as it long has. It was second in Fuel Efficiency and Technology and third in Safety and Affordability.

GMC was third in Driving Comfort, Exterior Styling and Ruggedness.

Michelle Krebs is executive analyst at Cox Automotive.