Commentary & Voices

Q2 2022 Kelley Blue Book Brand Watch Non-Luxury Report: Car and Electrified Vehicle Shopping Rise on High Gas Prices; Toyota Stays No. 1

Thursday August 4, 2022

Article Highlights

- Demand for traditional cars has significantly increased due to high gas prices.

- Shopping for electrified vehicles rebounded; one-in-four shoppers considered an EV or hybrid.

- Toyota remained the most-shopped brand, with Camry leading the way.

High gas prices led shoppers of non-luxury vehicles to consider traditional cars at a level not seen since before the pandemic, according to the most recent Kelley Blue Book Brand Watch™ report on non-luxury shopping. Shopping for electrified vehicles also rose. Toyota remained the most-shopped brand, widening the gap with No. 2 Ford.

The Kelley Blue Book Brand Watch Report is a consumer perception survey that also weaves in shopping behavior to determine how a brand or model stacks up with its segment competitors on a dozen factors key to a consumer’s buying decision. Kelley Blue Book produces separate Brand Watch reports for non-luxury and luxury brands each quarter. Beginning in Q1 2022, the methodology includes surveying both mobile and desktop users instead of only desktop users.

Car comeback?

It may not be a permanent comeback, but shopping for traditional cars has soared to its highest level since the third quarter of 2019, undoubtedly due to high gas prices. Of all non-luxury shoppers, a hefty 40% considered buying a car. That compares with 37% in the first quarter of this year as gas prices started to take off and only 33% in the second quarter a year ago.

QUARTERLY SEGMENT CONSIDERATION

Honda Accord, Honda Civic and Toyota Camry, respectively, had the highest shopping consideration. Camry shopping was up 12%. Civic was up 9%. Accord was down 3%, but still managed to stay on top. Dodge Charger and Chevrolet Malibu rounded out the five most-shopped cars.

Consumers likely were disappointed when they attempted to buy a car, however. Subcompact, compact and midsize cars were among the segments with the lowest inventories throughout the second quarter. Toyota and Honda cars had extremely low supply. In addition, some automakers, notably Detroit automakers, are mostly out of the car business in favor of SUVs and trucks. Asian automakers have stuck with cars.

Despite higher car shopping, SUVs remained tops with consumers. Of all non-luxury shoppers, 67% considered an SUV, up from 66% in this year’s first quarter and 64% in the year-ago second quarter.

As expected, shoppers were looking for fuel economy in Q2. The compact Honda CR-V and Toyota RAV4 were the most shopped SUVs. CR-V shopping rose 6%; RAV4 shopping was up 9%. Both popular models are offered with hybrid powertrains. The RAV4 hybrid ranked fifth most-shopped SUV and, once again, the most-shopped electrified vehicle. As with cars, shoppers likely were disappointed as hybrids ranked dead last for supply through most of the second quarter, and these specific models had almost non-existent inventory.

The much larger Chevrolet Tahoe and Dodge Durango, despite its hefty 14% decline in shopping, rounded out the five most-shopped SUVs.

Shopping for trucks dipped somewhat. Of non-luxury shoppers, 33% considered a truck, down from 35% in the first quarter but up from 31% in the second quarter a year ago. The second half of the year generally is when trucks sell best. Some supply has yet to arrive at dealerships, but truck supply has vastly improved of late even though it remains below pre-pandemic levels. General Motors reported that it has 95,000 trucks that it manufactured but parked awaiting parts. The automaker hopes to deliver the trucks to dealers by year-end.

Despite a 4% decline in shopping, the Chevrolet Silverado was the most-shopped pickup, again edging out the Ford F-150, which had 9% less shopping than last quarter. Other most-shopped pickups included the Toyota Tacoma at No. 3, the larger Ford F-Series models at No. 4 and the GMC Sierra at No. 5.

Minivan shopping held steady at 5% of non-luxury shoppers, a level it has been at for years. Toyota Sienna, Honda Odyssey, Chrysler Pacifica and Pacifica Hybrid and Kia Carnival were the most-shopped minivans. The segment and all most-shopped models had extremely low inventories. As with cars, some automakers, including GM and Ford, have abandoned the minivan market to focus on SUVs.

Toyota Stays No. 1

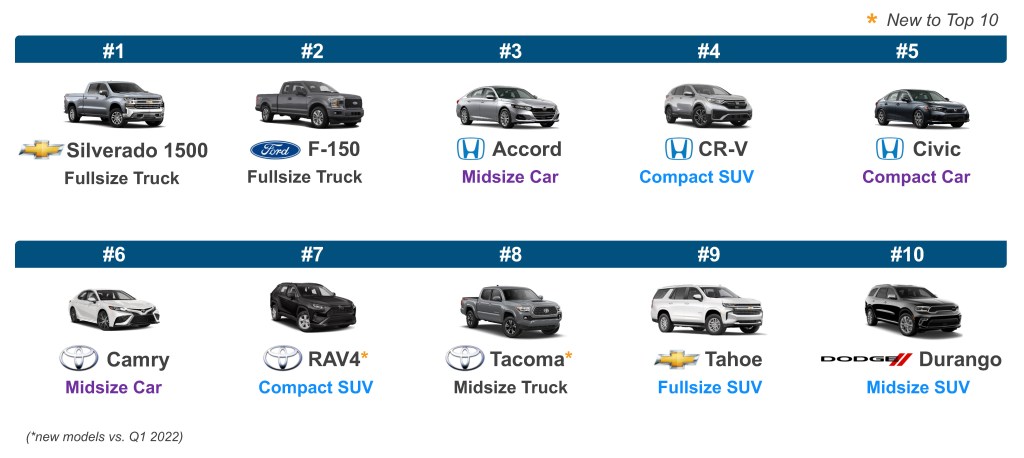

Despite having one of the leanest inventories in the industry, Toyota remained the leading non-luxury brand in shopping consideration, with three models in the Top 10 – RAV4, Tacoma and Camry, which was the biggest gainer.

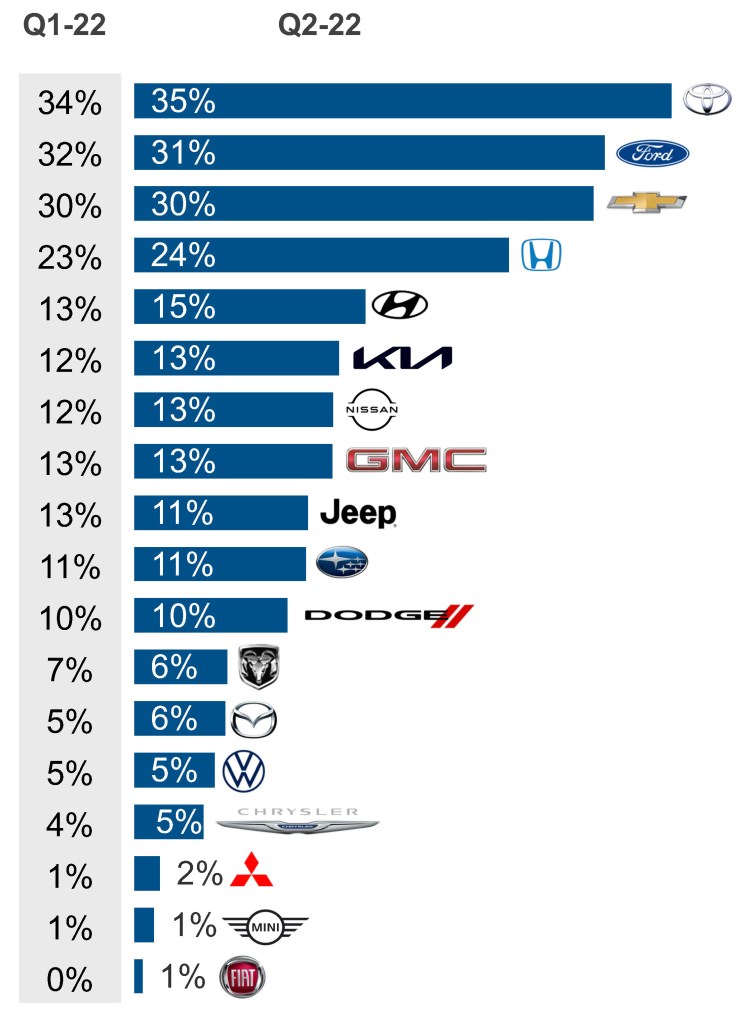

Of all non-luxury shoppers, 35% considered a Toyota, up 1 percentage point from the first quarter of this year. Toyota had held the No. 1 spot for nearly four straight years until Ford regained it in the fourth quarter of last year for the first time since 2015. Toyota quickly grabbed it back in the first quarter and widened the gap with Ford in the second quarter, when Ford’s shopping consideration dipped by 1 percentage point to 31%. A 9% drop in shopping for Ford’s volume-leading F-150 likely was the culprit.

QUARTERLY BRAND CONSIDERATION

After being the biggest gainer in this year’s first quarter, Chevrolet held steady at 30% of non-luxury shoppers considering the brand. Shopping for the volume-leader Silverado dipped in the second quarter, and Tahoe shopping fell by 12%. Both models had gained significantly in the first quarter. Ford’s dip and Chevrolet’s steady position closed the gap between the cross-town rivals.

Like Chevrolet, Dodge was another big gainer in the first quarter but held steady at 10% of non-luxury shoppers. The Durango, which had driven the first-quarter gain, cooled with its shopping falling 14% in the second quarter.

Honda, the fourth most-shopped brand, gained a percentage point of shopping consideration due to its much-in-demand and fuel-efficient models: CR-V, Civic and Accord. Honda also got a lift from the launch of the new HR-V in the quarter.

The second quarter’s largest gainer was Hyundai, which saw a 2-percentage point hike in shopping consideration. Others that improved by 1 percentage point were Kia, Nissan, Mazda, Chrysler, Mitsubishi and Fiat.

Jeep lost 2 percentage points, the most significant drop in shopping consideration of all non-luxury brands. Ram lost 1 percentage point.

Big trucks head the most-shopped list

Despite a slowdown in overall truck shopping, the full-size Chevrolet Silverado and Ford F-150 held the first and second spots for consideration for the third consecutive quarter. Both models improved production output and inventory in the second quarter.

Top 10 Models Considered

Honda and Toyota had the most models on the Top 10 most-shopped list with three each. The Toyota RAV4 (No. 7) and Tacoma pickup (No. 8) returned to the Top 10 list after dropping off in the first quarter. Camry (No. 6) remained on the list as well. Honda’s three volume leaders – Accord (No. 3), CR-V (No. 4), and Civic (No. 5) made the list.

From the Chevrolet brand, the Tahoe ranked No. 9. The Dodge Durango rounded out the list at No. 10.

Affordability, fuel efficiency gain importance to shoppers

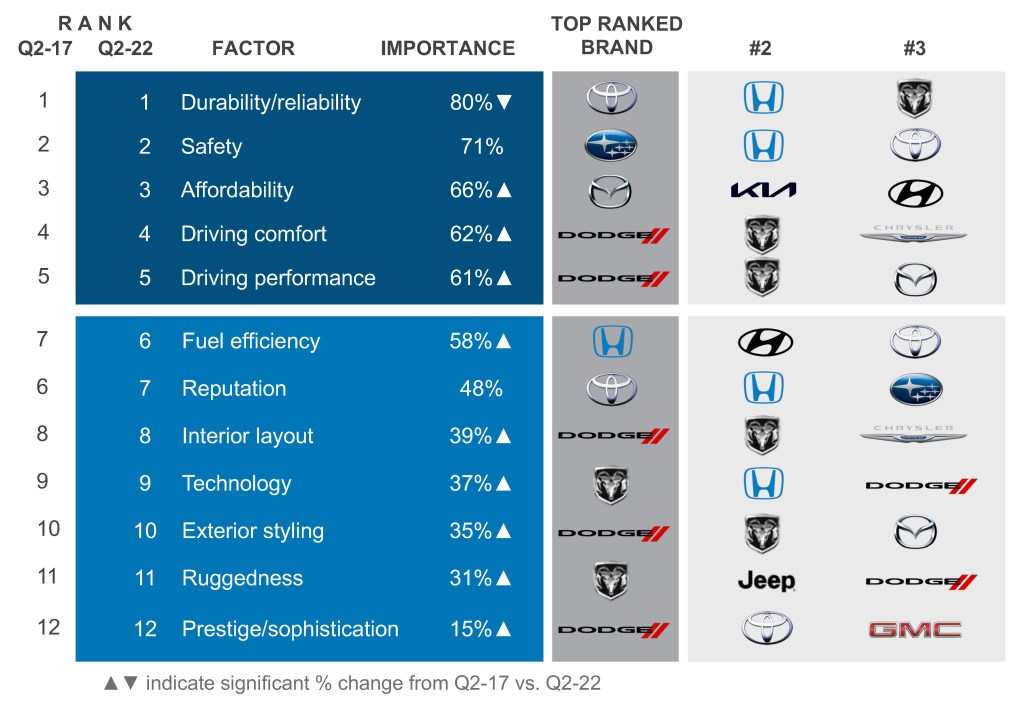

The ranking of a dozen factors most important to non-luxury shoppers when selecting a vehicle has remained largely unchanged. Still, factors that have become more important to consumers, not surprisingly in this era of inflation and high car and gas prices, are affordability, fuel efficiency, and driving performance.

FACTORS DRIVING NON-LUXURY CONSIDERATION

In Q2 2020, when gas was far cheaper and new vehicles were widely available, fuel efficiency and affordability had dropped down the list of importance. Fuel efficiency ranked 10th out of 12, with only 39% of shoppers noting efficiency as important. Affordability was 8th. Two years later, with prices for both vehicles and fuel at or near record levels, the landscape has changed significantly. Affordability is now a Top Three factor (back to the level it was in 2017) and Fuel Efficiency has jumped to 6th, with 58% of shoppers ranking fuel efficiency as a top factor in the vehicle-buying decision.

Mazda, Kia and Hyundai, respectively, ranked highest in affordability. Honda, Hyundai and Toyota, in that order, did best in fuel efficiency.

Dodge maintained the No. 1 spots for Driving Performance, Exterior Styling, and Prestige/Sophistication. It’s worth noting that Dodge also won the 2022 Kelley Blue Book Brand Image Award for Best Styling. For the first time in Brand Watch history, it took the top honors for Driving Comfort and Interior Layout.

Ram held on to the top spots for Technology and Ruggedness. However, Ram lost its lead in Safety to Subaru, which had long held the No. 1 spot, followed by Honda and Toyota. Ram lost Driving Comfort and Interior Layout to its sibling brand Dodge.

Toyota held onto the No. 1 spot for the all-important Durability/Reliability as it long has. Honda came in second while Ram took third-place honors.

Michelle Krebs is executive analyst at Cox Automotive.