Data Point

Despite Tesla Slide, EV Sales in Q2 Mark New Record

Thursday July 11, 2024

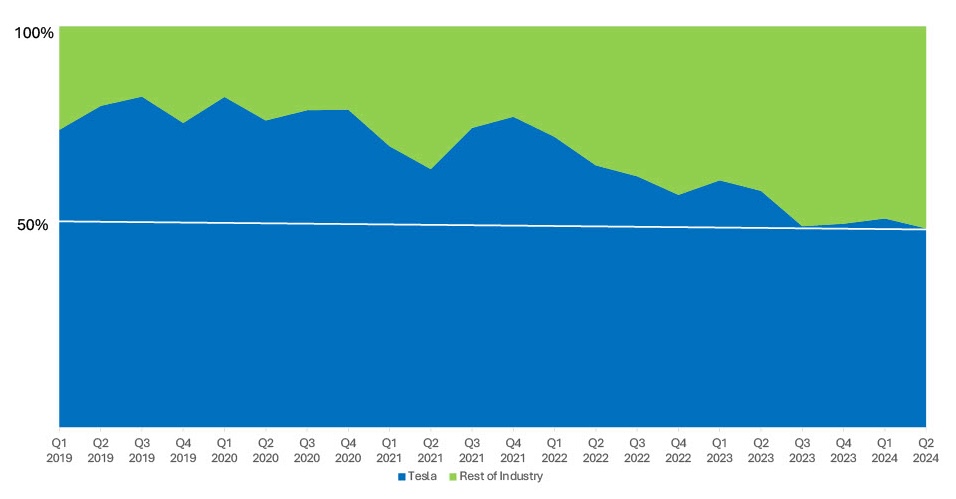

Electric vehicle sales in the U.S. grew by 11.3% year over year in the second quarter, reaching a record-high volume of 330,4631 units, according to new estimates from Kelley Blue Book. This growth was driven partly by improved availability, higher discounts and elevated levels of leasing. Total EV sales last quarter were higher than Q1 sales by 23% percent. In Q2, market leader Tesla sales volume declined by 6.3% year over year, but new products, notably from General Motors, helped lift overall volume higher. In the second quarter, Tesla’s share of EV sales fell below 50% for the first time in the U.S. to 49.7%.

The sales estimates from Kelley Blue Book show that electric vehicles accounted for approximately 8% of total new-vehicle sales in the second quarter, higher than the 7.1% share in the first quarter of the year and higher than the 7.2% recorded in Q2 last year.

Cox Automotive Industry Insights Director Stephanie Valdez Streaty commented: “EV sales exceeded expectations during a record-breaking quarter. Despite Tesla’s declining sales, with its EV sales share now below 50% for the first time, the overall competitive landscape for electric vehicles is intensifying. This increased competition is leading to continued price pressure, gradually boosting EV adoption. Automakers that deliver the right product at the right price and offer an excellent consumer experience will lead the way in EV adoption.”

TESLA SHARE OF TOTAL EV SALES

While Tesla remains the dominant player in the EV segment, new electric offerings by mainstream competitors – and more aggressive pricing – continue to provide shoppers with interesting alternatives. Notable new entries in Q2 include the BMW i5, Cadillac Lyriq, Honda Prologue, and Kia EV9 SUV. Higher volumes of the Ford Mustang Mach-E and F-150 Lightning helped the Ford brand retain its No. 2 position, behind Tesla, in the EV market.

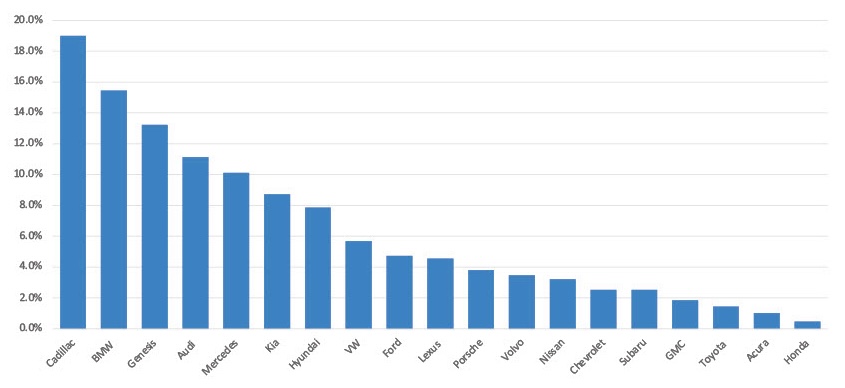

New EVs from General Motors are also helping grow industry volume. In Q2, GM added more than 21,000 EVs to the market. New models include electric versions of the Chevy Blazer, Equinox and Silverado, which tallied more than 10,000 sales in Q2, although the extra volume was not enough to offset the discontinued Chevy Bolt. In Q2, Chevrolet’s EV sales were lower by 19% year over year. Other major players who lost ground year over year in Q2 include Mercedes-Benz, Polestar, Porsche, Volvo and VW.

Q2 2024 EV SHARE OF TOTAL BRAND SALES

Added Valdez Streaty, “We remain bullish on electric vehicle sales in the long term. The growth will, at times, be very slow, as all-time horizons in the automobile business are vast, but the long-term trajectory suggests that higher volumes of EVs will continue over time. As EV infrastructure and technology improve, and more models are launched, many shoppers sitting on the fence will eventually choose an EV.”

1Kelley Blue Book counts exclude super exotics.