Data Point

Another Quarter, Another Record: EV Sales in the U.S. Surpass 300,000 in Q3, as Tesla Share of EV Segment Tumbles to 50%

Thursday October 12, 2023

Electric vehicle (EV) sales volumes set another record in Q3, as total sales of battery-powered vehicles jumped past 300,000 for the first time in the U.S. market. Year-to-date EV sales through September reached just over 873,000, putting the market firmly on track to surpass 1 million for the first time ever. The milestone will likely be achieved in November.

Total EV sales in Q3, according to an estimate from Kelley Blue Book, hit 313,086, a 49.8% increase from the same period one year ago and an increase from the 298,039 sold in Q2. Most automakers posted sizeable gains over 2022, with Volvo, Nissan, Mercedes and Hyundai delivering increases above 200%, thanks mostly to new products entering the market. In Q3, 14 new EV models that did not exist one year ago were in the mix, including Chevrolet Blazer and Silverado EVs. (The new Chevy EVs had very low sales – just an initial few to mark a Q3 launch). The EV market is transforming, to be sure.

Electric vehicle sales accounted for 7.9% of total industry sales in Q3, a record and up from 6.1% a year ago and 7.2% in Q2. As Cox Automotive has been reporting, higher inventory levels, more product availability, and downward pricing pressure have helped spur continued linear growth of EV sales in the U.S. market. EV sales have now increased for 13 straight quarters.

EV transaction prices in Q3 were down significantly from 2022. In an attempt to increase sales volume, Tesla slashed prices, which are now down roughly 25% year over year. The price cuts have helped, as Tesla’s Q3 sales grew by 19.5% year over year, surpassing the industry’s overall growth rate of 16.3%. However, Tesla’s share of the EV segment continues to plunge, hitting 50% in Q3, the lowest level on record and down from 62% in Q1. The long-promised Cybertruck may reverse the downward trend, although competition from Ford, Rivian and Chevrolet will likely impact Tesla’s electric pickup volume potential.

The German luxury makes – Audi, BMW, and Mercedes – continue to rapidly increase sales of EV models. In Q3, BMW and Mercedes EV sales more than triple year-ago levels, while Audi posted an EV sales gain of 94%.

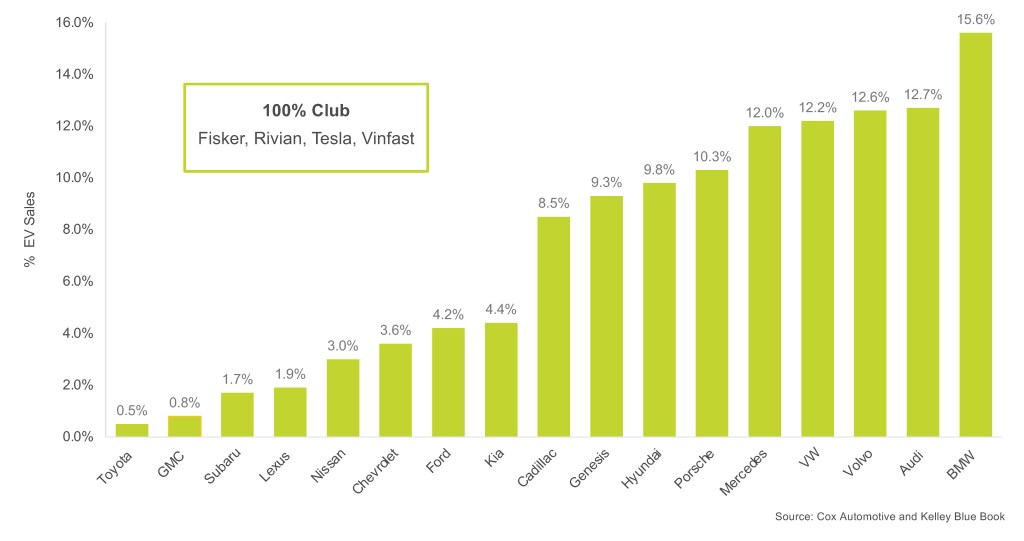

Among automakers selling internal combustion engine (ICE) and EV products, Audi, BMW and Volvo had the richest mix of EVs in Q3. BMW had the highest proportion, with over 15% of its sales being EVs, followed by Audi and Volvo, with over 12% of their sales being EVs, according to Kelley Blue Book estimates. Mercedes, Porsche and VW all had an EV mix in excess of 10% last quarter.

Q3 EV SHARE OF TOTAL BRAND SALES

In 2020, just three years back, EV sales in the U.S. passed 250,000 for the first time. This year, the market will jump past 1 million. In Q3, Tesla remains the undisputed leader in EV sales, with Ford a distant #2 on the list, selling just over 20,000 EVs.

Most analysts expect a flood of new EVs in the coming three years, with the number of available EV products likely to double by 2027. With this changing landscape, EV sales volume growth in the U.S. is expected to continue. Of late, product availability has grown exponentially, while consumer acceptance has grown in a more linear fashion. Those trends will likely continue, making for some very interesting market dynamics in the years ahead. Change is never easy.