Data Point

Electric Vehicle Sales Mark Another Record in Q3, Thanks to Higher Incentives, More Choices

Friday October 11, 2024

According to new estimates from Kelley Blue Book, electric vehicle (EV) sales in the U.S. grew by 11% year over year in the third quarter and reached record highs for both volume and market share. According to the latest counts, an estimated 346,3091 EVs were sold in Q3 2024, a 5% increase from Q2. The EV share of sales in Q3 hit 8.9%, the highest level recorded and an increase from 7.8% in Q3 2023.

“While year-over-year growth has slowed, EV sales in the U.S. continue to march higher,” said Stephanie Valdez Streaty, director of Industry Insights at Cox Automotive. “The growth is being fueled in part by Incentives and discounts; but as more affordable EVs enter the market and infrastructure improves, we can expect even greater adoption in the coming years.”

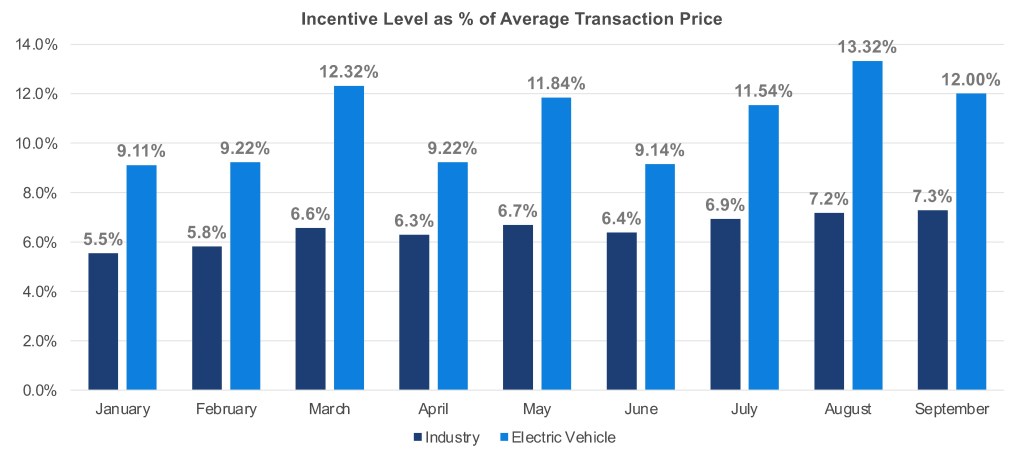

Electric vehicle incentives and discounts were elevated in Q3, which helped fuel higher sales. In Q3, incentives averaged more than 12% of the average transaction price (ATP), much higher than the industry-wide average of approximately 7%.

ELECTRIC VEHICLE INCENTIVES VERSUS INDUSTRY

The “leasing loophole” was also generously applied, as leasing allows all EV buyers to qualify for generous government-supported incentives. Electric vehicle prices were higher year over year in Q3 but by less than 1%. The average price paid for an EV in Q3 was just over $57,000, a premium of approximately 19% compared to the industry-wide ATP of just over $48,000.

EV LEASE PENETRATION OF RETAIL SALES VERSUS INDUSTRY

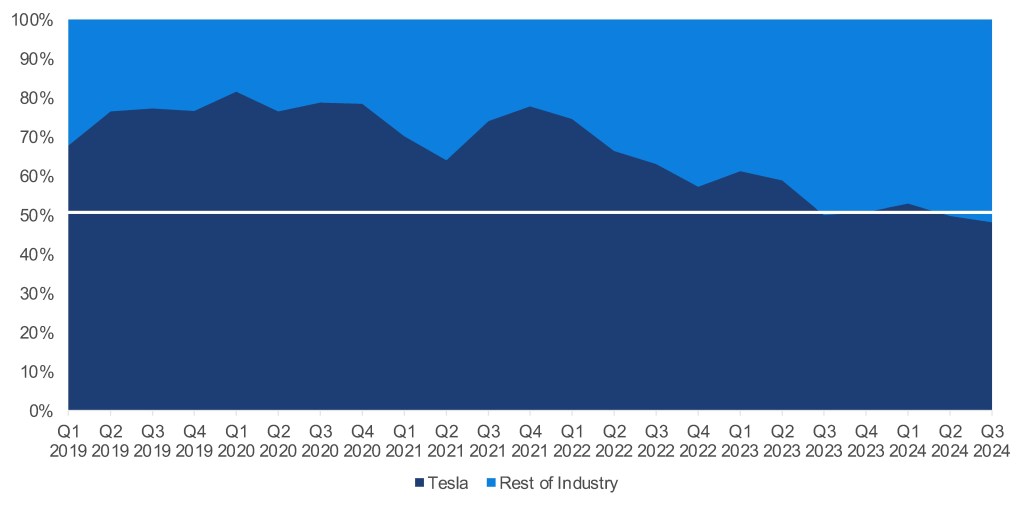

After seeing sales fall year over year in the first half, market leader Tesla returned to growth mode in Q3, with sales up 6.6%, thanks mostly to the newly introduced Cybertruck. Despite a six-figure price tag – average transaction price in September was north of $116,000, according to Kelley Blue Book estimates – more than 16,000 Cybertrucks were sold in Q3. In fact, Cybertruck outsold every other available EV except for two – Tesla’s popular Model Y and Model 3.

TESLA SHARE OF TOTAL EV SALES REMAINS BELOW 50%

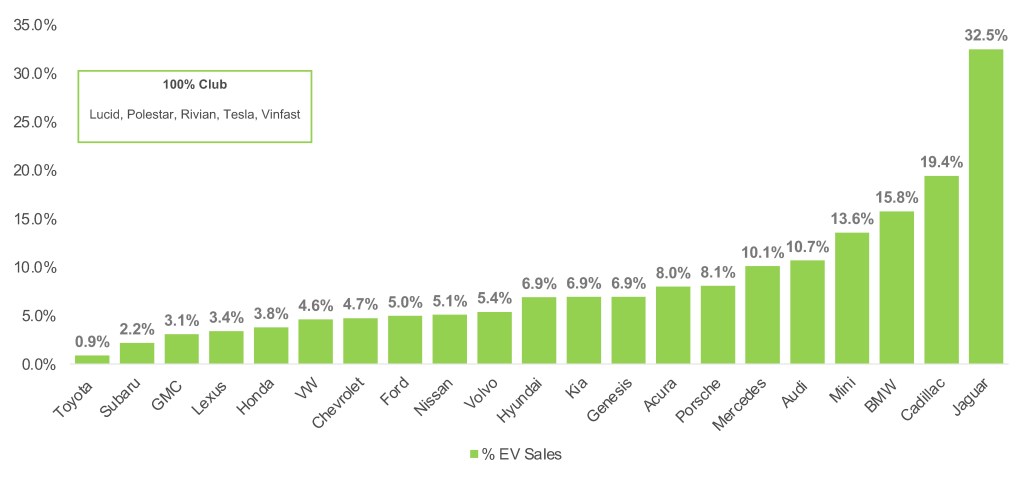

General Motors EV sales jumped significantly in Q3, up nearly 60% to 32,095. While still a distant second to market leader Tesla, GM improved its standing in the EV race thanks to strong sales from three of its four core brands – Cadillac, Chevrolet and GMC. Hyundai Motor Group fell behind GM and into third place, with sales generally flat year over year at 29,609. Ford was fourth in sales with 23,509, and Honda and Acura contributed more than 15,000 EV sales in the quarter, thanks to two new models. A year ago, American Honda EV sales were zero.

Q3 EV Share of Total Brand Sales

Cox Automotive was expecting 2024 to be a “year of more” for EVs in the U.S. – more products, more sales, more discounting, and more curious buyers jumping into the fray. With improving infrastructure, far more choices, and excellent deals to be had, the team expects further growth in the months ahead – a 10% share is well within reach.

1Kelley Blue Book counts exclude super exotics.