Data Point

Relentlessly Rising, Vehicle List Prices Reach All-Time Highs

Wednesday December 16, 2020

Article Highlights

- A simple measure of affordability is the average list prices of all vehicles on dealership lots across the country.

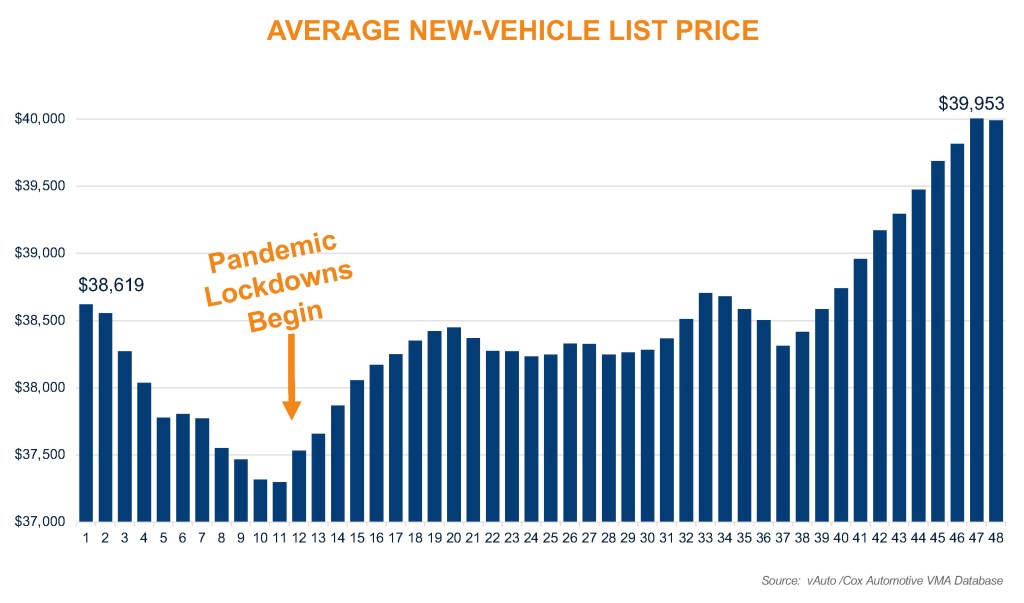

- New-vehicle list prices were knocking on the $40,000 door throughout November, up 3.5% from the first week of January and up 6.7% since the start of pandemic-driven lockdowns.

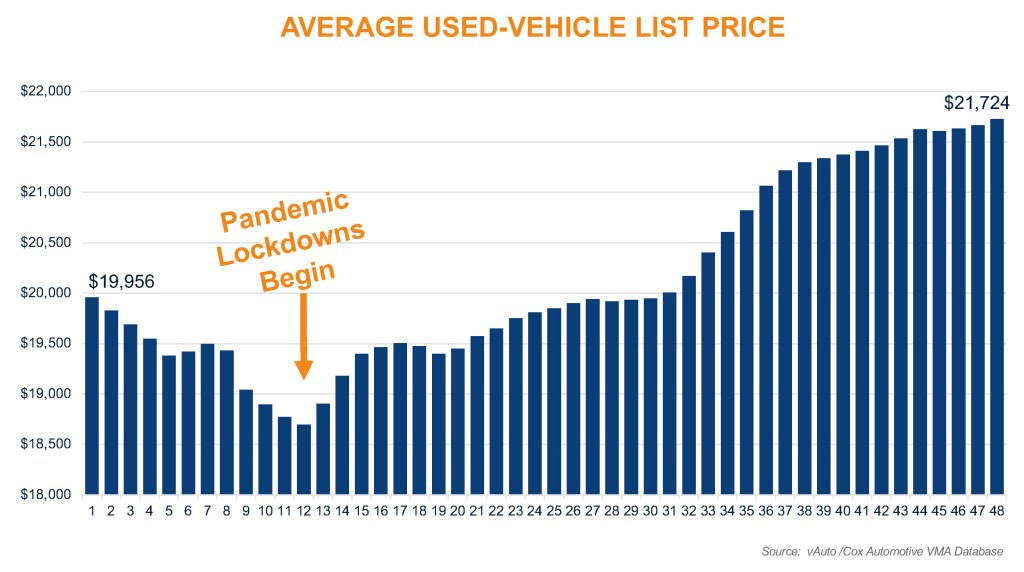

- Used-vehicle list prices have also relentlessly increased since January and are now up 8.8% from the beginning of the year.

If there’s a single trend we’ve consistently seen in 2020, it’s the relentless upward track of new- and used-vehicle prices. Vehicle affordability can be measured in many ways, and the Cox Automotive Industry Insights team is working with Moody’s Analytics to provide a true affordability measure based on a wide collection of data sets, including transaction prices and average household incomes. We began publishing that number in November to provide a holistic, insightful view of vehicle affordability in America and will be updating the index monthly.

A far simpler measure – less insightful, indeed, but interesting none-the-less – is the average list prices of all vehicles on dealership lots across the country. And that’s a lot of vehicles. In early December, according to an analysis of vAuto Available Inventory data, retail auto dealers were holding roughly 2.8 million new and 2.6 million used vehicles.

The list price of those vehicles is where millions of negotiations begin. Every deal will vary from there, as incentives are applied unevenly across the market, differing from region to region, person to person. Many incentives are called “conditional incentives”, meaning only buyers who meet certain criteria will qualify – military service, for example, often triggers additional incentives.

Like the cost of homes or higher education, the list price of vehicles will naturally increase over time, as new technology improves the breed. Still, the upward trend in 2020 has been noteworthy, driven in part by low inventory through the summer months.

New-vehicle list prices were knocking on the $40,000 door throughout November, up 3.5% from the first week of January and up 6.7% since the start of pandemic-driven lockdowns. List prices typically increase in the final months of the year, as new model year vehicles begin to populate dealership lots and oftentimes carry a more expensive list price than the outgoing model-year vehicles. In this case, the heavy mix of new 2021 SUVs and trucks is driving up our average list price relentlessly.

Used-vehicle list prices have also relentlessly increased since January and are now up 8.8% from the beginning of the year. The good news for buyers? Transaction price growth – the actual amount paid – for used vehicles has slowed in recent months, an indication the upward track of list prices may slow as well. Of course, used-vehicle prices typically peak in the spring, so we will certainly have some interesting months ahead.