Data Point

Repossessions are Down, Thanks to Accommodations and Stimulus

Friday March 19, 2021

Article Highlights

- Industry observers might expect an increase in vehicle repossessions but, in fact, our Manheim auction facilities across the country observed a more than 20% decline in repo volume in 2020.

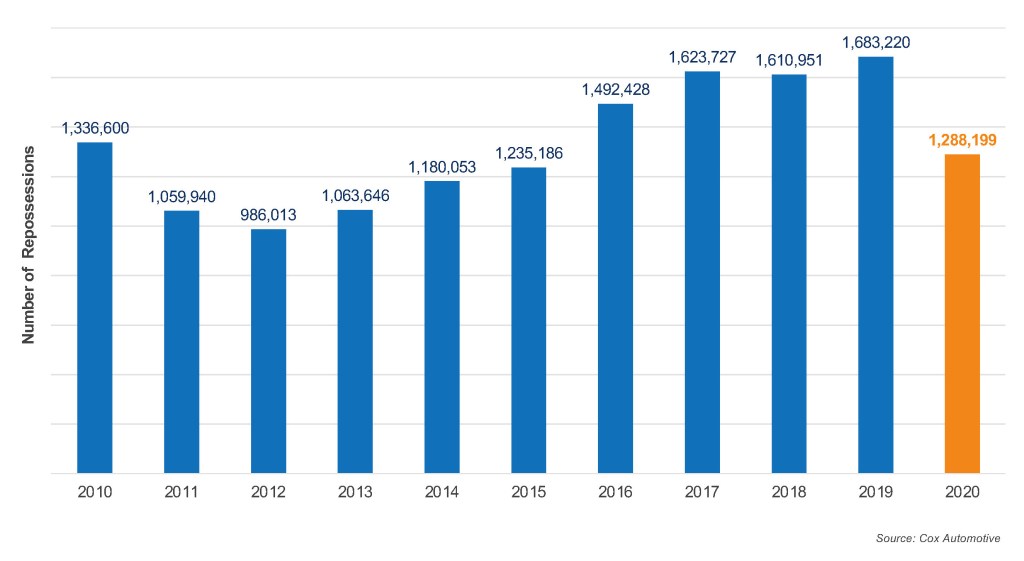

- Repossessions were down to 1.3 million in 2020 from a decade high of 1.7 million in 2019.

- The recently enacted American Rescue Plan included additional stimulus, enhanced unemployment benefits and other financial support for consumers that should help keep repossession rates in check throughout 2021.

The board of the Federal Reserve Bank met earlier this week and confirmed their decision not to move monetary policy and issued a statement seen by many as optimistic: “… indicators of economic activity and employment have turned up recently, although the sectors most adversely affected by the pandemic remain weak. Inflation continues to run below 2 percent.”

While vaccination rates are cause for optimism, the U.S. economy and employment picture is not all rosy. Weekly unemployment claims remain elevated and household incomes have been impacted. In this environment, industry observers might expect an increase in vehicle repossessions but, in fact, our Manheim auction facilities across the country observed a more than 20% decline in repo volume in 2020.

Annual U.S. Repossession Volume

There is no government or third-party source to officially tally repossession volumes. However, as the country’s largest auto auction, Manheim calculates repossession trends which serve as one proxy for the overall market. Working with consumer credit reporting agency Equifax, Cox Automotive has established a view of auto loan defaults to track repossessions.

We define defaults as auto loans beyond 120 days past due but exclude accounts included in bankruptcy proceedings. Historically, the default volume is larger than the actual repossession volume, as approximately 20% of defaulted auto loans never become a repossession. There are many reasons for this, including situations where the vehicle value or default amount may not be worth the effort required to repossess the vehicle or when the consumer and lender work out a mutually agreed plan.

Using these estimates, repossessions were down to 1.3 million in 2020 from a decade high of 1.7 million in 2019. That’s the good news. The bad news: The decline was likely a function of financial support as well as loan accommodations.

Equifax estimates that 2.3% of auto loans were under accommodation at the end of February, which was down from 2.5% at the end of January and 2.8% in December. Still, that 2.3% of auto loans under accommodation was 1.6 percentage points higher than February 2020, and that 1.6% represents nearly 1.2 million auto loans that likely would have fallen into delinquency and possibly complete default by now.

In February, 1.42% of auto loans were severely delinquent, which was a decline from 1.44% in January; 5.14% of subprime loans were severely delinquent, which was a decline from 5.21%. Sixty-day delinquencies fell in February after having increased in each of the prior 6 months. It is notable that delinquencies fell after enhanced unemployment benefits were reinstated and the $600 stimulus payments were distributed. Year over year, delinquencies were down 12.4% in February.

The recently enacted American Rescue Plan included additional stimulus, enhanced unemployment benefits and other financial support for consumers. That support coupled with an improving economy and labor market will help keep repossession rates in check throughout 2021.