Data Point

CPO Sales Drop for Third Consecutive Month, Remain Down 7% Overall

Thursday October 15, 2020

Article Highlights

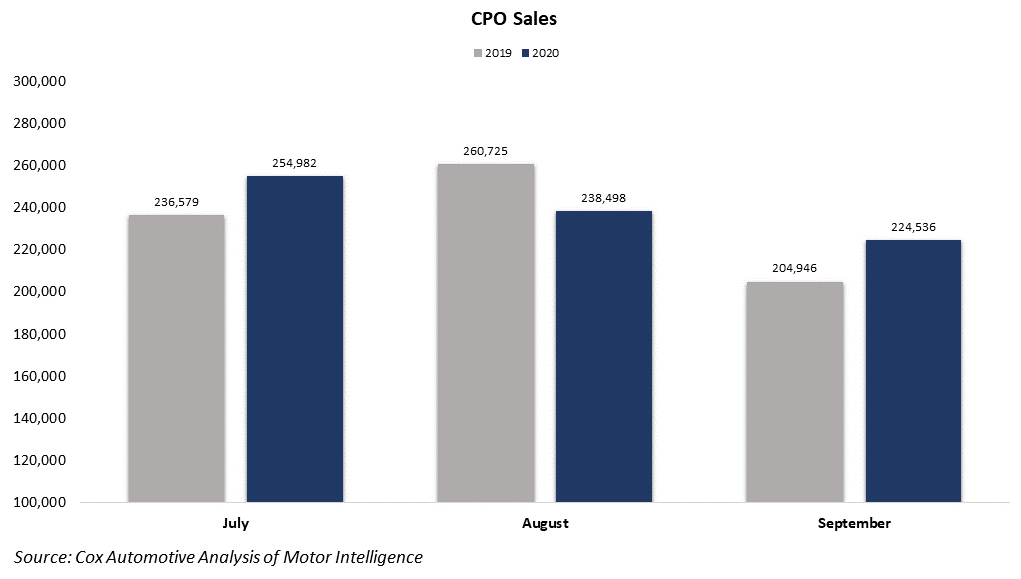

- Sales of certified pre-owned (CPO) vehicles increased 9.8% year over year in September and were down 6% month over month compared to August.

- For September, 224,536 CPO units were sold.

- For September, Toyota, Honda and Chevy continue to be the biggest players in the CPO market, collectively representing a third of all CPO sales.

Sales of certified pre-owned (CPO) vehicles increased nearly 10% year over year in September but were down 6% month over month compared to August. For September, 224,536 CPO units were sold.

The CPO market has been one of the strongest performing segments within the auto retail market. Consumer demand has improved from the peak of COVID-19 in April. CPO sales are down 7% year to date versus the same time in 2019. In the first nine months of 2020, the CPO market is more than 148,000 units below last year. The revised 2020 Cox Automotive CPO sales forecast, which is subject to change, is 2.6 million units, down from 2.8 million sold in 2019.

For September, Toyota, Honda and Chevy continue to be the biggest players in the CPO market, collectively representing a third of all CPO sales. Those three plus Ford and Nissan account for 45% of CPO sales so far in 2020. Last year, Toyota, Honda and Chevy accounted for 32% of the total industry CPO sales reflecting that brands are maintaining consistent CPO sales share this year compared to 2019.

According to Cox Automotive estimates, total used vehicle sales volume was down 5% year over year in September. We estimate the September used SAAR to be 38.0 million, down from 39.8 million last September and flat compared to August. The September used retail SAAR estimate is 20.2 million, down from 20.7 million last year and slightly down month over month from August’s 20.3 million rate.