Data Point

September Fleet Sales Improve Month Over Month, Remain Down 34% from Year-Ago Level

Tuesday October 6, 2020

Article Highlights

- The month-over-month improvement resumed in September with 124,930 total fleet volume sales up from 101,159 in August.

- Looking at automakers, manufacturers saw year-over-year changes in fleet sales ranging from an increase of 59% to a drop of 93%.

- Toyota saw its best performing month for fleet sales in 2020 with its rental channel increasing 71% year over year.

The month-over-month improvement resumed in September with 124,930 total fleet volume sales up from 101,159 in August. Combined rental, commercial and government purchases of new vehicles were down 34%, or 64,916 units, year over year in September.

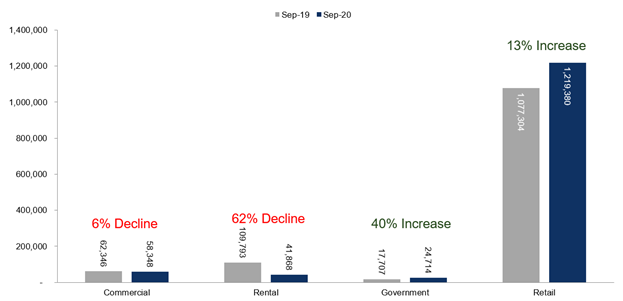

Government units were up 40% year over year, on a small base, while rental units were down 62% year over year in September, an improvement over the 83% year over year drop in August. New-vehicle sales into the commercial channel declined 6% year over year in September.

We estimate that the remaining retail deliveries were up 13% year over year in September, leading to an estimated retail SAAR of 14.5 million, up from 14.2 million last September and up from August’s 13.8 million rate. Combined, September’s total new vehicle deliveries were up 6.1% year over year with two more selling days compared to September 2019. With those volumes, the September SAAR was 16.3 million, a 5% decrease from last year’s 17.1 million but an improvement from August’s 15.2 million.

Looking at automakers, year-over-year changes in fleet sales ranged from an increase of 59% to a decrease of 93%. Toyota saw its best performing month for fleet sales in 2020, attributed mostly to daily rental performance. Toyota’s rental channel saw an increase of 71% year over year. Nissan saw the largest decrease in fleet sales in September, according to a Cox Automotive analysis.