Data Point

Auto Credit Availability Improved Again in September

Tuesday October 10, 2023

Article Highlights

- In September, the Dealertrack Credit Availability Index reported improved access to auto credit for all types of auto loans.

- Movement in credit availability factors was mixed in September.

- Credit availability was mixed across channels in September.

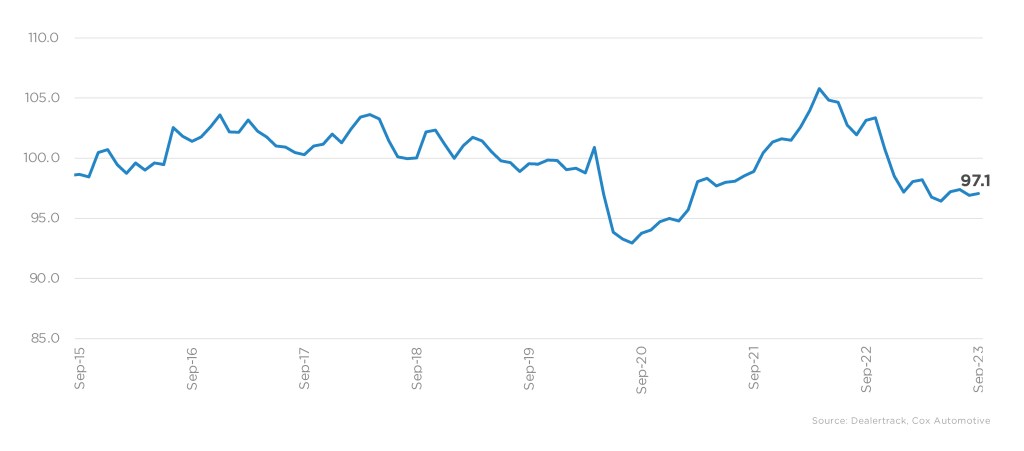

In September, the Dealertrack Credit Availability Index reported improved access to auto credit for most types of auto loans. During the summer, credit access was made more accessible across all channels and lender types. However, at the start of fall, credit access has started to tighten across most channels. Despite this, there has been an increase in loosening across most lender types. It’s important to note that credit access is still tighter than it was a year ago and, in many channels, tighter than before the pandemic. The All-Loans Index showed an increase of 0.2% to 97.1 in September. This means that access is now tighter by 5.9% year over year. Compared to February 2020, access is tighter by 2.1%.

Dealertrack Credit Availability Index

Auto loan access improved in September but was down year over year

All Auto Loans Index (Jan2019=100)

September Credit Availability Mixed Across Channels

Movement in credit availability factors was mixed in September. Approval rates increased, subprime share increased, negative equity share increased, down payments declined, and those moves improved consumer credit access. However, average terms lengthened, yield spreads widened, and those moves hurt consumer credit access.

The average yield spread on auto loans in September widened by 7 basis points (BPs), so rates consumers saw on auto loans were less attractive in September relative to bond yields. The average auto loan rate increased by 25 BPs in September compared to August, while the 5-year U.S. Treasury increased by 17 BPs, resulting in a narrower average observed yield spread.

The approval rate decreased by 5 BPs in September and was down 0.7 percentage points year over year. The subprime share increased to 11.1% from 11.0% in September but was down 0.6 percentage points year over year.

The share of loans with terms greater than 72 months was flat and was down 2.1 percentage points year over year.

Credit Availability Improved for Most Lender Types in September

Credit availability was mixed across channels in September. Independent used saw the most loosening, while certified pre-owned (CPO) saw the most tightening. On a year-over-year basis, all channels were tighter, with CPO loans having seen the most tightening.

Credit availability loosened in September across most lender types; banks tightened. Captives loosened the most. On a year-over-year basis, credit access to all lenders was tighter, with credit unions tightening the most.

Each Dealertrack Auto Credit Index tracks shifts in loan approval rates, subprime share, yield spreads and loan details, including term length, negative equity, and down payments. The index is baselined to January 2019 to show how credit access shifts over time.

Measures of Consumer Confidence Declined Again in September

The Conference Board Consumer Confidence Index® declined by 5.2% in September, as future expectations plunged 11.5%, but views of the present situation increased 0.3%. Consumer confidence was down 4.5% year over year following two back-to-back months of decline. Plans to purchase a vehicle in the next six months declined but remained up year over year. The confidence index did not fall as much during the pandemic as the sentiment index from the University of Michigan. Both series declined in August and September after improving in June and July. The Michigan index declined 2.0% for the month but was up 16% year over year. The consumer’s view of vehicle buying conditions has fallen to the lowest level since December, with negative trends in the perception of prices and rates. The daily index of consumer sentiment from Morning Consult also measured declining sentiment in September, as the index declined 2.1% from the end of August. Gas prices increased in July and August but declined slightly in September. According to AAA, the national average price for unleaded gas declined 0.1% in September to $3.82 per gallon, which was unchanged year over year.

The Dealertrack Credit Availability Index is a monthly index based on Dealertrack credit application data and will indicate whether access to auto loan credit is improving or worsening. The index will be published around the 10th of each month.

Jonathan Gregory

Jonathan Gregory is a Senior Manager on Cox Automotive’s economic and industry insights team, which works to find actionable insights for the industry posed by Cox Automotive clients. Jonathan works with the Sales, Finance, and Data Science organizations and creates innovative solutions often combining proprietary data from other Cox Automotive brands. Jonathan joined Cox Automotive in 2022.