Data Point

Auto Credit Availability Increased in September

Monday October 14, 2024

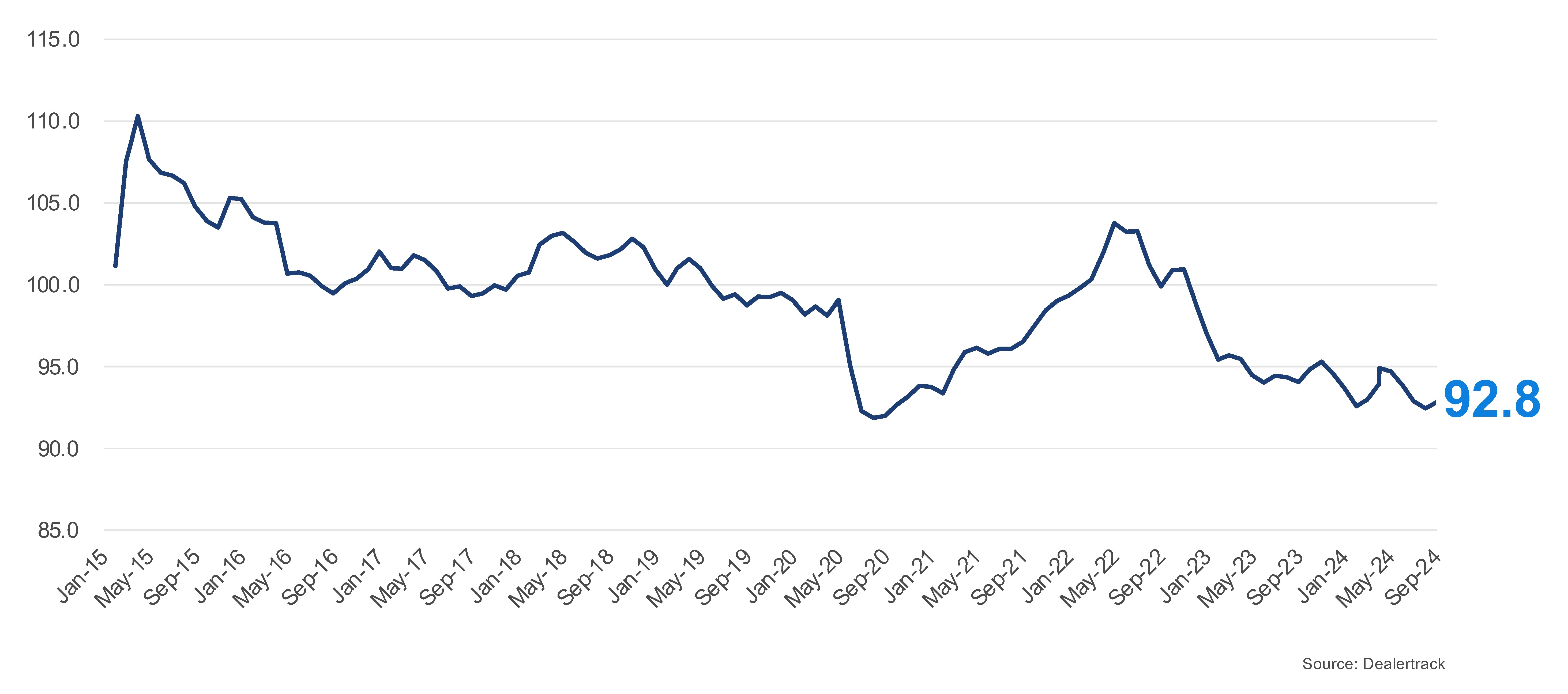

Access to auto credit increased in September as credit loosened across most channels and all lender types, marking the end of a five-month decline, according to the Dealertrack Credit Availability Index. The All-Loans Index was 92.8 in September, up 0.4% from the August reading but down 2.1% year over year.

Dealertrack Credit Availability Index1

Auto loan access improved in September but remained down year over year

All Auto Loans Index (Jan2019=100)

The Dealertrack Credit Availability Index improved due to reduced average auto loan rates, an increased share of subprime loans, and extended loan term lengths, all of which contributed to easier consumer credit access.

Credit Availability Loosens in September, Except for Independent Used Sales

Credit availability eased in September for all sales channels except independent used sales. Certified pre-owned loans loosened the most, while credit availability for used loans through independent dealers tightened the most but remained better than pre-pandemic levels. Overall, credit access was tighter than a year ago, with new loans showing the least tightening and certified pre-owned loans experiencing the most tightening compared to last year.

Credit Unions and Banks Lead Credit Loosening

In September, credit availability increased across all lender types. Credit unions and banks showed the most significant easing, while auto-focused finance companies loosened their standards the least, yet their credit availability is still tighter pre-pandemic levels. Compared to the previous year, auto-focused finance companies eased slightly, whereas banks experienced the greatest tightening.

Yield Spread Widens as Approval Rates Drop, Subprime Share Rises

In September, the average yield spread on auto loans widened by 6 basis points (BPs), making auto loan rates less favorable compared to bond yields. The average auto loan rate dropped by 15 BPs from August, while the 5-year U.S. Treasury fell by 21 BPs, leading to a bigger yield spread. Notably, auto loan rates have decreased by 113 BPs since March.

The approval rate decreased by 50 BPs in September and fell by 3.8 percentage points compared to the previous year. Meanwhile, the subprime share increased by 30 BPs in September and increased by 1.2 percentage points year over year. This marks the second consecutive rise in subprime share.

Long-Term Auto Loans and Negative Equity Rise in September, Down Payments Fall

The share of loans with greater than 72-month terms rose 80 BPs after declining from last month and was down 0.8 percentage points year over year. For a fourth month, the number of loans with negative equity increased by 20 BPs in September and was up 1.7 percentage points year over year. The down payment percentage fell 20 BPs after being flat three months in a row but is up 3.5 percentage points compared to last year.

Each Dealertrack Auto Credit Index tracks shifts in loan approval rates, subprime share, yield spreads and loan details, including term length, negative equity, and down payments. The index is baselined to January 2019 to provide a view of how credit access shifts over time.

Measures of Consumer Confidence Were Mixed in September

The Conference Board Consumer Confidence Index® declined 6.5% in September, when an increase had been expected, but August’s index was revised higher. Consumers’ views of the present and of the future declined. Consumer confidence was down 5.4% year over year. Plans to purchase a vehicle in the next six months increased slightly compared to August but was down slightly year over year. According to the sentiment index from the University of Michigan, consumer sentiment increased 3.2% in September compared to August and was up 3.2% year over year. The median consumer expectation for inflation in a year declined to 2.7%, which was the lowest level since December 2020. Expectation for inflation in 5 years increased to 3.1%. The consumer’s view of buying conditions for vehicles improved to the best level since April. The daily index of consumer sentiment from Morning Consult increased 1.4% in September, extending a streak of four-monthly gains. The index was up 8.6% year over year. Gas prices declined again in September. The national average price for unleaded gas from AAA was down 3.9% from the end of August to $3.20 per gallon, which was down 16% year over year.

The Dealertrack Credit Availability Index is a monthly index based on Dealertrack credit application data and will indicate whether access to auto loan credit is improving or worsening. The index will be published around the 10th of each month.

1In November 2023, the data behind the Dealertrack Auto Credit Availability Index was reset by our data sciences team as part of a migration to a new data management system. All points in the data set were reestablished, with January 2019 in the index set at 100 (as it had been previously). The All-Loans Index plot used in this post utilizes the new data set. The absolute numbers have shifted, but the trends and narrative have not. For more information, contact the Cox Automotive team.