Data Point

The Service Business is Returning, Just in Time

Wednesday March 17, 2021

Article Highlights

- The service business is not back to pre-pandemic normal, but it’s getting close, or at least dealers feel that way.

- In the latest Cox Automotive Dealer Sentiment Index, a slight majority of dealers reported service business was better than a year ago.

- Importantly, the same dealers were far more optimistic about their fixed operations business in the coming 90 days.

Late last month, according to data compiled by Xtime, a Cox Automotive software brand, the service department business at an average dealership was down approximately 8% from year-earlier levels. An 8% drop in business is serious but, in fact, it’s a big improvement from much of 2020. As the pandemic took hold, mileage dropped and service demand slowed. Business was down by 20% or more for much of last year, severely impacting what are typically strong profits from fixed operations.

The service business is not back to pre-pandemic normal, but it’s getting close, or at least dealers feel that way. In the latest Cox Automotive Dealer Sentiment Index (CADSI), our team began asking franchised auto dealers to describe their current fixed operations business. In Q1, a slight majority reported service business was better than a year ago (index score of 51). Importantly, the same dealers were far more optimistic about their fixed operations business in the coming 90 days, with an index score of 72.

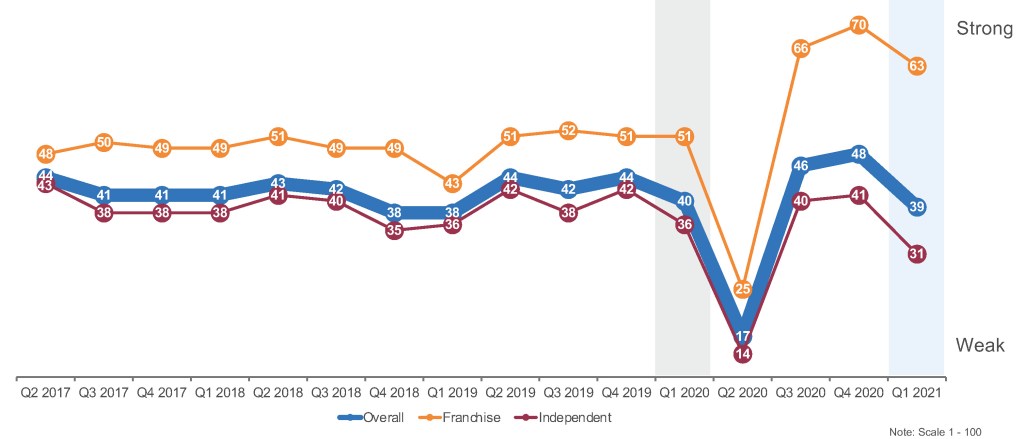

The fact the service business is showing signs of life is good news for dealers. Sales profitability surged to all-time highs in 2020, but those days are likely in the rearview mirror now. According to recent CADSI data, dealers reported record levels of profitability in Q3 and Q4 of 2020 – index scores of 66 and 70, respectively – but lower levels in Q1, as the profit index, at 63, was directionally heading back to a normal level. In 12 quarters stretching from Q2 2017 to Q2 2020, the average index rating was 49.4.

How Would You Describe Your Profits Over the Last 3 Months?

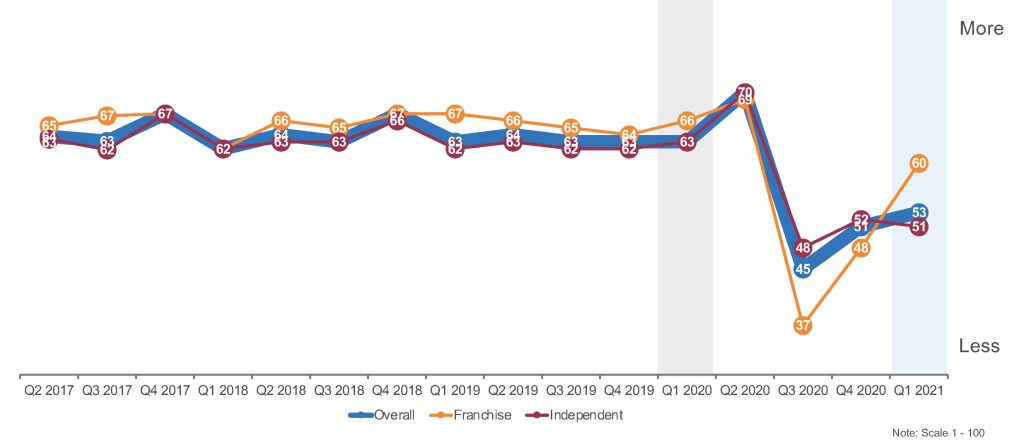

Dealers also reported in Q1 that competition was beginning to hold back business, unlike in Q2 and Q3 of 2020 when competition was of little concern. Moreover, dealers are feeling pressure to lower prices. Price pressure was rated at 60 in Q1, after bottoming out in Q3 2020 at 37 and jumping to 48 in Q4 2020. The index score of 60 means a majority of franchised dealers now feel more pressure to lower prices. That pressure, plus the current high cost of acquiring inventory, is biting into profitability.

How Much Pressure Do You Feel to Lower Prices?

The fixed operations side of the dealership business – the service lanes – has traditionally been the profit driver of franchised dealerships, not the sales department. In 2020, that equation was flipped, as low inventory and solid demand drove up profitability in new- and used-vehicle sales.

Service appointment volume is slowing inching back to normal, according to Xtime. And the timing could not be better: As sales profitability comes under pressure, improvements in fixed operations are welcome indeed.