Data Point

The Teen Years: When Our Market Fell in Love with the SUV

Thursday April 2, 2020

Article Highlights

- In 2010, as our Teen years got underway, 27 of 34 major auto brands sold a majority of cars.

- Only six automotive brands sold a majority SUVs in 2010.

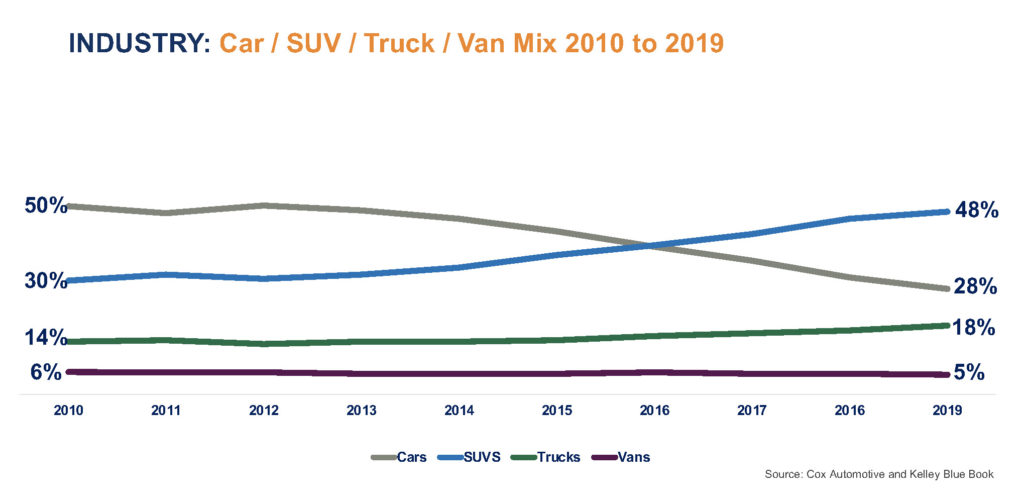

- In aggregate, the U.S. auto industry moved from 50% cars in 2010 to 28% in 2019.

This week the auto industry closed the books on Q1 2020, with sales falling quickly, ravaged by buyers more focused on social distancing than Super Duties. What vehicles were sold in March were mostly SUVs and pickups – the new normal in our new-vehicle landscape and the results of 10-year shift that turned our auto world upside-down.

Our team at Kelley Blue Book analyzed 34 different automotive brands, from Acura to Volvo, tracking each one’s sales mix through the past decade and documenting the U.S. market shift from a car market to an SUV market. Here’s what they found.

In 2010, as our Teen years got underway, 27 of 34 major auto brands sold a majority of cars — traditional 3-box sedans, with space up front for an engine, passengers in the middle, cargo in the trunk. One brand, Chrysler, sold a majority vans at that time. Only six automotive brands sold a majority SUVs in 2010.

Jeep and Land Rover were always all-in with SUVs – 100% of their sales mix. They still are today. And not surprising, GMC and Subaru were both majority-SUV brands back in then (54% and 68% respectively), GMC with the big Yukons and Subaru with its crossover, AWD vehicles.

More surprising, though, is that both Cadillac and Lexus were already SUV heavy in 2010 (52% and 51%, respectively), pioneers for luxury, a segment that now in 2020 is even more heavily SUV focused. Move over diamonds, SUVs are a girl’s best friend.

In 2019, as the transformation decade closed, only seven of our 34 brands still sell a mix tilted toward cars. The new Genesis brand, desperately prepping a new luxo-SUV for launch, was 100% sedans in 2019, followed by Tesla at 91% SUV-free and 100% electric. Other car brands still in existence today include Dodge, Fiat, Honda, Kia and Mini.

In aggregate, the U.S. auto industry moved from 50% cars in 2010 to 28% in 2019. As cars dwindled, SUVs proliferated, growing from 30% of the market to 48% in 2019. The pickup truck segment grew some (rising from 14% to 18%) and vans held steady, in the 5-to-6% range.

The transformations are perhaps most interesting with brands such as Infiniti – 70% cars to 71% SUVs – and Porsche – 67% cars to 68% SUVs – but nearly all saw a similar shift. Very few brands kept a consistent mix. The attached slide deck showcases the brand-level transformation.

Every decade sees our business change. That’s a given. The real question: What change will we find in the decade ahead? Our bet, Tesla is ahead of the curve.