Data Point

Used-Vehicle Days’ Supply Breaks 50; Average Listing Price Surpasses $28,000

Thursday January 20, 2022

Article Highlights

- The average used vehicle listing price in December surpassed $28,000 for the first time.

- Days’ supply hit 51, the highest since January 2021.

- Available inventory inched higher, edging closer to normal.

Revised, Feb. 17, 2022 – Used-vehicle inventory rose in December with the days’ supply hitting 51 for the first time since January 2021, and the average listing price exceeding $28,000 for the first time ever, according to the Cox Automotive analysis of vAuto Available Inventory data.

2.38M

Total Unsold

Used Vehicles

as of December 27

51

Days’ Supply

$28,193

Average Listing Price

69,826

Average Mileage

The total supply of unsold used vehicles on dealer lots across the U.S. climbed to 2.38 million units at the end of December, compared with Cox Automotive’s revised number of 2.25 million at the end of November. The supply at the end of December was about 9% lower than at the same time in 2020.

At the end of December, the days’ supply of unsold used vehicles was 51, up from the revised number of 45 at the end of November. It was the first time since mid-January 2021 that the days’ supply was over 50. Days’ supply began dropping last January, bottoming out at 30 in April and inching its way higher ever since. Still, days’ supply at the end of December was nearly four days below the December 2020 level.

The Cox Automotive days’ supply is based on the daily sales rate for the most recent 30-day period. Used-vehicle sales during December sales ran about 4% behind the year-earlier period.

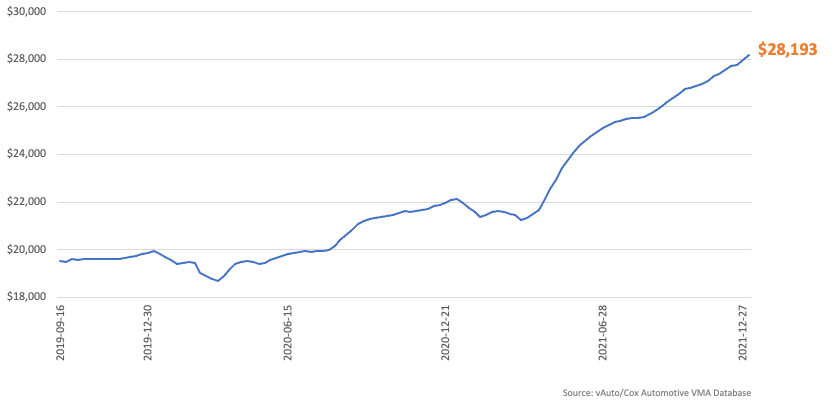

The average listing price for used vehicles exceeded $28,000 each of the last two weeks of December, closing the month at $28,193. That’s up from the revised $27,726 in November 2021, when the average listing price surpassed $27,000 for the first time. The average used-vehicle listing price was up 28% at the end of December compared with the year earlier and 42% higher than at the end of 2019.

Average Used-Vehicle Listing Price

Franchised dealers had 1.35 million used vehicles in inventory for a 48 days’ supply. That compares with 1.29 million vehicles in inventory for a 41 days’ supply in November 2021. The average listing price for franchised dealers was $30,552 – the first time it surpassed the $30,000 mark. That was up from $29,728 in November with average mileage of 69,826, up from 61,976 in November.

Non-franchised dealers had 1.03 million vehicles in stock for a 55 days’ supply in December. That compares with 1.01 million for a 48 days’ supply in November. The average price of a used vehicle on an independent dealer’s lot was $24,998, up from $24,585 in November with an average mileage of 79,248, up from 78,267.

The lowest price segment – under $10,000 – had the lowest supply of under 7,000 vehicles for a days’ supply of 39. The segments ranging from $10,000 to $25,000 had days’ supply between 46 and 48. The category of $25,000 to $30,000 had the most supply with more than 1 million vehicles in stock for 52 days of supply. Price categories above $30,000 had days’ supply over 50 as well.

For more insights on used-vehicle inventory using a 30-day rolling sales methodology to calculate days’ supply, reach out to the Cox Automotive Public Relations team.

Michelle Krebs is executive analyst at Cox Automotive.