Data Point

Used-Vehicle Supply Drops on Strong Sales

Friday September 8, 2023

Article Highlights

- Used-vehicle inventory fell slightly to 2.25 million units at the start of September.

- Used days’ supply stood at 44, a decrease from July.

- The average used-vehicle listing price decreased slightly through August and drops below $27,000.

Used-vehicle inventory declined throughout August on stronger sales, according to the Cox Automotive analysis of vAuto Available Inventory data. The total supply of unsold used vehicles on dealer lots – franchised and independent – across the U.S. stood at 2.25 million units at the beginning of September, down less than 7,500 units from the supply at the end of July. Still, inventory was down 9%, or 233,636 units, from the same time a year ago.

2.25M

Total Unsold

Used Vehicles

as of Sept. 4, 2023

44

Days’ Supply

$26,651

Average Listing Price

69,893

Average Mileage

Total days’ supply at the beginning of September stood at 44, compared to 48 at the beginning of August. The days’ supply was down 15% from year-ago levels. Days’ supply has been holding at the mid-to-high 40s since April.

“Used-vehicle inventory had been increasing after hitting a low point in March,” said Chris Frey, senior manager of Economic and Industry Insights at Cox Automotive. “But that increase in inventory stalled in the middle of July and into August, as sales unexpectedly picked up.”

The Cox Automotive days’ supply is based on the daily sales rate for the most recent 30-day period, ending September 5, when sales were 1.53 million units, up 8% compared to August 2022. Total used-vehicle retail sales through the first eight months of the year are now down less than 4% compared to the same timeframe in 2022.

“Used-vehicle sales have shown remarkable strength since mid-July, chipping away at available supply and denting the days’ supply figure,” said Frey.

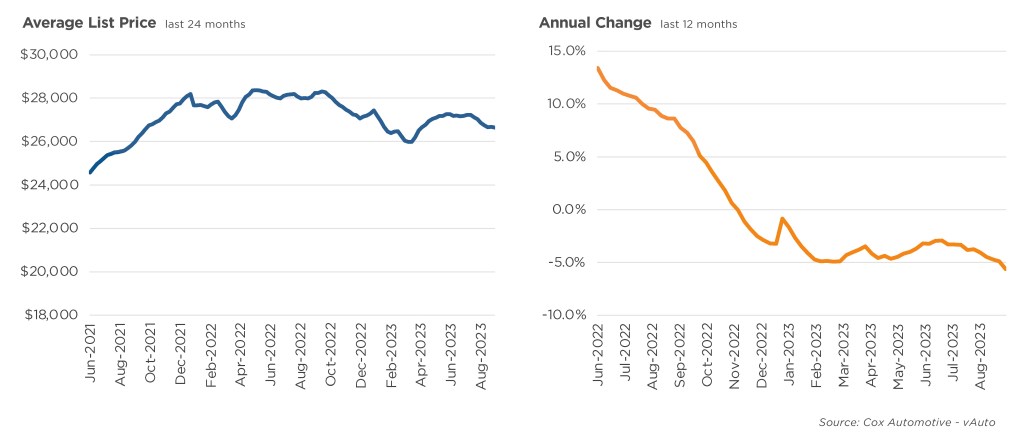

The average used-vehicle listing price began September lower than one month ago and was down 6% compared to August 2022. The average used-vehicle listing price is now at $26,651, down 1% from $27,023 at the end of July. Meanwhile, according to the Manheim Used Vehicle Value Index, wholesale prices increased 0.2% in August from July and were down 7.7% from a year ago.

August 2023 AVERAGE USED-VEHICLE LISTING PRICE

Prices have been falling since mid-July, helping to spark some demand.

As with new cars, and as has been the case for months, the lower the price segment, the tighter the inventory. Used vehicles priced under $10,000 had a days’ supply of 30, with days’ supply increasing with every higher price segment to the over $35,000 category with the highest days’ supply of 56.

Honda, Subaru, Toyota, Nissan and Hyundai were the non-luxury brands with the lowest inventory of used vehicles at the beginning of September. Honda had 36 days’ supply. Subaru, Toyota and Nissan all had 38 days’ supply, with Hyundai at 39. They were the only brands with sub-40 days’ supply. Most mainstream brands – both luxury and non-luxury – had used-vehicle days’ supply under 60.

Rebecca Rydzewski

Rebecca Rydzewski is an automotive analyst with over 20 years of experience in the automotive industry. She provides industry and data analysis using consumer and industry data from Cox Automotive and its brands including Autotrader and Kelley Blue Book. Rydzewski joined Cox Automotive in March 2022.