CAMIO

Used-Vehicle Inventory Closes Out Year at Highest Level in Five Years

Wednesday March 20, 2024

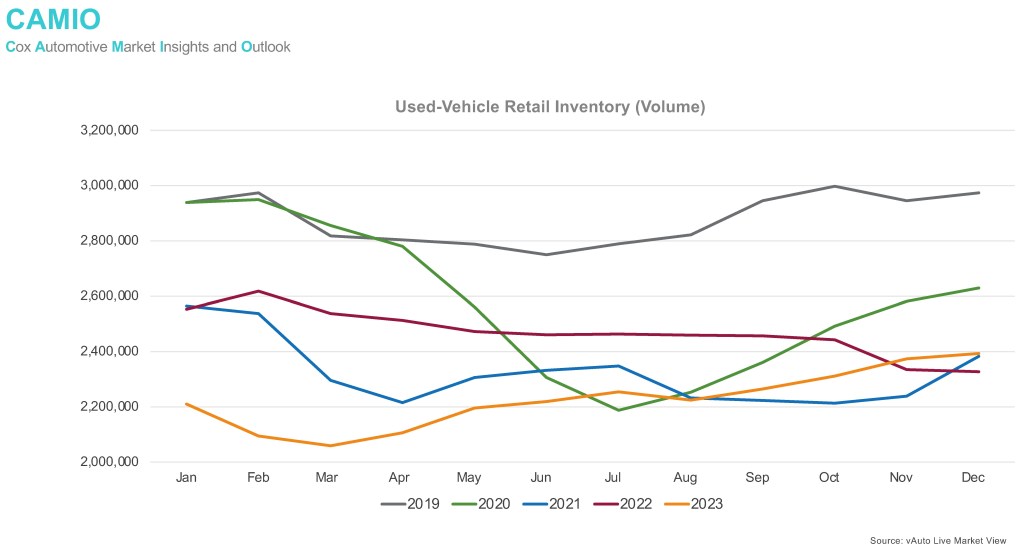

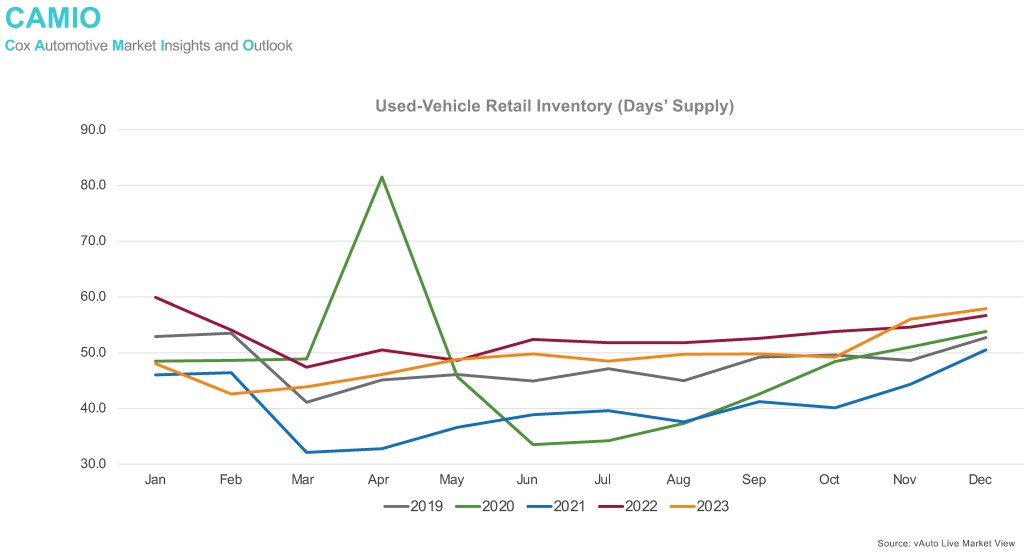

Takeaway: After bottoming at a low historical level in Q1, the supply of used units generally rose through most of 2023, ending at roughly the highest levels of the year and up 2% against 2022. This allowed days’ supply to recover through the fourth quarter at 56 days’ supply, the highest of any week in 2023. In general, while unemployment has remained low, higher relative used-vehicle prices and much higher interest rates weighed on demand, keeping the pace of sales for used vehicles lower, pushing days’ supply measurements at the end of 2023 to the highest level seen in the last five years.

What’s next: Three main drivers will influence used-vehicle supply in 2024 – off-lease, rentals and repos. A shortage of off-lease supply is expected to start in the second half of 2024, which marks the three-year anniversary of lower new-vehicle production/sales – and lower leasing. Off-lease is a major inflow for the used-vehicle marketplace, and this significant shortage will continue until bottoming out in 2025. However, rental units are expected to see around 20% growth in wholesale, which will lead to additional supply for the used retail market. Meanwhile, higher defaults are leading to more repossessions, also driving a bit more supply at auction in the first half of the year. This will likely get curtailed in the second half of 2024 – especially as the loan base stagnates.