Data Point

Used-Vehicle Supply Closed 2023 at the Highest Levels of the Year

Friday January 19, 2024

Article Highlights

- Used-vehicle inventory rose to 2.39 million units at the close of December.

- Used days’ supply stood at 56, the same as November.

- The average used-vehicle listing price increased slightly but remained well below $27,000.

Used-vehicle inventory closed 2023 at the highest levels of the year, according to the Cox Automotive analysis of vAuto Available Inventory data.

2.39M

Total Unsold

Used Vehicles

as of Jan. 1, 2024

56

Days’ Supply

$26,446

Average Listing Price

68,794

Average Mileage

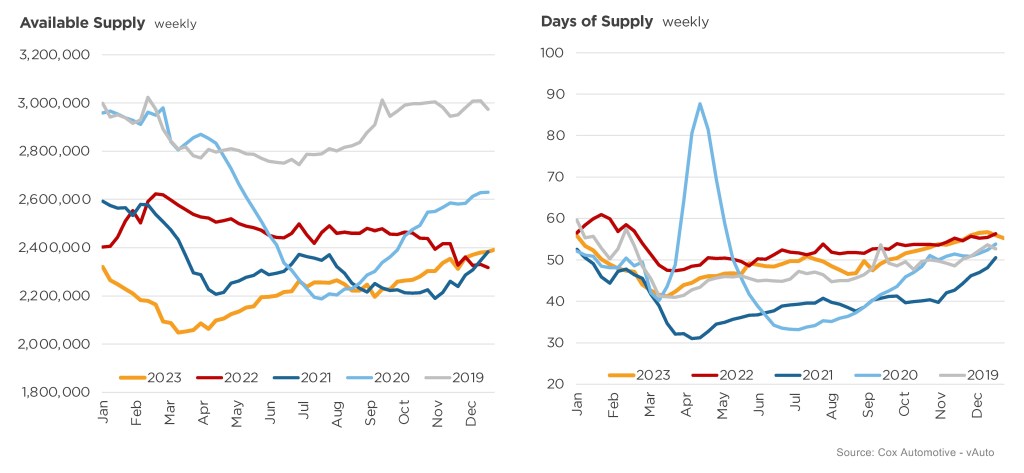

The total supply of unsold used vehicles on dealer lots – franchised and independent – across the U.S. stood at 2.39 million units at the close of December, up 4% from a year ago and the highest levels since the fourth quarter of 2022.

At the end of December, total days’ supply remained steady at 56, which is the same as the revised measurement for the end of November. Used-vehicle days’ supply was up 1% from year-ago levels, and the range of days’ supply has remained consistent between 54 and 56 since the beginning of November.

USED-VEHICLE INVENTORY VOLUME AND DAYS’ SUPPLY

Days’ supply is now at 56, up 4% year over year as inventory increased.

“After bottoming out at a low historical level in the first quarter of 2023, the supply of used units generally rose throughout most of 2023, ending at roughly the year’s highest levels in both volume and days of supply,” said Jeremy Robb, senior director of Cox Automotive Economic and Industry Insights.

The Cox Automotive days’ supply is based on the estimated daily retail sales rate for the most recent 30-day period, ending Jan. 1, 2024, when sales were 1.30 million units.

“Throughout the fourth quarter, we saw a fairly steady level of weekly used sales and ended the year with estimated sales running about 2% higher compared with 2022,” said Robb. “For the full year, we estimate sales for used retail were down about 3%, curtailed by a constrained supply of newly used vehicles into our ecosystem.”

Robb added, “Looking ahead, the retail used-vehicle market should continue to feel the pinch of lower new-vehicle sales in 2021 and 2022, keeping supply constrained.”

Used-Vehicle Listing Increases Slightly

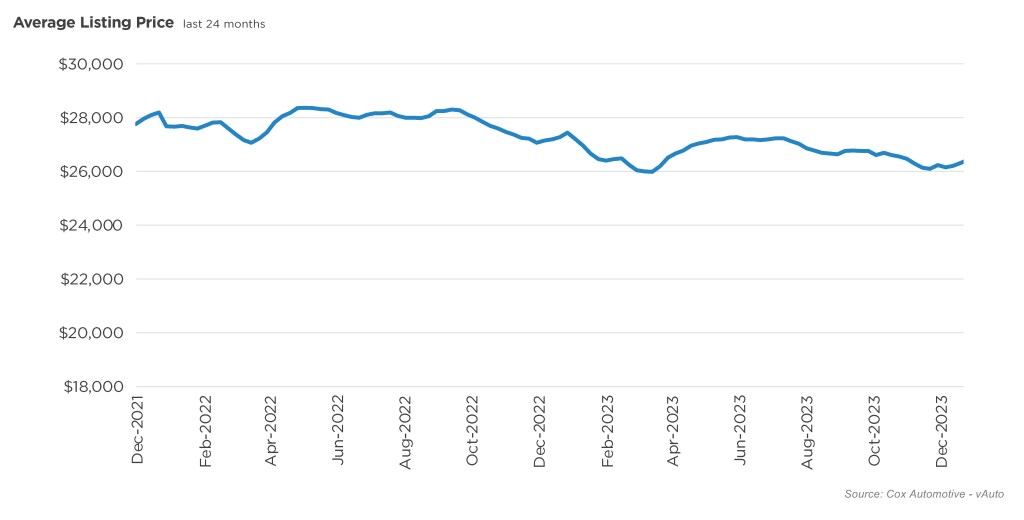

The average used-vehicle listing price was $26,446 at the end of December, up from $26,226 at the end of November but down 3% from a year earlier.

AVERAGE USED-VEHICLE LISTING PRICE

Prices have been increasing marginally in recent weeks but remain down 3% from a year earlier.