Data Point

Used-Vehicle Prices Keep Falling as Inventory Stabilizes, Sales Drop

Friday December 16, 2022

Article Highlights

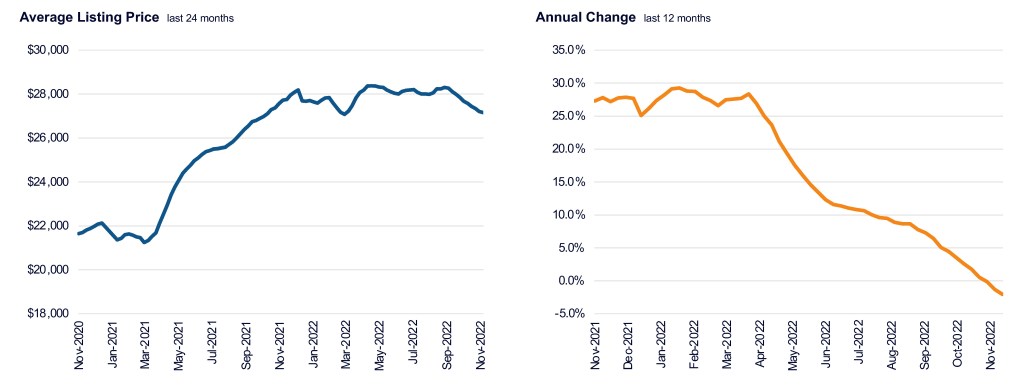

- The average listing price for a used vehicle fell again to just over $27,000, its lowest since last spring.

- The asking price gap with 2021 is now negative. Prices are down 2% from a year ago.

- Used-vehicle inventory remained relatively steady; sales weakened.

Revised, Jan. 13, 2023 – Used-vehicle asking prices fell again through the month of November to their lowest average since last spring as inventory stabilized and sales fell, according to the Cox Automotive analysis of vAuto Available Inventory data.

2.33M

Total Unsold

Used Vehicles

as of Nov. 28, 2022

54

Days’ Supply

$27,156

Average Listing Price

69,916

Average Mileage

The total supply of unsold used vehicles on dealer lots, both franchised dealers and independents, across the U.S. stood at 2.33 million units at the close of November, about 4% higher than a year ago. That compares with a revised 2.44 million at the end of October.

“Since June, inventory has been relatively stable, though there have been slight declines starting in October,” said Quentin Wallace, Cox Automotive research manager. “While we were expecting an increase in used inventory to end the year like prior years, that hasn’t occurred yet, and we might see even lower levels into December.”

Total days’ supply at the end of November stood at a revised 54, 17% above year-ago levels. October ended with a revised 53 days’ supply. Used inventory levels have been in this ballpark for several months.

The Cox Automotive days’ supply is based on the daily sales rate for the most recent 30-day period, which ended on November 28. Sales in the period were 1.35 million vehicles compared with the revised 1.37 million for the equivalent 30-day period in October.

For the full month of November, Cox Automotive estimates used retail sales declined 10% from a year ago and 1% from October, based on same-store estimates from Dealertrack.

“Despite the slowdown in recent weeks, we continue to see abnormally strong used-vehicle sales for this time of year. Traditionally, the end of the year sees much softer used-vehicle sales activity,” said Wallace.

The average listing price was $27,156 at the end of November, down from the revised $27,578 at the end of October. Prices are now down 2% from a year ago, as predicted, and could drop further by year-end to 5% below year-ago prices.

Average Used-Vehicle Listing Price Pace of Decline Rising

Price growth now falling – trend suggests reaching -5% growth by Christmas

As with new vehicles, the lower the price, the tighter the inventory. The days’ supply increases with every $10,000 increase in price category. Days’ supply for vehicles under $10,000 is 34. At the opposite end of the spectrum, days’ supply for vehicles over $35,000 is 61.

Acura, Honda, Lexus, Mazda, Mitsubishi, Nissan, Subaru, Toyota and Volkswagen have the lowest days’ supply of used vehicles at 50 or lower.

For more insights on used-vehicle inventory using a 30-day rolling sales methodology to calculate days’ supply, reach out to the Cox Automotive Public Relations team.

Michelle Krebs is executive analyst at Cox Automotive.