Data Point

Used-Vehicle Inventory Remains Limited to Start November

Friday November 10, 2023

Article Highlights

- Used-vehicle inventory stood at 2.30 million units at the beginning of November.

- Used days’ supply was 49, a decrease from the beginning of October.

- The average used-vehicle listing price remained below $27,000.

Used-vehicle inventory volume at the start of November was slightly higher than in early October but days’ supply remained flat, according to the Cox Automotive analysis of vAuto Available Inventory data.

2.30M

Total Unsold

Used Vehicles

as of Nov. 6, 2023

49

Days’ Supply

$26,533

Average Listing Price

69,971

Average Mileage

The total supply of unsold used vehicles on dealer lots across the U.S. – franchised and independent – stood at 2.30 million units at the beginning of November. That was down 4%, or 93,298 units, from the same time a year ago.

“Used-vehicle inventory volume is still considered to be limited,” said Chris Frey, Cox Automotive senior manager of Economic and Industry Insights. “It has been stuck in the 2.2 million to 2.3 million range for the past four months.”

Using estimates of used retail days’ supply based on vAuto data, an initial assessment indicates November began with 49 days’ supply, flat compared to the start of October and four days lower than how November 2022 began at 54 days. After topping 50 days in July, days’ supply for the used-vehicle market has fluctuated in the mid-to-high 40s.

The Cox Automotive days’ supply is based on the daily sales rate for the most recent 30-day period, ending Nov. 6, when sales were 1.40 million units, up 5% compared to the same period in 2022. Year-to-date retail sales through the beginning of November are now down 4% compared to the same timeframe last year.

Average Used-Vehicle Listing Price Remains Under $27,000

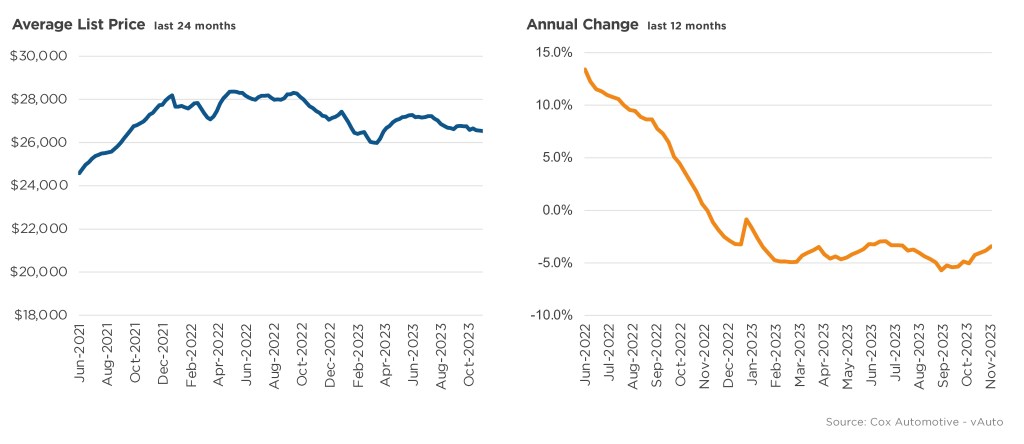

The average used-vehicle listing price of $26,533 at the beginning of November was down from the start of October and down 3% compared to the same period in 2022. Used-vehicle listing prices have been below $27,000 since the end of July. Meanwhile, according to the Manheim Used Vehicle Value Index, wholesale used-vehicle prices decreased 2.3% in October from September and were down 4.0% from a year ago.

AVERAGE USED-VEHICLE LISTING PRICE AND ANNUAL CHANGE

Prices have been declining at a slow pace since early September.

As with new cars, and as has been the case for months, the lower the price segment, the tighter the inventory. Used vehicles priced under $10,000 had a days’ supply of 32, with days’ supply increasing with every higher price segment to the over $35,000 category with the highest days’ supply of 58.

Once again, Honda, Mazda and Toyota were the non-luxury brands with the lowest inventory of used vehicles through September. Honda had 39 days’ supply, while Mazda and Toyota both had 40 days’ supply. Most other mainstream brands – both luxury and non-luxury – had used-vehicle days’ supply under 50.

Rebecca Rydzewski

Rebecca Rydzewski is an automotive analyst with over 20 years of experience in the automotive industry. She provides industry and data analysis using consumer and industry data from Cox Automotive and its brands including Autotrader and Kelley Blue Book. Rydzewski joined Cox Automotive in March 2022.