Data Point

Used-Vehicle Inventory Rapidly Depleted Due to Brisk Sales

Wednesday April 21, 2021

Article Highlights

- Used-vehicle supply fell to levels of last summer.

- Days’ supply plummeted to a scant 33.

- Used-vehicle prices kept climbing but increases began to slow.

Used-vehicle inventory tumbled through March to lows not seen since last summer, according to a Cox Automotive analysis of vAuto Available Inventory data.

2.34M

Total Unsold Used Vehicles

end of March

33

Days’ Supply

$21,343

Average Listing Price

The total supply of unsold used vehicles totaled 2.34 million vehicles at the end of March, down from 2.59 million vehicles at the end of February, which was lower than January. March stock compares with a supply of 2.86 million vehicles in the same year-ago period. Used-vehicle supply was 18% below March a year ago and 16% below the end of March 2019.

The used-vehicle days’ supply throughout March kept dropping, plummeting to 33, down from 48 in January and February. By the end of the month, the days’ supply was down to levels seen during the inventory dry months of June and July 2020. March 2021 days’ supply was 33% below March 2020 and 20% below the same period in 2019.

The days’ supply of used vehicles had remained relatively stable since last October, but strong spring sales, thanks to tax refunds and stimulus checks, depleted the supply. Used-vehicle sales were brisk during March, running 22% ahead of the same period in 2020 and even 5% higher than the comparable period of 2019. The Cox Automotive days’ supply is based on the daily sales rate for the most recent 30-day period.

Franchised dealers had 1.33 million used vehicles in inventory for a 31 days’ supply. Independent dealers had 1.01 million vehicles in inventory for a 34 days’ supply.

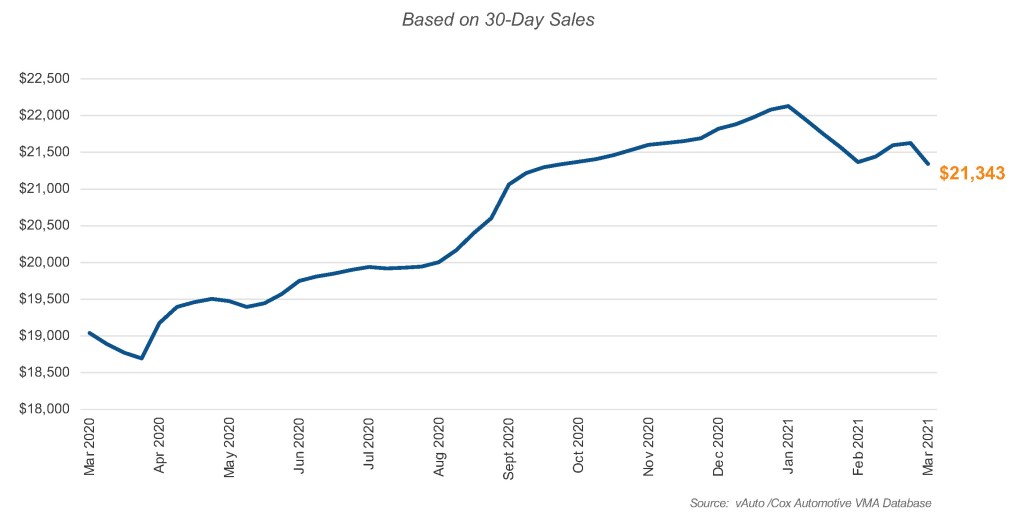

The average listing price continued to be high, closing the month at $21,343. That was nearly 13% higher than the same week a year ago. The pace of rising prices is starting to slow slightly. For franchised dealers, the average listing price was $23,270. For independents, it was $18,802.

Average Used-Vehicle Listing Price

Used vehicles with a listing price of under $10,000 were in the lowest supply at 23 days. Vehicles in the $10,000 to $25,000 range had at or slightly below average inventories. Vehicles priced above $25,000 had a bit better supply.

More insights are available from Cox Automotive on used-vehicle inventory, using a 30-day rolling sales methodology to calculate days’ supply.

Michelle Krebs is executive analyst at Cox Automotive.