Data Point

Used-Vehicle Sales Gain Momentum, Despite Elevated Prices

Thursday March 17, 2022

Article Highlights

- Used-vehicle sales in the last week of February were the best since November.

- Days’ supply dropped to 51 at end of February from 55 at the end of January.

- The average used-vehicle list price dipped again to $27,608 from December high.

Revised April 14, 2022 – Tax refunds finally are arriving, ushering in the traditional spring bounce for used-vehicle sales, according to the Cox Automotive analysis of vAuto Available Inventory data. Sales of used vehicles, while still pricey, started to heat up the last week of February.

2.62M

Total Unsold

Used Vehicles

as of March 1

54

Days’ Supply

$27,609

Average Listing Price

70,529

Average Mileage

The inventory of used vehicles began building to more normal levels at the end of January, ahead of the spring selling season. On March 1, the total supply of unsold used vehicles on dealer lots across the U.S. stood at 2.62 million units. That compared with Cox Automotive’s revised number of 2.55 million at the end of January. The supply entering March was nearly 5% above a year ago.

However, sales heated up by the end of the month and closed with a days’ supply of 54, down from the revised number of 55 at the end of January. The days’ supply at the end of February was up 11% year over year.

The Cox Automotive days’ supply is based on the daily sales rate for the most recent 30-day period, which in this case ended March 1. Cox Automotive estimated that used-vehicle retail sales increased 3% in February from January but had failed to show the typical seasonal increase driven by tax refund season until the last week of the month.

“We are finally beginning to see the important spring bounce in our used-vehicle data,” said Charlie Chesbrough, Cox Automotive senior economist. He noted that in the last week of February, used-vehicle sales were up a hefty 104,000 units from the previous week, marking the best week for used-vehicle sales since late November.

“High prices don’t seem to be hampering sales,” said Chesbrough. “But the hot sales caused a big drop in the days’ supply.”

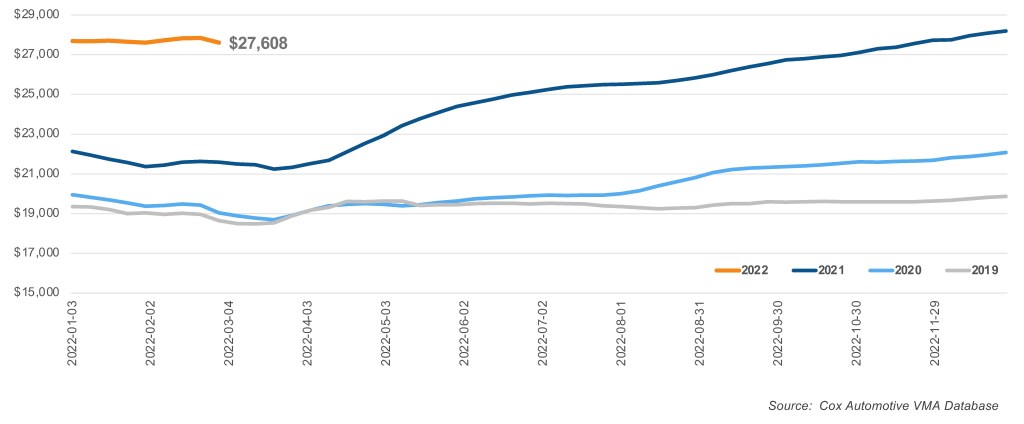

At the end of February, the average listing price dipped again to $27,609, about the same as a month earlier but off the December peak when it surpassed $28,000, according to Cox Automotive data. Still, the average listing price was 28% above the end of February 2021. On the wholesale side, used-vehicle values, according to the Manheim Used Vehicle Value Index, declined 2.1% in February on a seasonally adjusted basis and have declined 3.8% in the first 15 days of March compared to the full month of February.

Average Used-Vehicle Listing Price

The lowest price segments had the lowest inventory and lowest days’ supply, according to Cox Automotive analysis of vAuto Available Inventory data. Vehicles under $10,000 had only a 32 days’ supply. Those priced between $10,000 and $15,000 had a 37 days’ supply. Price segments from $15,000 to $35,000, which represent the biggest volume of supply, had days’ supply ranging from 43 to 59 – the higher the price segment the higher the days’ supply.

For more insights on used-vehicle inventory using a 30-day rolling sales methodology to calculate days’ supply, reach out to the Cox Automotive Public Relations team.

Michelle Krebs is executive analyst at Cox Automotive.