Data Point

Used-Vehicle Supply Stabilizes; Prices Rise

Thursday December 17, 2020

Article Highlights

- Used-vehicle supply held steady at 51 days’ supply.

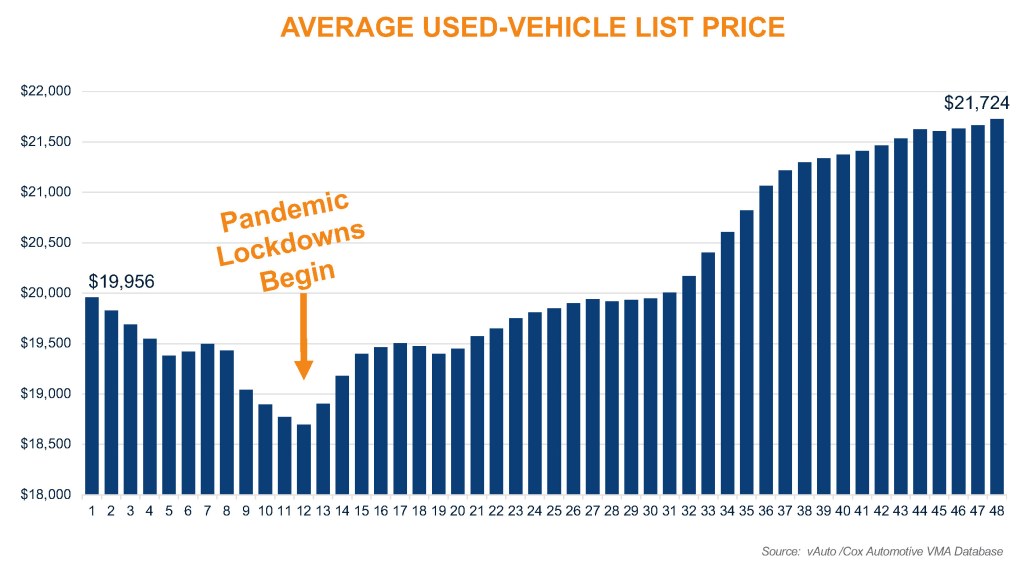

- Average used-vehicle list price hits another new high of $21,724.

- Franchised dealers have lower days’ supply, highest average list price than independents.

Used-vehicle inventory has held steady in recent weeks, while the average used-vehicle list price keeps climbing, according to a Cox Automotive analysis of vAuto Available Inventory data.

2.61M

Total Unsold Used Vehicles

as of Dec. 1

51

Days’ Supply

$21,724

Average Listing Price

66,284

Average Miles

The total U.S. supply of unsold used vehicles opened the month of December at 2.61 million vehicles, up from 2.56 million at the start of November but down from 2.95 million at the same time a year ago. That put the days’ supply at 51, roughly the same level since the end of October.

The Cox Automotive days’ supply is based on the daily sales rate for the most recent 30-day period.

The used-vehicle sales pace has been declining since peaking in mid-July. Early in the pandemic recovery, used-vehicle sales took off. They climbed rapidly and, in early summer, were running between 10% and 15% above the same period in 2019. Since then, the sales pace has been in rapid decline. By end of August, the used-vehicle sales pace turned negative compared to last year, reaching a recovery low point of down 17% in mid-November. The pace has improved since then, but just slightly.

“The weak sales pace has allowed inventory to rebuild, and the days’ supply has gradually been rising,” said Charlie Chesbrough, Cox Automotive senior economist. “Improving new-vehicle sales through the summer and fall created more trade-ins, also boosting supply.”

Still, Chesbrough added used-vehicle supply remains relatively tight at 12% below last year’s levels. That is why used prices remain elevated.

The average list price hit another record at $21,724, according the Cox Automotive analysis of vAuto Available Inventory data. That was up from $21,607 a month ago and from $19,606 a year ago. At the depth of the pandemic, the week of March 23, the average list price bottomed out at $18,681 and has been on a steady rise since then.

The Cox Automotive data shows a distinct difference in inventory levels and prices between franchised dealers and independents. Franchised dealers started the month with an available supply of 1.49 million unsold used vehicles for a 47 days’ supply. Independent dealers had an available supply of 1.12 million vehicles for a 57 days’ supply. The average list price for franchised dealers was $23,376. It was $19,294 for independent dealers.

The days’ supply was lowest for vehicles listed at under $10,000, which represents a small part of the market. The largest segment – the $15,000 to $20,000 range – had 50 days’ supply, in line with the overall national average. The other price segments had days’ supply in the 51 to 56 range.

Across the mainstream brands, days’ supply was in the same general ballpark, with no wild outliers in either direction. Of mainstream non-luxury brands, Honda had the lowest supply at 45 days. Hyundai, Nissan, Subaru and Toyota were under 50 days’ supply. Some luxury models had higher than the average supply with Audi, BMW and Lincoln at over 55 days’ supply.

Michelle Krebs is executive analyst at Cox Automotive.