CAMIO

Used-Vehicle Wholesale Values Retreat in 2022

Wednesday June 7, 2023

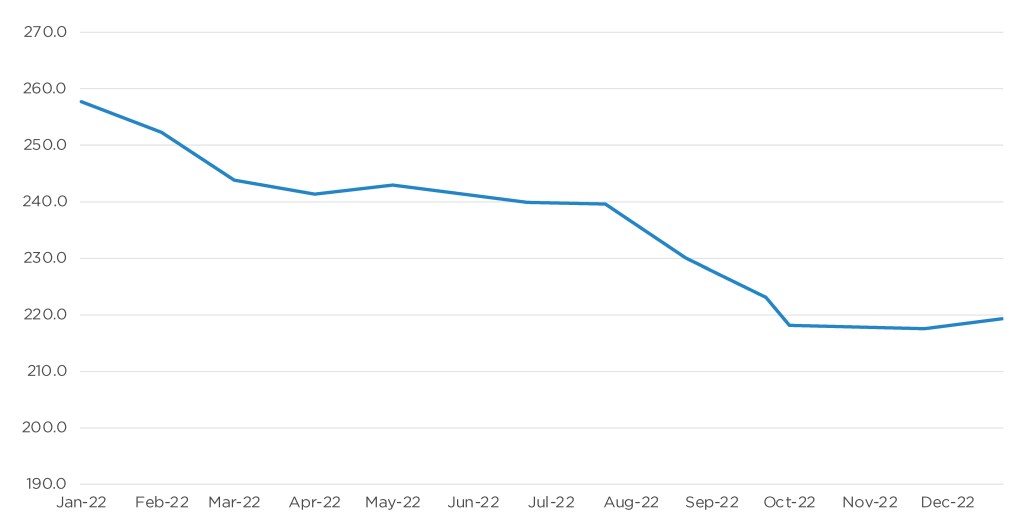

After an unprecedented run-up in used-vehicle values from 2020 through 2021, the Manheim Used Vehicle Value Index (MUVVI) retreated in 2022. Annualized gains after the pandemic began reached as high as 54% and averaged nearly 26% from June 2020 through December 2021. Last year was a different story, delivering a decline of 15% from December 2021 to December 2022, the single largest year-over-year decline in the index’s history.

During 2022, the index saw only two month-over-month gains, May and December, both of which achieved less than 1% in magnitude. While supply in the used market remained tight in 2022, dealers were less willing to pay higher prices at auction compared to the pandemic frenzy in 2020 and 2021.

Supply at the auctions improved last year from the very tighter levels in 2021, but the sustained higher prices were not easy for dealers to digest. The interest rate increases that the Fed started in March 2022 contributed to some trepidation in the retail market, making it less likely that dealers would need to restock as quickly. And as dealers held back, wholesale prices declined throughout the year. Still, the graphic below suggests that a floor was set under auction prices by October.

Monthly Manheim Used Vehicle Value Index

Outlook: Supply in the used market has been tight to start 2023, and it has only modestly improved. Consumer demand, while somewhat muted by high used prices and high interest rates, remains fairly robust even when measured against historical norms. Given that dealers will need to source vehicles from as many options as possible, we expect auction prices to improve slightly and end the year up roughly 2% compared to December 2022.