Smoke on Cars

What to Expect in Tax Season 2020

Tuesday December 17, 2019

Article Highlights

- In 2020, we expect the market to follow the same weekly pattern as the 2018 and 2019 markets.

- Week 9 is likely to see a 20-30% jump in used retail sales.

- The stronger demand in the peak tax-refund delivery period typically delivers higher used-vehicle margins in the spring months of March and April.

Tax refunds drive the demand that makes the spring season the most important season of the year for the used-vehicle market.

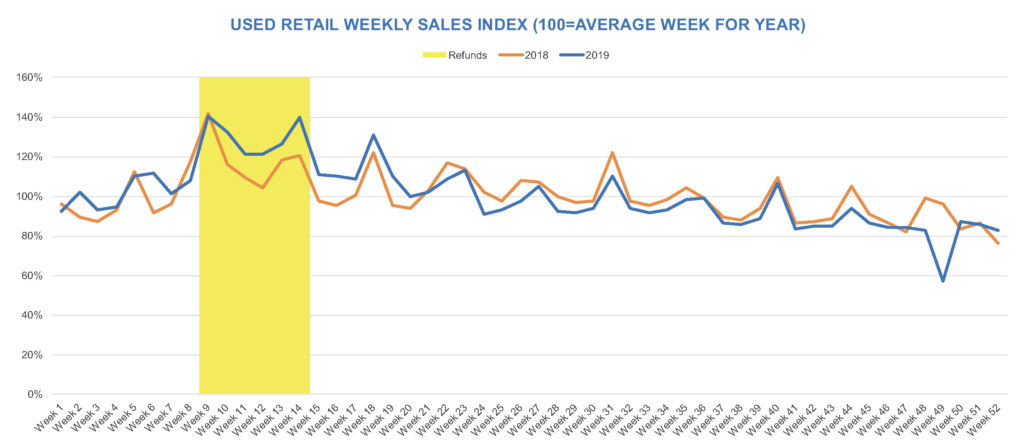

In 2020, we expect the market to follow the same weekly pattern as the 2018 and 2019 markets. Week 9 is likely to see a 20-30% jump in used retail sales. The tax refund buying season typically lasts 6-7 weeks. Over that period, the average weekly sales pace is usually 20-30% higher than the average weekly sales pace for the year.

Week 9 corresponds to when about half of tax refunds have been distributed by the IRS. Over the last two years, 47% and 46% of tax refunds, respectively, have been distributed by calendar week 9. The peak demand ends by calendar week 16, which is usually when more than 90% of tax refunds have been distributed.

With no disruptive changes to withholdings or IRS procedures covering tax year 2019, we expect tax refund season to follow the same pattern in 2020, so the key market weeks are weeks 9 through 16 or starting around February 24 and lasting through April 12.

The stronger demand in this peak tax-refund delivery period typically delivers higher used-vehicle margins in the spring months of March and April. The increased margin in March or April is typically 40-50 basis points better (relative to vehicle cost) than February or about $90 to $150 in additional gross profit.

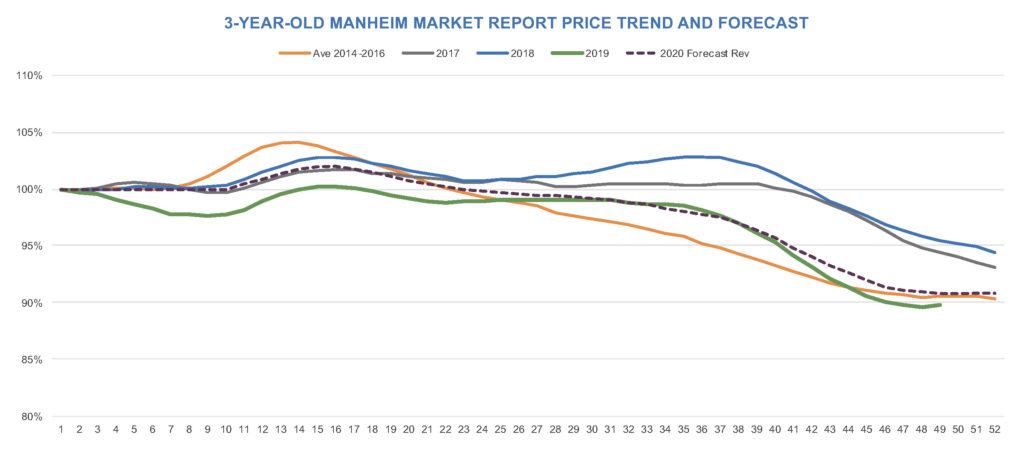

The improved margin happens despite a higher cost of inventory as this peak tax refund season also sees higher wholesale vehicle values while dealers must build up and replace used-vehicle inventory. 2018 and 2019 both saw a cumulative increase of 2.6% in 3-year-old vehicle values over the tax refund season. We are forecasting the same increase for 2020 over calendar weeks 10-15 or March 2 through April 12. Note that the increase builds over a six-week period.

The tax-related spring bounce is most pronounced in more affordable price segments. Leveraging historical MMR price data, the segments that typically do not see a bounce in prices include Luxury Car Mid-Size, Luxury Car Premium, Luxury SUV, and Pickup Heavy-Duty Full-Size. The segments that tend to see the biggest bounce include Compact Car, Mid-Size Car, and Sports Car Sporty.