Commentary & Voices

Wholesale Prices Rebound To End The Year

Wednesday January 8, 2020

Article Highlights

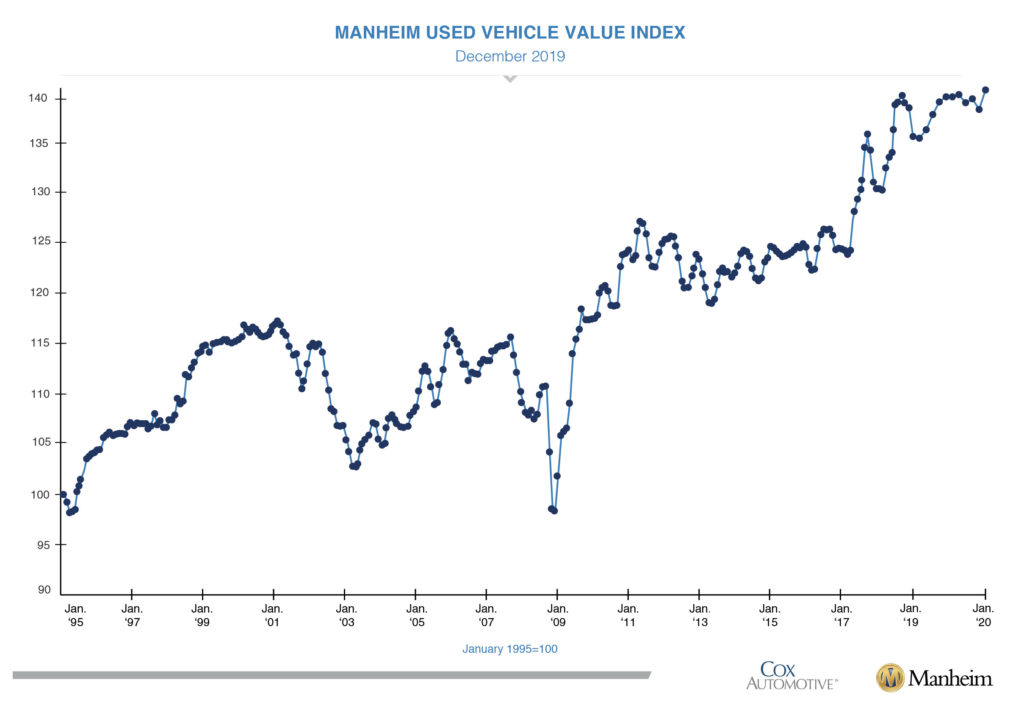

- Wholesale used vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) increased 1.54% month over month in December.

- This brought the Manheim Used Vehicle Value Index to 141.1, a 2.5% increase from a year ago.

- Following a normalizing trend in weekly Manheim Market Report (MMR) prices at the end of November, December saw stability and even gains in many segments.

Wholesale used vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) increased 1.54% month over month in December. This brought the Manheim Used Vehicle Value Index to 141.1, a 2.5% increase from a year ago.

Following a normalizing trend in weekly Manheim Market Report (MMR) prices at the end of November, December saw stability and even gains in many segments. Three-year-old vehicle values in aggregate were up 0.1% for the month. As a result of the stabilization at year-end, prices in aggregate ended 2019 at a historically more normal level of 90% relative to the value at the beginning of the year but well below the performance experienced in either of the last two years.

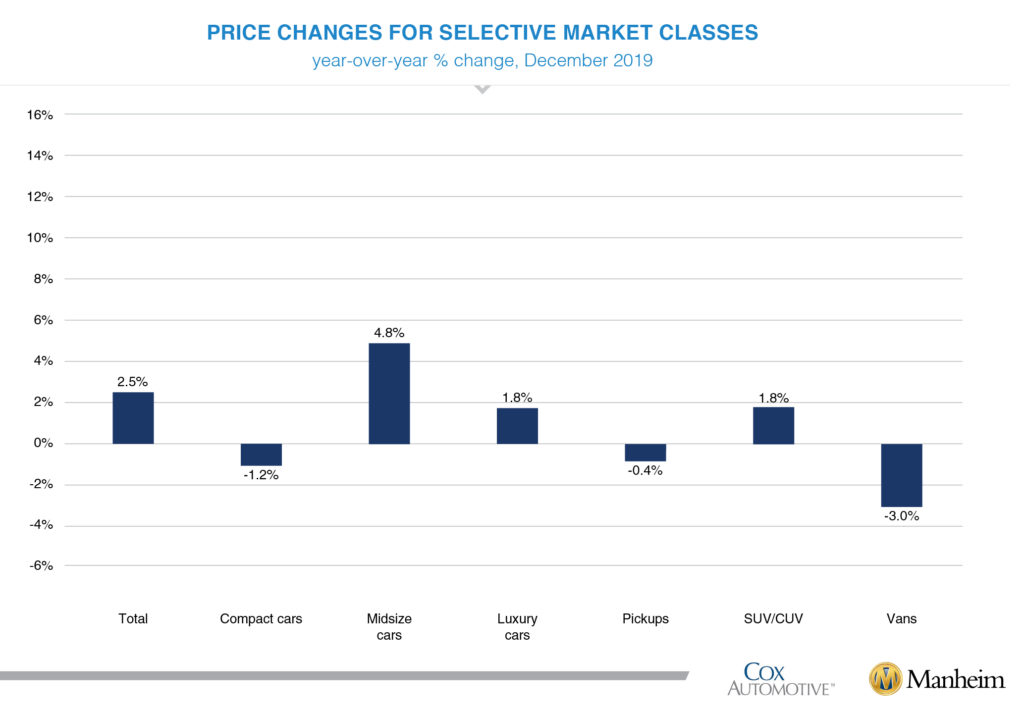

On a year-over-year basis, some major market segments saw seasonally adjusted price increases in December. Midsize cars outperformed the overall market, while most other major segments underperformed the overall market.

Mixed retail results for vehicle sales year over year. According to Cox Automotive estimates, total used vehicle sales volume was flat year over year in December. We estimate the December used SAAR to be 40.0 million, on par with 40.0 million last December and up from November’s 39.7 million rate. The December used retail SAAR estimate is 20.1 million, up from 19.6 million last year and up month over month from November’s 19.3 million rate.

December total new-vehicle sales were down 6.3% year over year, with one less selling day compared to December 2018. The December SAAR came in at 16.7 million, a decline from last year’s 17.4 million and down from November’s 17.1 million rate. New light vehicle sales in 2019 decreased 1.4% versus the prior year to 16.97 million vehicles, ending the streak of more than 17 million annual new-vehicle sales that started in 2015.

Fleet was a core driver of strength in the new vehicle market for 2019, but fleet purchases slowed by year-end. Combined rental, commercial, and government purchases of new vehicles were down 0.7% year over year in December. Retail sales of new vehicles were down 7.1% in December, leading to a retail SAAR of 14.3 million, down from 15.0 million last December and down from November’s 14.8 million rate. Fleet sales were up 2.9% in 2019, and retail sales were down 2.3%, as the overall new vehicle market finished the year down 1.4%.

New-vehicle inventories came in under 4 million units for the eighth consecutive month.

Rental risk pricing increased. The average price for rental risk units sold at auction in December was up 3.5% year over year. Rental risk prices were up 1.5% compared to November. Average mileage for rental risk units in December (at 51,400 miles) was up 6% compared to a year ago and up 5% month over month.

Declining consumer confidence amid mixed conditions. The consumer confidence index disappointed in December as the index declined 0.2% when analysts had expected an increase. Consumer confidence ended the year down slightly from last year. The underlying measures of the future and present situation again diverged, as the index for the present situation increased from a five-month low in November; but the future situation index fell. Housing has been a contributor to economic growth in 2019, and the trends at year-end suggest continued strength. New home sales, which are new contracts on newly constructed homes, increased 1.3% in November and are up 17% year over year. Pending home sales, which are new contracts signed on existing homes, increased 1.2% in November and are up 5.6% year over year.

The Manheim Used Vehicle Value Index data file is available for download.

For additional details, read the press release or listen to the quarterly call replay.

Download the quarterly call presentation below.