Data Point

With New-Vehicle Inventory Tight, Incentive Program Volume Predictably Dips in Q3

Wednesday September 29, 2021

With new-vehicle inventory tight throughout the quarter, incentive program volume was down year over year in Q3 and down from the 5-year average. Incentive spend as a percent of average transaction price is also down, according to recent data from Kelley Blue Book.

Incentive program volumes, as measured by the Cox Automotive Rates & Incentive team, is a look at the total number of different incentive programs in the market in each month. The incentive volume count does not consider the value of each incentive but rather indicates the pure volume of different offers available across all vehicle brands.

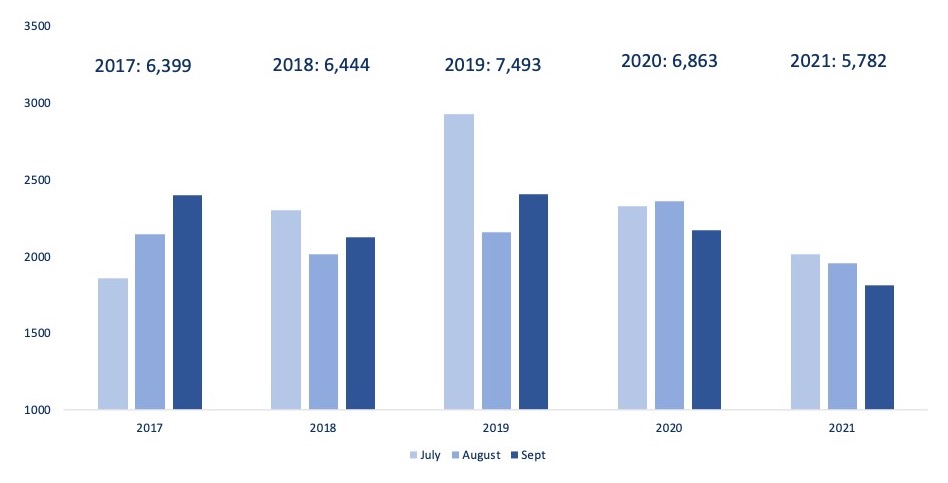

Throughout this year, incentive program volume has been down from historic averages. In Q3, the incentive program volume of 5,782 was lower by nearly 16% from Q3 2020 and down more than 12% from the five-year average. In terms of incentive program volume, Q3 was also the lowest quarter of 2021, well below Q1 (7,172) and Q2 (6,981).

Monthly Incentive Program Volume (Industry): Q3 2021

September normally delivers a high volume of incentive programs, with many “Labor Day Specials” thrown into the mix. But in this tight-inventory environment, the incentive program volume in September 2021 was in fact the lowest in more than four years.

With tight new-vehicle inventory, automakers and dealers have little reason to sprinkle extra sweetener on any new-vehicle deal. In August, the average incentive package amounted to only 5.6% of the new-vehicle average transaction price (ATP), according to the Kelley Blue Book analysis. In August 2019, the average incentive package was more than 10% of ATP.

“The near-empty, new-vehicle lots are a tough reality for dealers and consumers alike right now,” said Brian Finkelmeyer, senior director of new vehicle solutions at Cox Automotive. “With inventory down, it’s good to see dealers and automakers taking a realistic approach to the market. If nothing else, the inventory shortage is forcing automakers to be more efficient with their variable expenses and reduce the complexity – and size – of their incentive programs.”

“It was reported recently that Lexus is still considering a ‘December to Remember’ year-end sales program. Considering current conditions, 2021 is likely to be remembered as the year without incentives.”

The Cox Automotive Rates & Incentives (CAR&I) team has developed a methodology for measuring the accuracy of data used to calculate pricing and payment information presented through dealer service provider tools (e.g., dealer websites, inventory management, digital retailing & advertising, desking, equity, etc.). Approximately 17,500 individual dealerships – rooftops, in automotive parlance – in the U.S. rely on CAR&I incentive data for powering 5 different software applications through Cox Automotive native software/sites and our many industry partners. In all, an estimated 90,000 applications are relying on CAR&I data in a given month, providing valuable information to 40 million shoppers.