Commentary & Voices

Year-End Incentive Complexity Is A Real Grinch

Tuesday November 19, 2019

Article Highlights

- Retail incentives are part of 95% of all auto transactions, as consumers have become conditioned to expect offers whenever they acquire a new vehicle.

- Incentives have been tracking higher as a percentage of the transaction price all year long, sometimes eclipsing 10% of the sales price, a typical tripwire for excessive incentives spending on a per-unit basis.

- Dealers need provide transparent offer comparisons, making it easy for customers to decipher all the offers that may apply.

Auto manufacturers are cranking up incentive programs for the year-end close-out. The advertised offers look very compelling, but the level of conditions to qualify for the most attractive mix of programs could not be any more complex. In other words, the process of shopping, comparing, and selecting a vehicle is more confusing than ever. Making matters worse, dealers are under great pressure to make sense of it all and assemble the best options available to competitively win sales.

So how did we get here? By mixing the typical year-end sales rush with slowing market conditions. Consider:

- The end of year sales period has always been important for the industry, particularly the month of December, often the biggest month of the year in terms of the overall percentage of total annual sales.

- Retail sales are slowing (down more than 2% year to date through October) and inventory for many companies is growing. We’re hearing rumbles of excess vehicles on storage lots and the reemergence of the dreaded sales bank to keep the plants running.

- Holiday sales started early this year, and not just for automotive. Some promotions started right after Halloween—Black Friday has somehow become the month of November.

- Incentives have been tracking higher as a percentage of the transaction price all year long, sometimes eclipsing 10% of the sales price, a typical tripwire for excessive incentives spending on a per-unit basis.

Retail incentives are part of 95% of all auto transactions, as consumers have become conditioned to expect offers whenever they acquire a new vehicle. In this year-end rush, consumers and dealers are looking for clarity as they attempt to find the best deals available. Consumers demand transparency and have the choice to take their business elsewhere. Dealers need to embrace transparency by working with the most qualified solutions providers backed up by the best data providers to decipher all the chaos. In the end, dealers and consumers want the same thing: The best deal available with realistic, accurate monthly payments.

How do consumers know what the best deal is? The advertised offers may look very compelling, but the conditions to qualify are often confusing. Each unit could potentially have a different stack of offers dependent on its location, time spent in stock, and the unique qualifications of the buyer. We don’t want consumers to be discouraged, so help them out by being clear and transparent. Explain how conditional incentives will impact their monthly payment.

As a dealer, it is critical to recognize that the perception of the deal can begin well before a customer arrives on the lot. With consumers visiting fewer dealers, the person who enters your showroom is likely a buyer, and it’s time to embrace that. Provide transparent offer comparisons, making it easy for customers to decipher all the offers that may apply. And get it right the first time, both in-store and online. There are no second chances. Inspect your vehicle listings, websites, payment calculation tools, and digital retail applications to ensure pricing accuracy, consistency, and transparency at any point where customers may engage with your store.

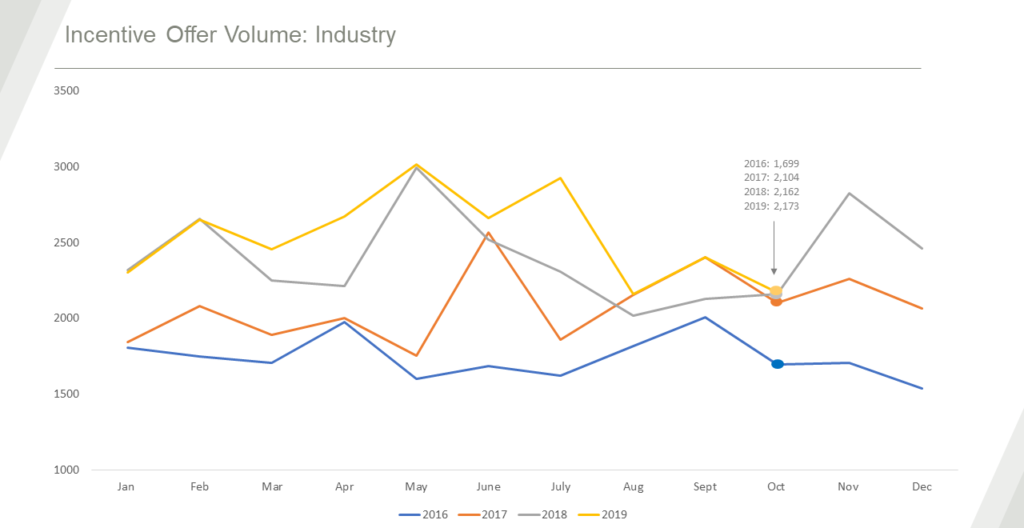

With the outright number of offers and level of complexity at all-time records, as shown in the chart below, our focus at Cox Automotive Rates & Incentives is to assist dealers and their technology partners to leverage the data, create accurate offers and comparisons, and pull consumers into the showrooms to cash in on the attractive offers being promoted this time of year.

Incentives are an important part of the business, but equally confusing for both consumers and dealers. Together, our role is to simplify the process and make it easy for consumers to find the perfect vehicle with a payment package that makes them happy. Consumers tell us continually that deal negotiation can be the toughest part of buying a vehicle. Make this process more transparent and frictionless, and you will be rewarded with committed, happy, long-term customers.

Todd Somerville is practice leader at Cox Automotive Rates & Incentives. Hear more from Todd by listening to him on the vAuto podcast: You Can’t Advertise a Payment You Can’t Fund.

The Cox Automotive Rates & Incentives (CAR&I) team has developed a methodology for measuring the accuracy of data used to calculate pricing and payment information presented through dealer service provider tools (e.g., dealer websites, inventory management, digital retailing & advertising, desking, equity, etc.). Approximately 17,500 individual dealerships – rooftops, in automotive parlance – in the U.S. rely on CAR&I incentive data for powering 5 different software applications through Cox Automotive native software/sites and our many industry partners. In all, an estimated 87,000 applications are relying on CAR&I data in a given month, providing valuable information to 40 million shoppers.