Economic outlook

Cox Automotive Industry Update Report: August 2019

Tuesday August 13, 2019

Article Highlights

- July saw 164,000 jobs created, which was in line with expectations. The pace of growth slowed from 193,000 jobs created in June. The prior two monthly numbers were revised down for 41,000 net fewer jobs than originally estimated.

- July new vehicle sales were up 2% YOY, with one more selling day as July 2018. The July SAAR came in at 16.8 million, declining versus last year’s 16.9 million and down from June’s 17.1 million rate.

- Days’ supply for July was 66, up 1 day YOY and down 1 day from June. Average car days’ supply came in at 57 which was down 2 days YOY and up 1 day from June. Light truck days’ supply was 70 last month, up 3 days from last year and down 2 days from June.

The August 2019 Cox Automotive Industry Update Report shares Cox Automotive’s multifaceted insight into the automotive marketplace to provide an overview of economic indicators, supply, demand, credit and other vital topics and trends affecting the industry.

ECONOMIC INDICATORS

- July saw 164,000 jobs created, which was in line with expectations. The pace of growth slowed from 193,000 jobs created in June. The prior two monthly numbers were revised down for 41,000 net fewer jobs than originally estimated. The July increase was just below the average monthly job creation YTD of 165k, which is lower than last year’s 223k and 2017’s 179k. The headline unemployment rate remained at 3.7%. The YOY change in average hourly earnings improved a tenth of a point to 3.2%.

- The Personal Consumption Expenditure Index, the key gauge of inflation that the Fed follows, showed that price inflation remained very subdued and stable in June at 1.4%, which is well below their 2% target. Core prices excluding food and energy were up slightly to 1.6% year-over-year.

DEMAND

- July new vehicle sales were up 2% YOY, with one more selling day as July 2018. The July SAAR came in at 16.8 million, declining versus last year’s 16.9 million and down from June’s 17.1 million rate.

- Cox Automotive estimates that used vehicle sales were soft in July as sales decreased by 0.3% YOY, which led to the July used SAAR coming in at 39.7 million units, down from last July’s 40.1 million.

- Combined rental, commercial, and government purchases of new vehicles were up 8% YOY in July, and down 37% MOM. The commercial (+30%) fleet channel was up YOY in July. New vehicle retail sales were up 1% in July, leading to a retail SAAR of 14.7 million, down from 14.9 million last July.

SUPPLY

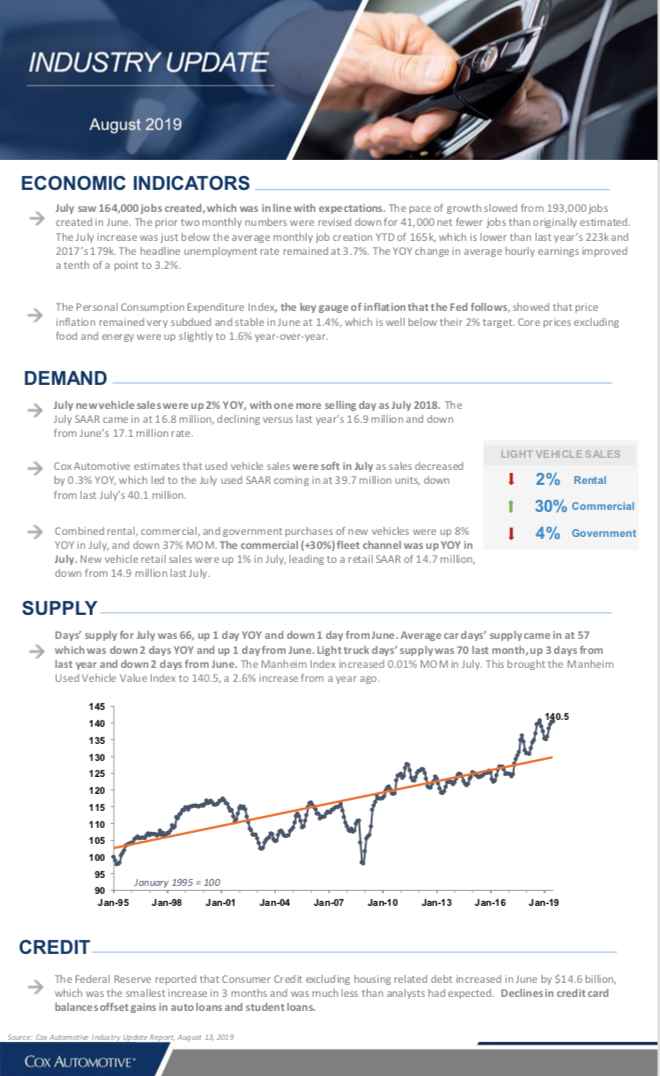

- Days’ supply for July was 66, up 1 day YOY and down 1 day from June. Average car days’ supply came in at 57 which was down 2 days YOY and up 1 day from June. Light truck days’ supply was 70 last month, up 3 days from last year and down 2 days from June. The Manheim Index increased 0.01% MOM in July. This brought the Manheim Used Vehicle Value Index to 140.5, a 2.6% increase from a year ago.

CREDIT

- The Federal Reserve reported that Consumer Credit excluding housing related debt increased in June by $14.6 billion, which was the smallest increase in 3 months and was much less than analysts had expected. Declines in credit card balances offset gains in auto loans and student loans.