Economic outlook

Cox Automotive Industry Update Report: December 2019

Tuesday December 17, 2019

The December 2019 Cox Automotive Industry Update Report shares Cox Automotive’s multifaceted insight into the automotive marketplace to provide an overview of economic indicators, supply, demand, credit and other vital topics and trends affecting the industry.

ECONOMIC INDICATORS

- Consumer sentiment improved in November based on the final data for the month from the University of Michigan. The consumer sentiment index increased 1.4%, but left consumer sentiment slightly lower than this time last year. The reading on current conditions declined, but the reading on expectations improved.

- Home sales activity strengthened this spring and summer aided by lower mortgage rates, and October saw a rebound in existing home sales following a decline in September. The seasonally adjusted annualized rate (SAAR) of existing home sales increased 1.9% in October from September, and existing home sales are up over last year by 4.6%. The residential real estate market’s biggest challenge is supply, which will eventually be aided by the increasing volume of permits and starts. The inventory of existing homes for sale was down in October by 4.3% from a year ago.

DEMAND

- November total new vehicle sales were up 2.1% YOY, with one more selling day compared to November 2018. The November SAAR came in at 17.1 million, a decline from last year’s 17.4 million but up from October’s 16.5 million rate.

- Cox Automotive estimates that used vehicle sales decreased 2.7% YOY in November, which resulted in a used SAAR of 39.7 million, down from last year but up slightly from October. CPO sales were up 15% in November versus last year and are up 4% YTD.

- Combined rental, commercial, and government purchases of new vehicles were down 9.3% YOY in November. Retail sales of new vehicles were up 4.1% in November, leading to a retail SAAR of 14.9 million, up from 14.8 million last November and the strongest retail SAAR of 2019.

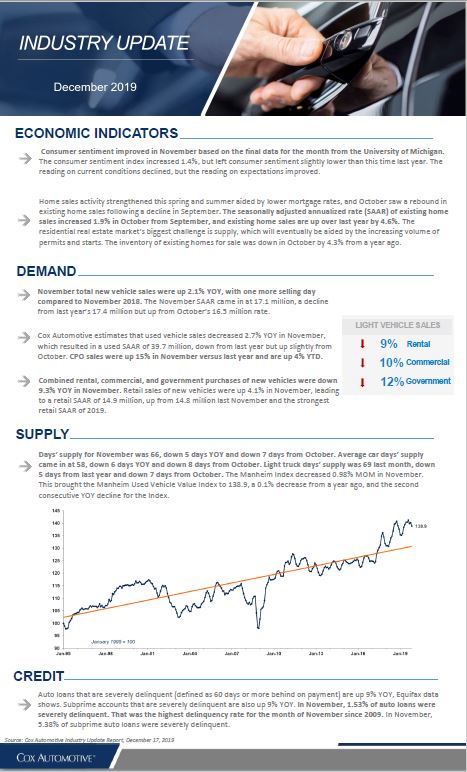

SUPPLY

- Days’ supply for November was 66, down 5 days YOY and down 7 days from October. Average car days’ supply came in at 58, down 6 days YOY and down 8 days from October. Light truck days’ supply was 69 last month, down 5 days from last year and down 7 days from October. The Manheim Index decreased 0.98% MOM in November. This brought the Manheim Used Vehicle Value Index to 138.9, a 0.1% decrease from a year ago, and the second consecutive YOY decline for the Index.

CREDIT

- Auto loans that are severely delinquent (defined as 60 days or more behind on payment) are up 9% YOY, Equifax data shows. Subprime accounts that are severely delinquent are also up 9% YOY. In November, 1.53% of auto loans were severely delinquent. That was the highest delinquency rate for the month of November since 2009. In November, 5.38% of subprime auto loans were severely delinquent.