Commentary & Voices

Q2 2021 Kelley Blue Book Brand Watch Report: BMW Dominated; Porsche, Audi Accelerated; Tesla Slows

Tuesday August 24, 2021

Article Highlights

- BMW was the most-shopped luxury brand for the 12th straight quarter and widened the gap with Lexus.

- Tesla Model 3 sedan remained the most-shopped luxury vehicle, car or SUV.

- Luxury SUV shopping dominated, but luxury car shopping stabilized.

BMW had a stellar second quarter in shopping consideration that also translated into sales, according to the Kelley Blue Book Brand Watch™ report for Q2 2021. Audi and Porsche gained traction. Tesla waned in some areas, though the Model 3 remained the most-shopped luxury vehicle.

The Kelley Blue Book Brand Watch report is a consumer perception survey that also weaves in consumer shopping behavior to determine how a brand or model stacks up with its segment competitors in a dozen factors key to a consumers’ buying decision. Kelley Blue Book produces a separate Brand Watch report for non-luxury and luxury brands each quarter.

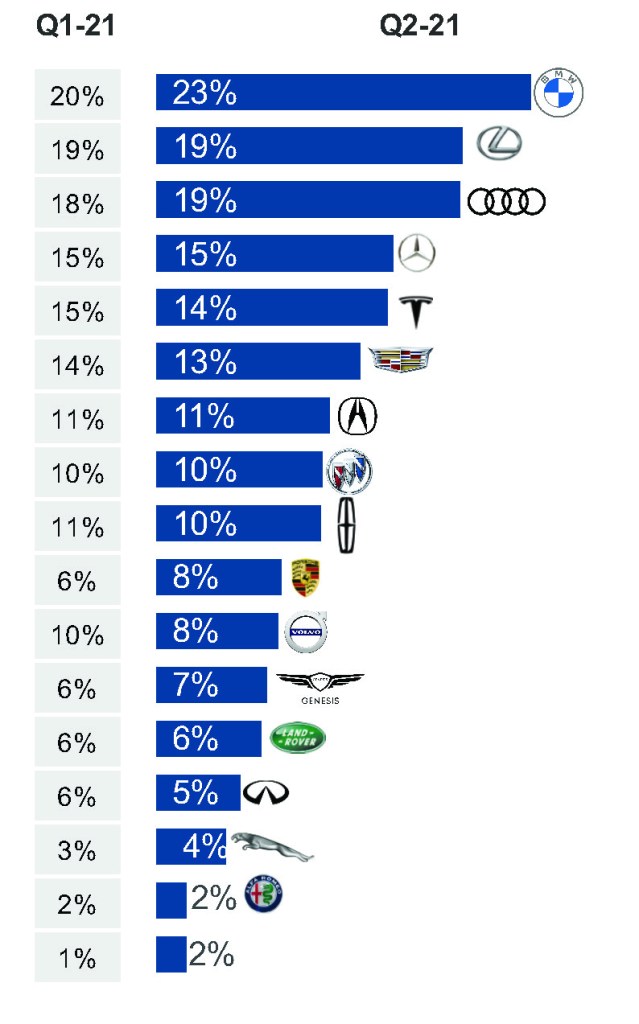

In the second quarter, BMW outmaneuvered its competitors and the global computer chip shortage, delivering the biggest gain in shopping consideration among luxury brands and grabbing the luxury vehicle sales lead. BMW has dominated its competitors in shopping consideration for 12 straight quarters and did so again in the second quarter with a healthy gain of 3 percentage points from the first quarter. Of all luxury vehicle shoppers, 23% considered a BMW.

Quarterly Luxury Brand Consideration

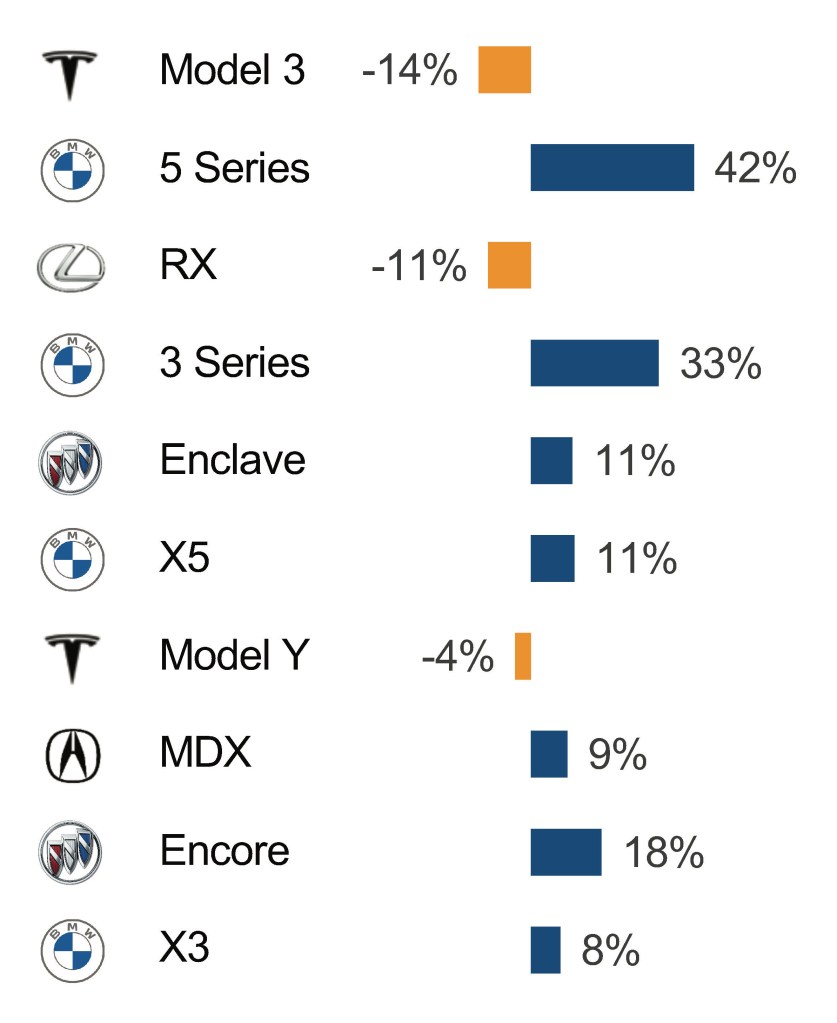

BMW’s gains came from two sedans and two utility vehicles. The BMW 5 Series saw a hefty 42% increase in shopping; the BMW 3 Series had a 33% rise putting it back in the Top 10 most-shopped luxury vehicles after an absence in the first quarter. The X5 and X3 utility vehicles had shopping hikes of 11% and 8%, respectively. BMW could see consideration grow further with the U.S. introduction of new products, including the new 2 Series and electric i4 sedan.

Runners-up by brand

BMW’s gain created a wider gap to runner-up Lexus, which held steady at shopping consideration of 19% of all luxury shoppers. Audi gained a percentage point, tying with Lexus, on the strength of the Q7 and A6. Mercedes-Benz held steady at 15% to take the third most-shopped spot.

Porsche had the second-biggest gain after BMW, up two percentage points, due to the surge in shopping consideration for the 911, Macan and 718. Their gains offset a decline in shopping for the Cayenne.

Tesla shopping consideration runs hot and cold, depending on new product offerings and features as well as news headlines. One quarter it dominates; the next it wanes. The second quarter this year saw the brand wane in some areas. But never count Tesla out of the hunt. It may well be back in the third quarter. Tesla’s shopping consideration dipped a percentage point due to declining consideration for the Model Y, Model S and Model 3 – down the most of any of the most-shopped models. Still, the Model 3 remained the most-shopped luxury vehicle.

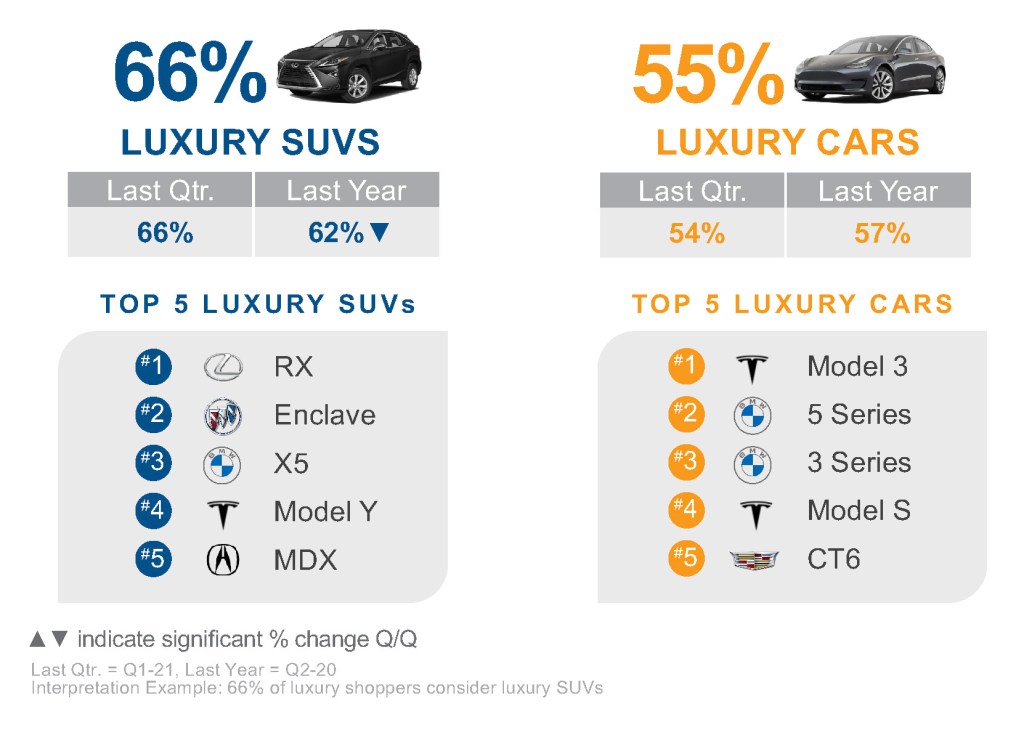

Luxury SUV shopping dominated

By segment, shopping consideration for luxury SUVs was unchanged from the first to the second quarter. Of luxury vehicle shoppers, 66% considered an SUV. The luxury SUV may gain some momentum with several new models being launched through year-end, including the redesigned Lexus NX, the Volvo C40 and the long-awaited Infiniti QX60.

LUXURY SEGMENT CONSIDERATION

For the sixth straight quarter, the Lexus RX was the most-shopped luxury SUV, despite inventory challenges. Lexus had the lowest inventory of any luxury brand throughout the quarter, and the RX had one of the lowest days’ supply of all models.

The revamped Buick Enclave jumped to the No. 2 spot from No. 4 in the first quarter among most-shopped SUVs. Shopping consideration for the Enclave increased by 11%. Shopping consideration for the small Encore was up even more at 18%.

The list of Top 5 most-shopped SUVs was rounded out by the BMW X5, Tesla Model Y and revamped Acura MDX.

Quarterly Consideration Growth

Top 10 Models

Q2-21 versus Q1-21

Luxury car shopping gains a bit

Luxury cars have not experienced the dramatic decline in shopping consideration that non-luxury cars have in recent years. Indeed, shopping for luxury cars in the second quarter gained 1 percentage point to 55% of all luxury vehicle shoppers. That was down a bit from 57% in the year-earlier quarter. Luxury car consideration could improve, or at least stabilize further, with the upcoming introduction of new models, such as the Audi A3, BMW 2 Series, Mercedes-Benz C-Class and Acura ILX.

The car category got a boost from higher shopping of BMW and Tesla sedans. Both brands each had two models on the list of Top 5 most-shopped luxury cars. Although down in the quarter, the Tesla Model 3 was first among cars – and all luxury vehicles. The BMW 5 Series and BMW 3 Series sedans, Tesla Model S and the Cadillac CT6 rounded out the list in that order.

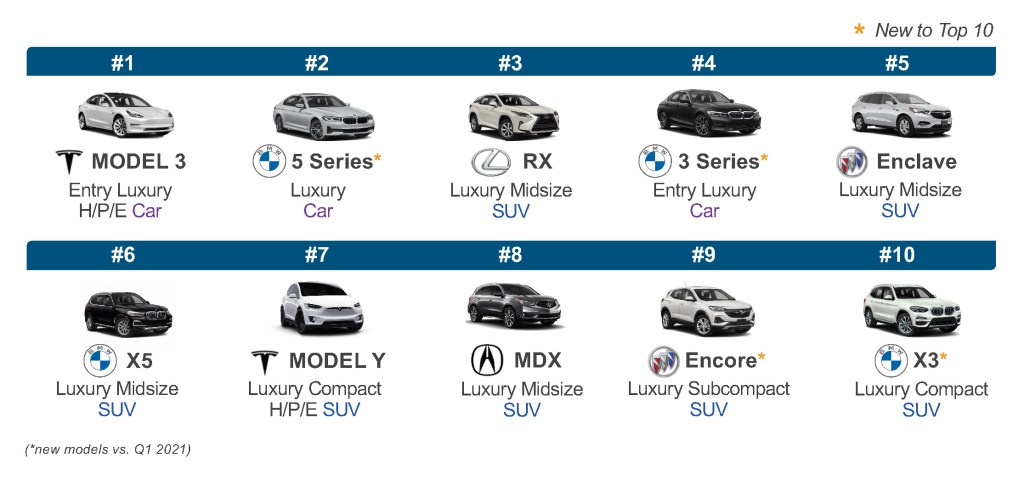

BMW dominated the top 10 most-shopped vehicles

Even though luxury SUV shopping held steady while luxury car shopping eked out a gain, luxury SUVs still dominated the Top 10 list of most-shopped luxury vehicles. Of the Top 10, seven were SUVs and only three were cars, though one car – the Tesla Model 3 – was the most-shopped of all.

Top 10 Considered Models by Luxury Shoppers

After a softer first quarter, BMW came back strong in the second quarter putting four vehicles on the Top 10, the most of any brand. They were the 5 Series (No. 2), 3 Series (No. 4), X5 (No. 6) and X3 (No. 10).

Tesla and Buick each had two models on the Top 10 list. Tesla had the Model 3 (No. 1) and Model Y (No. 7). Buick had the Enclave (No. 5) and Encore (No. 9). Lexus had one model – the RX at No. 3. Acura had one with the MDX at No. 8.

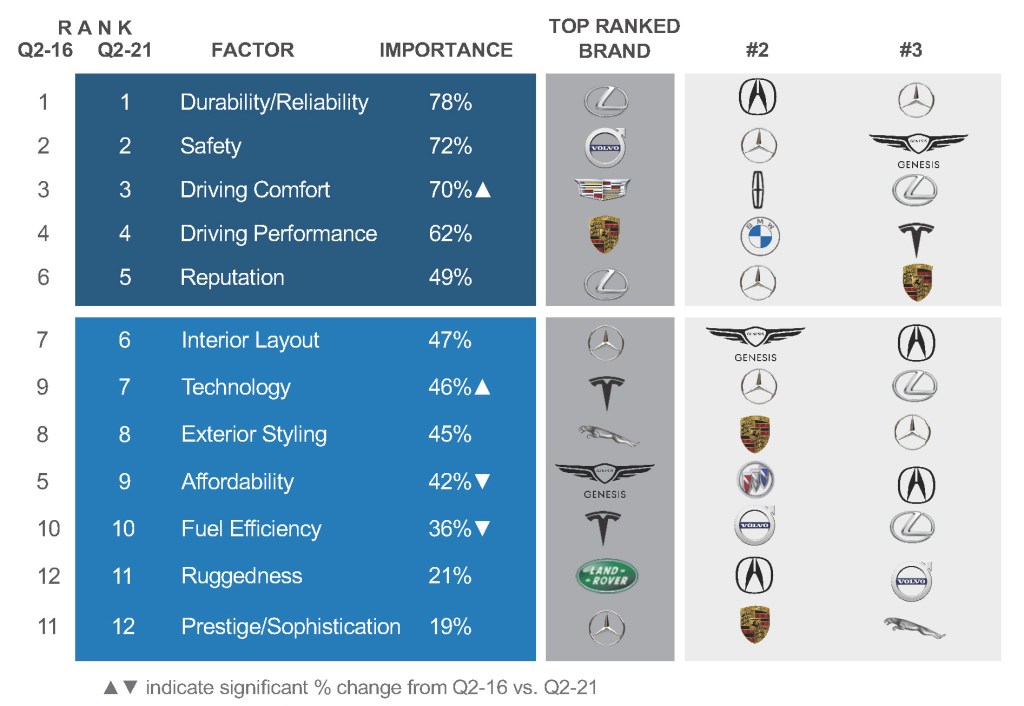

Technology rose in importance to buyers

Among the 12 most important factors to buyers of luxury vehicles, the top four have remained largely unchanged for the past five years. For luxury and non-luxury, Reliability/Durability always has been most important by a wide margin with Toyota/Lexus seemingly untouchable in that factor. Safety is always second, owned by Volvo among luxury makes.

Factors Driving Luxury Consideration

Technology has become increasingly important as vehicles add comfort features, driver-assist systems and ultimately electrified propulsion. Affordability and Fuel Efficiency have become less important factors despite rising transaction and fuel prices.

In the first quarter, Tesla took first place in four of the 12 factors. In the second quarter, it took only two wins – Technology and Fuel Efficiency. As the only all-electric brand, luxury and non-luxury, Tesla has been the top brand in those two factors for more than four years. Tesla took third place in Driving Performance in the quarter.

Mercedes-Benz had a good showing in the rankings of important factors in the quarter, thanks to the technologically advanced EQS electric vehicle and the elegant C-Class. It ranked No. 1 for Interior Layout and Prestige/Sophistication again. It took the No. 2 spot for Safety, Reputation and Technology, and it secured the No. 3 spot for Durability/Reliability and Exterior Styling.