Press Releases

Cox Automotive Forecast: First Quarter New-Vehicle Sales Expected to Increase Year over Year as Market Momentum Shows Signs of Fading

Wednesday March 26, 2025

Article Highlights

- As market momentum fades, March’s new-vehicle sales volume is expected to reach 1.43 million, up 15.2% from last month’s total but down 1.4% from year-ago levels.

- First-quarter new-vehicle sales are forecast to grow year over year by less than 1% as prices rise and sales incentives are dialed back.

- Full-year forecast reduced from 16.3 million to 15.6 million, as Cox Automotive sees economic uncertainty, affordability, and potential tariff impacts slowing new-vehicle sales.

Updated, April 2, 2025 – Initial industry estimates of new-vehicle sales in March suggest nearly 1.56 million units were sold, beating the Cox Automotive forecast by a large margin; our team had expected volume in March to be 1.43 million, a decline from 2024 levels. In fact, sales in March were higher year over year and not just by a little. The seasonally adjusted annual rate (SAAR) of sales in March is now initially estimated at 17.8 million, the highest SAAR in four years and nearly 2 million units higher than the Cox Automotive forecast of 15.9 million.

It is important to recognize that the Cox Automotive forecast was finalized and released at noon on Wednesday, March 26, approximately five hours before President Trump disrupted everything, speaking from the Resolute Desk in a hastily organized press conference and signing an executive order calling for 25% import taxes on all vehicles entering the U.S. beginning April 3, with additional tariffs on auto parts likely coming in May, if not sooner.

The March 26 executive order changed everything — at that point, our new-vehicle sales forecast for March was wrecked. The market shifted dramatically, from slowing to growing, from “better to wait” to “better buy now.”

The pace at which the market turned cannot be understated. Senior Economist Charlie Chesbrough, following the announcement, noted, “Trump’s comments sent shockwaves across the marketplace. Tariffs have been threatened and delayed multiple times over recent months, but it now seems nearly certain that a 25% tariff on 50% of the new-vehicle market is happening next week. Prices are set to rise, and I expect we’ll see strong sales activity for a month or two, but sales will slow noticeably once prices begin to rise.”

The Cox Automotive team is expecting the market’s newfound momentum to continue into May, or at least until the pre-tariff inventory is drawn down by anxious consumers. The team is also expecting new-vehicle prices to rise dramatically by the second half of the year, slowing the market noticeably. Cox Automotive has lowered its full-year sales forecast from 16.3 million to 15.6 million. At this moment, at the start of Q2, sales are roaring, but as consumers feel the impact of new auto tariffs, that momentum will fade.

ATLANTA, March 26, 2025 – March new-vehicle sales are expected to illustrate a market not significantly impacted by tariff threats and economic uncertainty but clearly slowing after a red-hot end of 2024. The March SAAR, or seasonally adjusted selling rate, is expected to reach 15.9 million in March, a small increase from last year’s 15.7 million pace but down from February’s 16.0 million level.

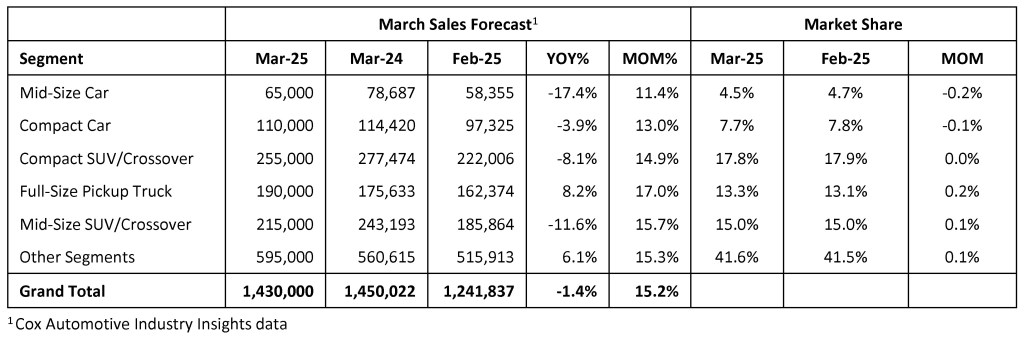

Sales volume in the month of March is expected to decline by 1.4% from last year but increase more than 15% from last month. Seasonal adjustments accounting for selling day differences explain rising SAARs and falling sales volume. March has 26 selling days, two more than last month and one less than last year. “March is an important month for the new-vehicle market as it kicks off the spring selling season after slow winter months,” noted Charlie Chesbrough, senior economist at Cox Automotive.

“Vehicle sales are expected to finish near February’s pace,” added Chesbrough, “but there is a risk we could see a more disappointing finish. What March sales will likely confirm is that the post-election ‘Trump bump’ that our market enjoyed at the end of last year is likely fading, as concern among consumers regarding the future of tariffs and the economy – a new economic uncertainty – is holding back the market.”

March 2025 New-Vehicle Sales Forecast

First Quarter Sales End Mostly Flat, According to Cox Automotive Forecast, as Momentum Slows

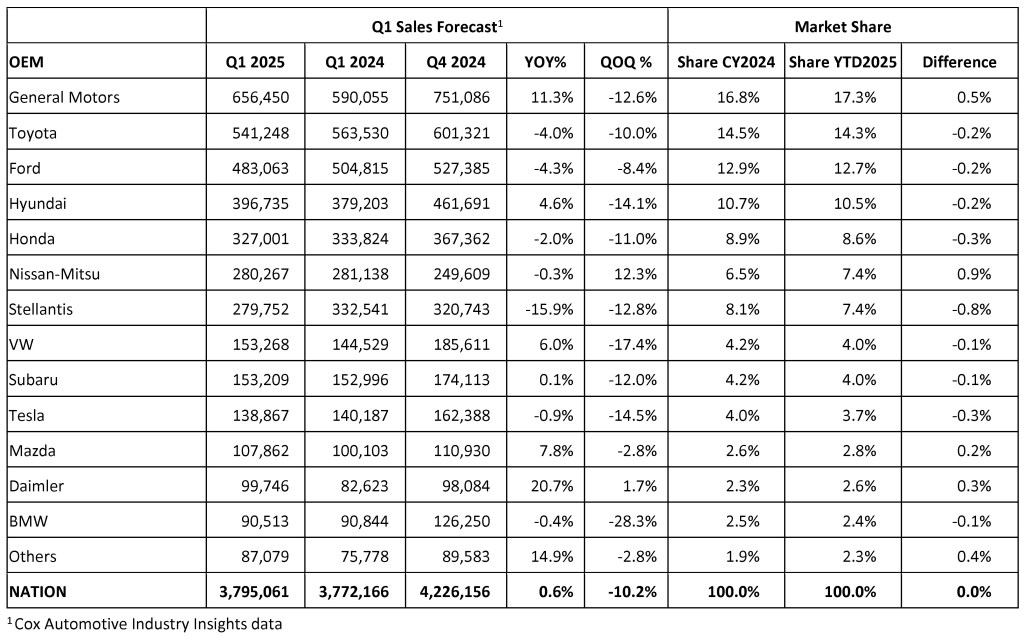

Cox Automotive forecasts new-vehicle sales volume in the first quarter to finish higher by less than 1% year over year. Sales of 3.79 million units represent an increase of 0.6% from Q1 2024 (3.77 million) but will be more than 10% lower compared to Q4 2024 (4.22 million). Higher prices and lower sales incentives are likely contributing to the slowdown.

After a red-hot December, the new-vehicle market in January and February tallied sales much closer to the recent two-year average. With the March SAAR expected to reach 15.9 million, the Q1 2025 sales pace is expected to be 15.8 million, up from a pace of 15.5 million in Q1 2024 and close to the two-year average of 15.7 million. In Q4 2024, the average monthly sales pace was 16.5 million.

General Motors is again forecast to be the market leader in Q1, with strong sales gains year over year. All GM’s brands are expected to deliver solid growth in the quarter. Nissan is also forecast to deliver positive numbers in Q1, with total market share gaining nearly 1% after tumbling in 2023 and early 2024. A key contributor to Nissan’s success? Two of their most affordable nameplates – Versa and Sentra – are seeing double-digit growth from last quarter.

Q1 2025 New-Vehicle Sales Forecast

Stellantis is expected to see sales decline nearly 16% from last year, resulting in an almost 1% decline in market share. Nearly every vehicle in their portfolio is down from last year, with Ram pickups down the most. As a result, Nissan is expected to outpace Stellantis in new-vehicle sales this quarter. Tesla is also likely to decline further, with market share falling below 4%. More battery-electric competition from legacy manufacturers and a controversial CEO are likely strong headwinds for sales.

At the end of the first quarter, Cox Automotive lowered its full-year new-vehicle sales forecast to 15.6 million, down from the original forecast of 16.3 million. Continued affordability challenges, economic uncertainty impacting consumer confidence, and the potential for higher inflation due to new tariffs at American borders will all potentially hold back new-vehicle sales in 2025. Last year, approximately 16 million new vehicles were sold in the U.S., according to estimates from Cox Automotive’s Kelley Blue Book, the best results since the market was upended by the 2020 COVID pandemic.

About Cox Automotive

Cox Automotive is the world’s largest automotive services and technology provider. Fueled by the largest breadth of first-party data fed by 2.3 billion online interactions a year, Cox Automotive tailors leading solutions for car shoppers, auto manufacturers, dealers, lenders and fleets. The company has 29,000+ employees on five continents and a portfolio of industry-leading brands that include Autotrader®, Kelley Blue Book®, Manheim®, vAuto®, Dealertrack®, NextGear Capital™, CentralDispatch® and FleetNet America®. Cox Automotive is a subsidiary of Cox Enterprises Inc., a privately owned, Atlanta-based company with $22 billion in annual revenue. Visit coxautoinc.com or connect via @CoxAutomotive on X, CoxAutoInc on Facebook or Cox-Automotive-Inc on LinkedIn.

Media Contacts:

Mark Schirmer

734 883 6346

mark.schirmer@coxautoinc.com

Dara Hailes

470 658 0656

dara.hailes@coxautoinc.com