Economic Outlook

Cox Automotive Industry Update Report: July 2017

Friday July 21, 2017

Article Highlights

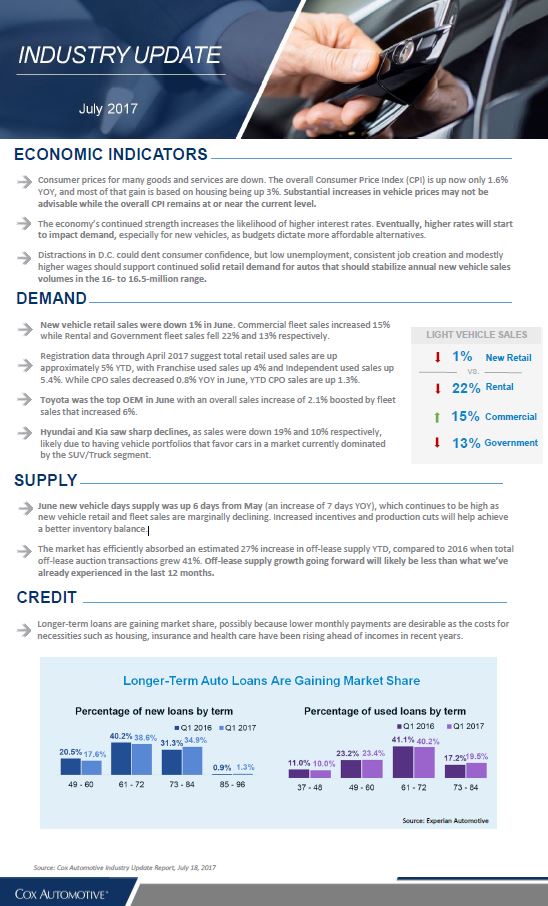

- ECONOMIC INDICATORS: Consumer prices for many goods and services are down. The overall Consumer Price Index (CPI) is up now only 1.6% YOY, and most of that gain is based on housing being up 3%. Substantial increases in vehicle prices may not be advisable while the overall CPI remains at or near the current level.

- DEMAND: New vehicle retail sales were down 1% in June. Commercial fleet sales increased 15% while Rental and Government fleet sales fell 22% and 13% respectively.

- SUPPLY: June new vehicle days supply was up 6 days from May (an increase of 7 days YOY), which continues to be high as new vehicle retail and fleet sales are marginally declining. Increased incentives and production cuts will help achieve a better inventory balance.

A monthly report leveraging Cox Automotive’s multifaceted insight into the automotive marketplace to provide an overview of economic indicators, supply, demand, credit and other vital topics and trends affecting the industry.