Economic outlook

Cox Automotive Industry Update Report: April 2019

Tuesday April 16, 2019

Article Highlights

- ECONOMIC INDICATORS: The Employment Report for March eased fears regarding a dramatic slowdown in the economy as 196,000 jobs were created when analysts had expected 177,000. Prior payroll numbers were revised up for a net addition of 14,000 jobs, so the monthly average for the quarter was a solid 180,000. Job gains were strongest in health services, professional services, and restaurants. Like last month, we are seeing job losses in several sectors including retail and manufacturing.

- DEMAND: March new vehicle sales were down 2.2% YOY, with one less selling day compared to March 2018. The March SAAR came in at 17.5 million, up versus last year’s 17.2 million. Cars continue to see declines, as sales in March fell 7.9% compared to last year.

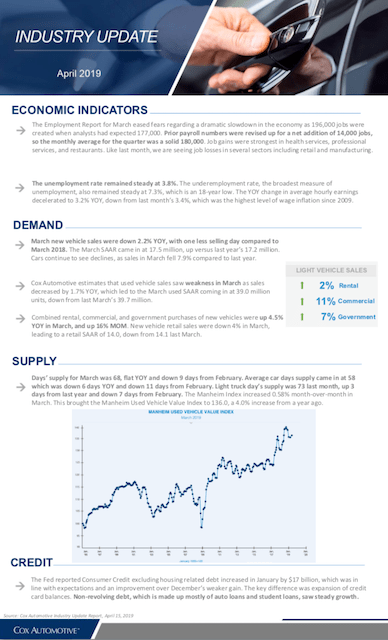

- SUPPLY: Days’ supply for March was 68, flat YOY and down 9 days from February. Average car days supply came in at 58 which was down 6 days YOY and down 11 days from February. Light truck day’s supply was 73 last month, up 3 days from last year and down 7 days from February. The Manheim Index increased 0.58% month-over-month in March. This brought the Manheim Used Vehicle Value Index to 136.0, a 4.0% increase from a year ago.

The April 2019 Cox Automotive Industry Update Report shares Cox Automotive’s multifaceted insight into the automotive marketplace to provide an overview of economic indicators, supply, demand, credit and other vital topics and trends affecting the industry.

ECONOMIC INDICATORS

- The Employment Report for March eased fears regarding a dramatic slowdown in the economy as 196,000 jobs were created when analysts had expected 177,000. Prior payroll numbers were revised up for a net addition of 14,000 jobs, so the monthly average for the quarter was a solid 180,000. Job gains were strongest in health services, professional services, and restaurants. Like last month, we are seeing job losses in several sectors including retail and manufacturing.

- The unemployment rate remained steady at 3.8%. The underemployment rate, the broadest measure of unemployment, also remained steady at 7.3%, which is an 18-year low. The YOY change in average hourly earnings decelerated to 3.2% YOY, down from last month’s 3.4%, which was the highest level of wage inflation since 2009.

DEMAND

- March new vehicle sales were down 2.2% YOY, with one less selling day compared to March 2018. The March SAAR came in at 17.5 million, up versus last year’s 17.2 million. Cars continue to see declines, as sales in March fell 7.9% compared to last year.

- Cox Automotive estimates that used vehicle sales saw weakness in March as sales decreased by 1.7% YOY, which led to the March used SAAR coming in at 39.0 million units, down from last March’s 39.7 million.

- Combined rental, commercial, and government purchases of new vehicles were up 4.5% YOY in March, and up 16% MOM. New vehicle retail sales were down 4% in March, leading to a retail SAAR of 14.0, down from 14.1 last March.

SUPPLY

- Days’ supply for March was 68, flat YOY and down 9 days from February. Average car days supply came in at 58 which was down 6 days YOY and down 11 days from February. Light truck day’s supply was 73 last month, up 3 days from last year and down 7 days from February. The Manheim Index increased 0.58% month-over-month in March. This brought the Manheim Used Vehicle Value Index to 136.0, a 4.0% increase from a year ago.

CREDIT

- The Fed reported Consumer Credit excluding housing related debt increased in January by $17 billion, which was in line with expectations and an improvement over December’s weaker gain. The key difference was expansion of credit card balances. Non-revolving debt, which is made up mostly of auto loans and student loans, saw steady growth.