Economic Outlook

Cox Automotive Industry Update Report: October 2017

Wednesday October 18, 2017

Article Highlights

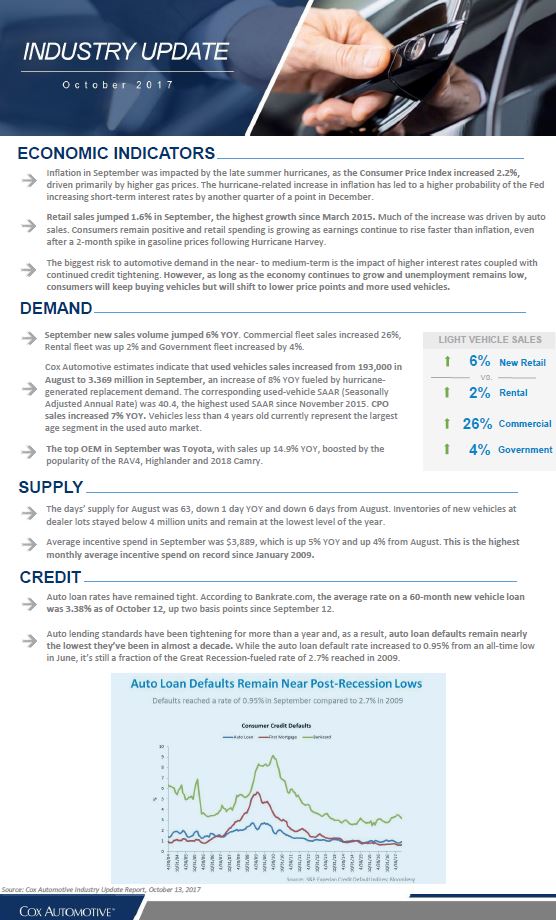

- ECONOMIC INDICATORS: As economy continues to grow and unemployment remains low, consumers will keep buying vehicles but will shift to lower price points and more used vehicles.

- DEMAND: September new vehicle sales volume jumped 6% YOY and used vehicle volume increased 8% YOY fueled by hurricane-generated replacement demand.

- SUPPLY: The days’ supply for August was 63, down 1 day YOY and down 6 days from August.

A monthly report leveraging Cox Automotive’s multifaceted insight into the automotive marketplace to provide an overview of economic indicators, supply, demand, credit and other vital topics and trends affecting the industry.