Economic outlook

Cox Automotive Industry Update Report: October 2018

Wednesday October 17, 2018

Article Highlights

- ECONOMIC INDICATORS: We do not expect to see much if any impact to vehicle demand and prices in October as a result of Hurricane Michael.

- DEMAND: New vehicle sales decreased 6% YOY and Used vehicle sales decreased by an estimated 2% YOY in September.

- SUPPLY: The days’ supply for September was 64, up 1 day YOY and down 3 days from August.

The October 2018 Cox Automotive Industry Update Report shares Cox Automotive’s multifaceted insight into the automotive marketplace to provide an overview of economic indicators, supply, demand, credit and other vital topics and trends affecting the industry.

ECONOMIC INDICATORS

- Several states from Florida to Virginia experienced devastation from Hurricane Michael. However, the nature of this fast-moving storm did not produce the kind of vehicle damage we saw last year from either Hurricane Harvey or Irma. We do not expect to see much if any impact to vehicle demand and prices in October.

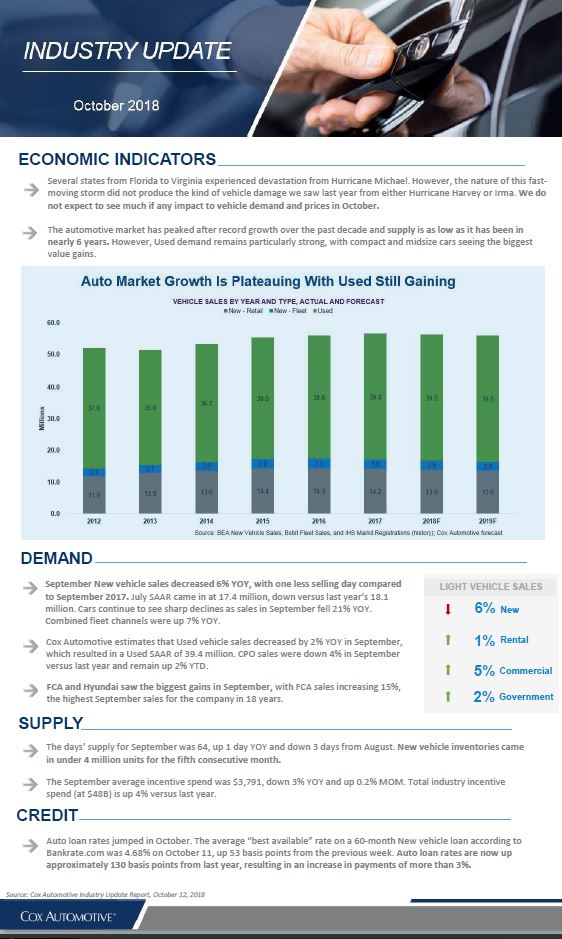

- The automotive market has peaked after record growth over the past decade and supply is as low as it has been in nearly 6 years. However, Used demand remains particularly strong, with compact and midsize cars seeing the biggest value gains.

DEMAND

- September New vehicle sales decreased 6% YOY, with one less selling day compared to September 2017. July SAAR came in at 17.4 million, down versus last year’s 18.1 million. Cars continue to see sharp declines as sales in September fell 21% YOY. Combined fleet channels were up 7% YOY.

- Cox Automotive estimates that Used vehicle sales decreased by 2% YOY in September, which resulted in a Used SAAR of 39.4 million. CPO sales were down 4% in September versus last year and remain up 2% YTD.

- FCA and Hyundai saw the biggest gains in September, with FCA sales increasing 15%, the highest September sales for the company in 18 years.

SUPPLY

- The days’ supply for September was 64, up 1 day YOY and down 3 days from August. New vehicle inventories came in under 4 million units for the fifth consecutive month.

- The September average incentive spend was $3,791, down 3% YOY and up 0.2% MOM. Total industry incentive spend (at $48B) is up 4% versus last year.

CREDIT

- Auto loan rates jumped in October. The average “best available” rate on a 60-month New vehicle loan according to Bankrate.com was 4.68% on October 11, up 53 basis points from the previous week. Auto loan rates are now up approximately 130 basis points from last year, resulting in an increase in payments of more than 3%.

Get the full October 2018 Cox Automotive Industry Update Report to learn more.

Tags

Source: Cox Automotive Industry Update Report, October 12, 2018