Economic Outlook

Cox Automotive Industry Update Report: May 2017

Tuesday May 16, 2017

Article Highlights

- ECONOMIC INDICATORS: The economic environment remains mixed: the labor market is strong and consumer sentiment is high but retail sales and GDP remain moderate.

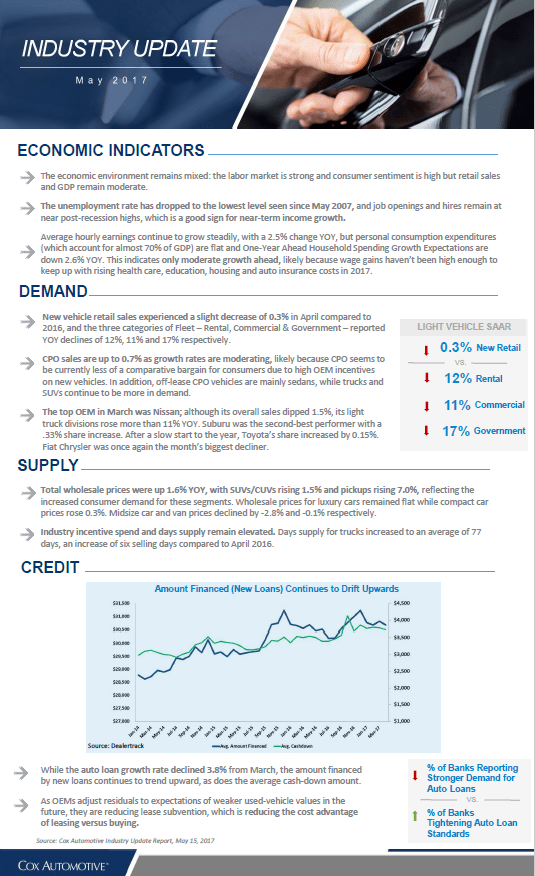

- DEMAND: New vehicle retail sales experienced a slight decrease of 0.3% in April compared to 2016, and the three categories of Fleet – Rental, Commercial & Government – reported YOY declines of 12%, 11% and 17% respectively. New vehicle retail sales experienced a slight decrease of 0.3% in April compared to 2016, and the three categories of Fleet – Rental, Commercial & Government – reported YOY declines of 12%, 11% and 17% respectively.

- SUPPLY: Total wholesale prices were up 1.6% YOY, with SUVs/CUVs rising 1.5% and pickups rising 7.0%, reflecting the increased consumer demand for these segments. Wholesale prices for luxury cars remained flat while compact car prices rose 0.3%. Midsize car and van prices declined by -2.8% and -0.1% respectively.

This monthly report leverages Cox Automotive’s multifaceted insight into the automotive marketplace to provide a one-page overview of economic indicators, supply, demand, credit and other vital topics and trends affecting the industry.