Reimagining the Automotive Consumer Experience

Friday February 21, 2020

Article Highlights

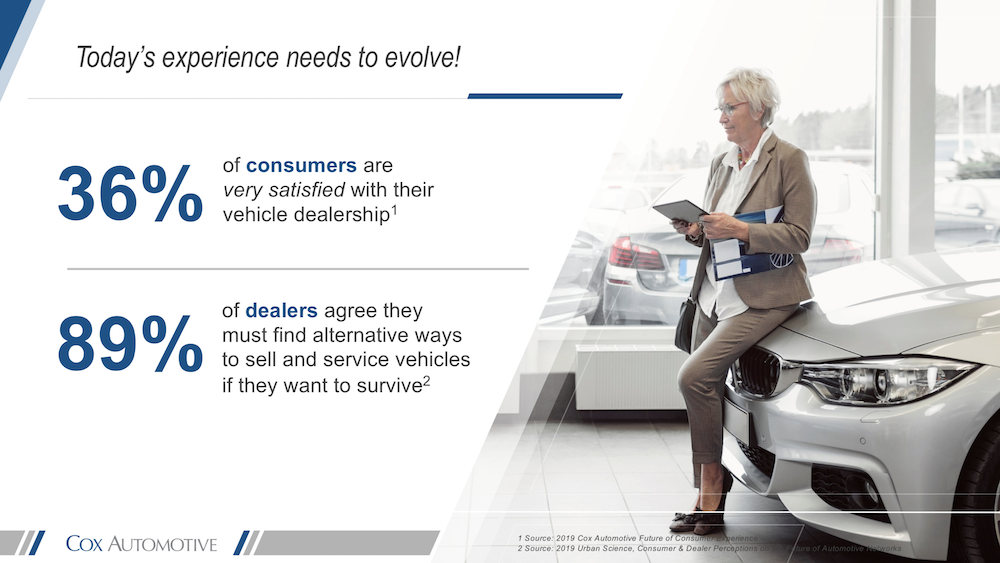

- 2 in 3 consumers say that experience is more important than price in the purchase decision, and in fact, they would pay more for a great experience or even switch brands because of experience.

- In the research backing the study, consumers indicated the most friction in the current automotive experience is found during the vehicle purchase process (acquisition) and routine service and maintenance visits. Naturally, services that streamline and improve these areas are most appealing.

- The research shows consumers are more likely to trust brands that offer no-hassle experience centers, with product displays and opportunities to drive a vehicle. Slightly more than half of the consumers surveyed by Cox Automotive indicated they would likely switch to a brand that offered this concept.

It used to be that the key differentiator for dealers and manufacturers would be the product on their lots – the vehicle. However, over the years, OEMs have improved their product quality, and the difference between the quality of one vehicle over another is now harder for consumers to distinguish. As a result, consumer experience is of greater importance now more than ever.

2 in 3 consumers say that experience is more important than price in the purchase decision, and in fact, they would pay more for a great experience or even switch brands because of experience.

It’s no secret the current car-buying experience has room for improvement and that few owners are looking forward to the next 3-hour wait while their vehicle is serviced. But what does an ideal automotive consumer experience actually look like?

In Cox Automotive’s latest study, we provide a roadmap for what the future automotive experience could look like. Reimagining the Automotive Consumer Experience is a comprehensive look at the opportunities all stakeholders in the automotive industry have to improve the overall automotive experience for consumers. The comprehensive report was developed by a Cox Automotive team of experts who spent the better part of 2019 interviewing futurists, organizing focus groups, developing concepts and surveying 2,000 consumers to measure the merit of each concept. The report includes insights from the new 2019 Cox Automotive Future of Consumer Experience study.

Consumers Seek Less Friction in Service and Acquisition

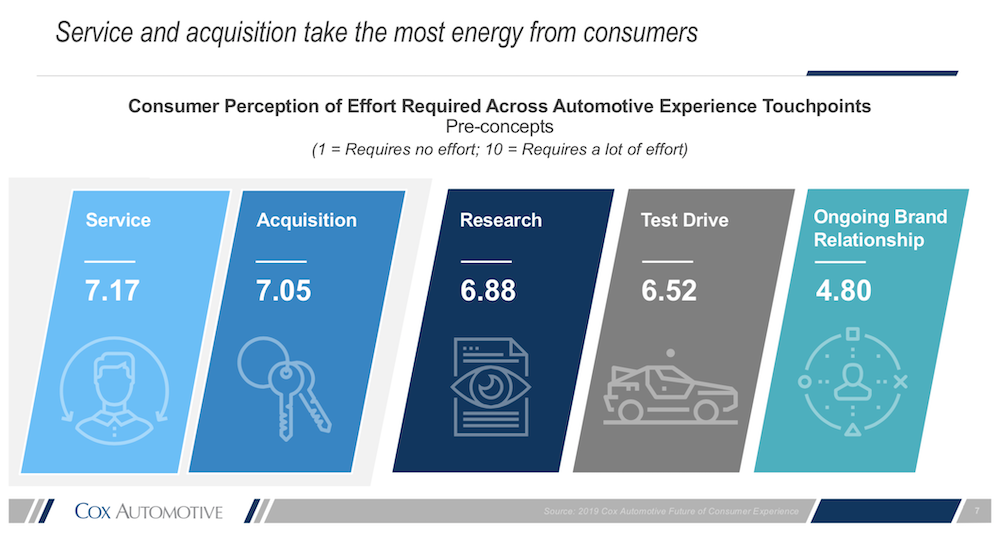

In a world experimenting with drone-delivered pizzas, it may come as no surprise that U.S. consumers are interested in services that help make their lives easier – services that reduce friction, i.e., the amount of effort a consumer must personally put forth.

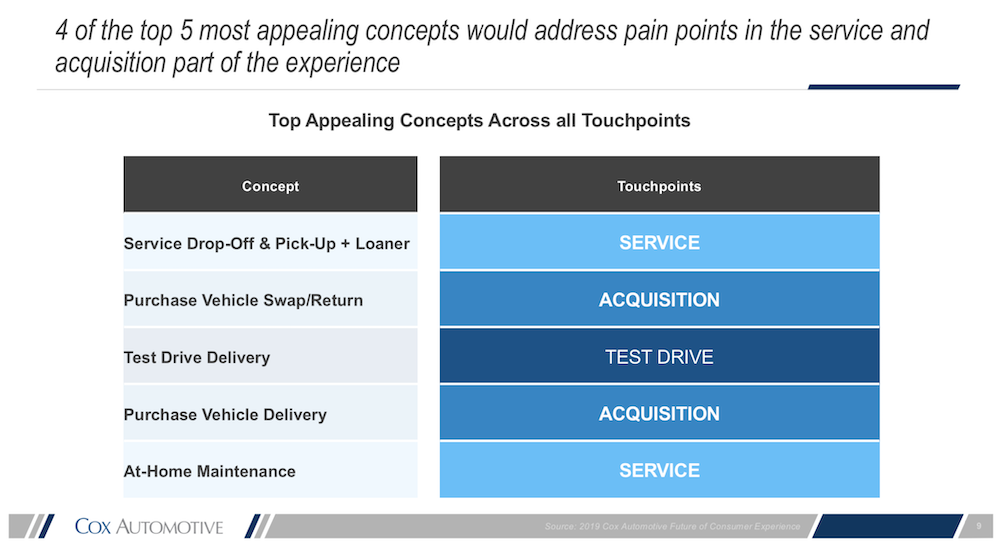

In the research backing the study, consumers indicated the most friction in the current automotive experience is found during the vehicle purchase process (acquisition) and routine service and maintenance visits. Naturally, services that streamline and improve these areas are most appealing.

Among the most attractive concepts: Consumers universally agreed – 89% – that an ideal ownership experience would include a service to pick-up a vehicle in need of maintenance or repair and return the vehicle when the work is complete. How appealing is the concept? Nearly 70% of consumers would consider switching to a brand offering the benefit.

Other top friction-reducing concepts include at-home vehicle maintenance, new-vehicle delivery, and hassle-free return or swap of a newly purchased vehicle.

Consumers Still Want Immersive, High Touch Experiences with the Vehicle

While consumers are seeking ways to reduce time spent in acquisition mode or to support routine maintenance, the modern vehicle buyer is also interested in immersive, high-touch experiences while researching a vehicle to buy.

It is a misconception that consumers don’t want to visit dealerships, the research shows. What consumers don’t want is the hard sell. Six in 10 consumers want help from dealership staff – a product specialist, not a salesperson – to learn more about products. For this reason, the concept of Brand Experience Centers performed very well in the research, as the no-sales environment provides a chance for shoppers to experience the vehicle on their terms, gather more information, and ultimately feel more confident in their decision. Test-drive delivery, where a new-vehicle is brought directly to the potential buyer for a test drive – possibly 24 hours in length – was appealing as well.

The research shows consumers are more likely to trust brands that offer no-hassle experience centers, with product displays and opportunities to drive a vehicle. Slightly more than half of the consumers surveyed by Cox Automotive indicated they would likely switch to a brand that offered this concept.

Industry Stakeholders Should Pay Attention to Forward Thinking Trailblazer Consumers

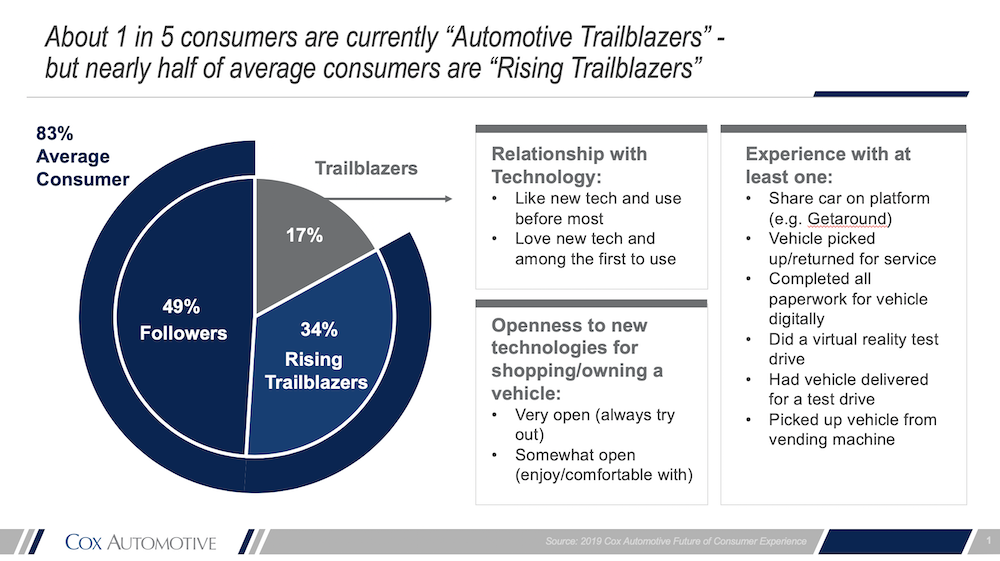

To understand the Reimagining the Automotive Consumer Experience report, it’s important to understand the central group of consumers Cox Automotive identified as Trailblazers. These consumers are early technology adopters and open to new technology in their vehicle shopping and activities. They have already experienced at least one of the proposed concepts, which suggests some service providers are already delivering on these concepts to gain a competitive advantage.

Cox Automotive believes today’s Trailblazers are tomorrow’s average car buyer and that Trailblazer attitudes and expectations will become mainstream within 3 to 5 years. Trailblazers are more likely to find the virtual test drive offering appealing and embrace the idea of vehicle recommendations powered by artificial intelligence (AI). Trailblazers want to use voice-controlled vehicle search systems while shopping and are also more likely to rely on AI systems embedded into vehicles to recommend service or maintenance intervals.

Trailblazers made up 17% of the total 2,000 participants surveyed. Nearly half of the Trailblazers were Gen Z or Millennials – under the age of 40 – and 63% of this group was “very open” to switching vehicle brands. Conversely, only 37% of average consumers are “very open” to switching brands. Notably, Millennials are the largest car-buying cohort in the U.S. today.

The Time for Change is Now

For those who think these ideas are too futuristic…Innovation is accelerating: first steps into the future should already be happening!

Technology adoption among consumers is simply moving faster and faster. We consider the “tipping point” of adoption for a technology to be when it’s used by 25% of the population. If we look back far enough, we see clear evidence we are reaching that tipping point faster and faster. For example, the tipping point for the Internet was reached in 7 years compared to 46 years for Electricity or 26 years for TV.

Many dealers are already familiar with some of the concepts tested and state they plan to adopt them in the next 2-3 years, creating an even greater risk for those that wait to change.

![]()

Our danger is convincing ourselves that the automotive industry is somehow different. It is unique, but not in a way that makes us immune to the impending change consumers are demanding.

About the Reimagining the Automotive Consumer Experience study:

Drawn from a broad collection of existing and new research, interviews with influencers, futurists and consumer experience experts, and a series of focus groups with target consumers, the Reimagining the Automotive Consumer Experience report was developed to help Cox Automotive and its clients begin to reshape the automotive industry with a fresh focus on consumer-driven experiences. The final concepts were measured in a survey of 2,000 US consumers over the age of 16.

Get the report

This report provides a look at the opportunities the automotive industry has to improve the automotive consumer experience.

Download