Data Point

CPO Sales Improve Slightly in April, Remain Behind 2021

Friday May 6, 2022

Article Highlights

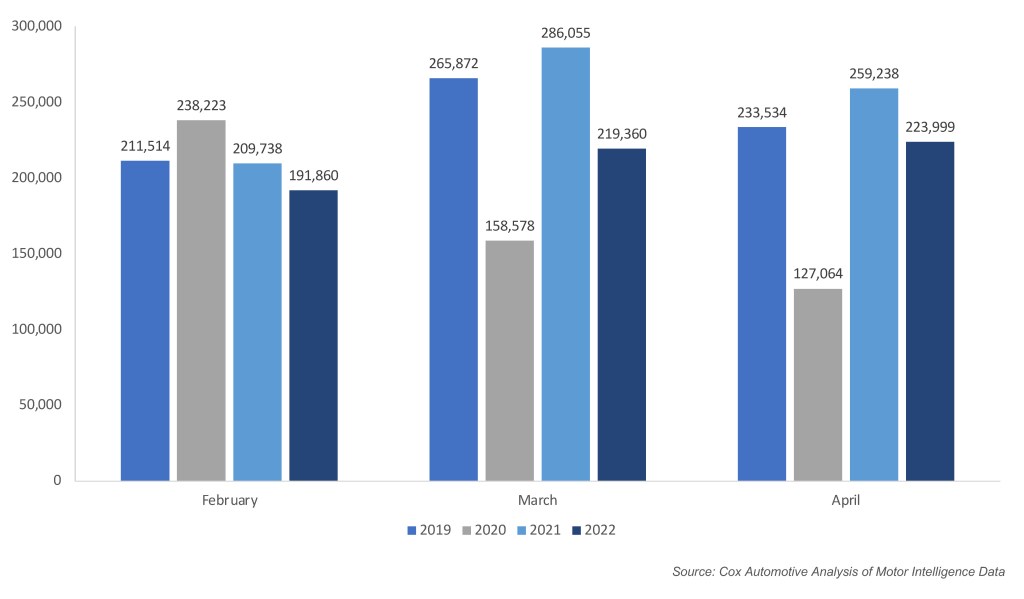

- Certified pre-owned (CPO) sales in April rose to 223,999 units.

- This total is up 2% from March’s 219,360, but down 14% from April 2021.

- April’s CPO result is the highest since September 2021 and is the fourth straight uptick this year.

Certified pre-owned (CPO) sales in April rose to 223,999 units, up 2% from March’s 219,360. April’s CPO result is the highest since September 2021 and is the fourth straight uptick this year. However, CPO sales are down 14% year over year.

APRIL 2022 CPO SALES

Leveraging a same-store set of dealerships selected to represent the country from Dealertrack, we estimate that used retail sales declined 13% in April from March and failed to show the larger seasonal increase driven by tax refund season. The Dealertrack estimates indicate that used retail sales were down 21% year over year.

According to Charles Chesbrough, senior economist at Cox Automotive: “Sales of CPO vehicles are down nearly 16% year to date and are on trend with the overall used-vehicle market, which is experiencing a weaker spring than expected. Cox Automotive expects stronger sales activity in the second half of the year to improve CPO sales.”