Data Point

Fleet Sales Improve Year Over Year in April, Outperform Retail Sales

Thursday May 5, 2022

Sales into large fleets, not including sales into dealer and manufacturer fleets, decreased 12% month over month in April to 154,654 units, according to an early estimate from Cox Automotive.

APRIL 2022 FLEET SALES

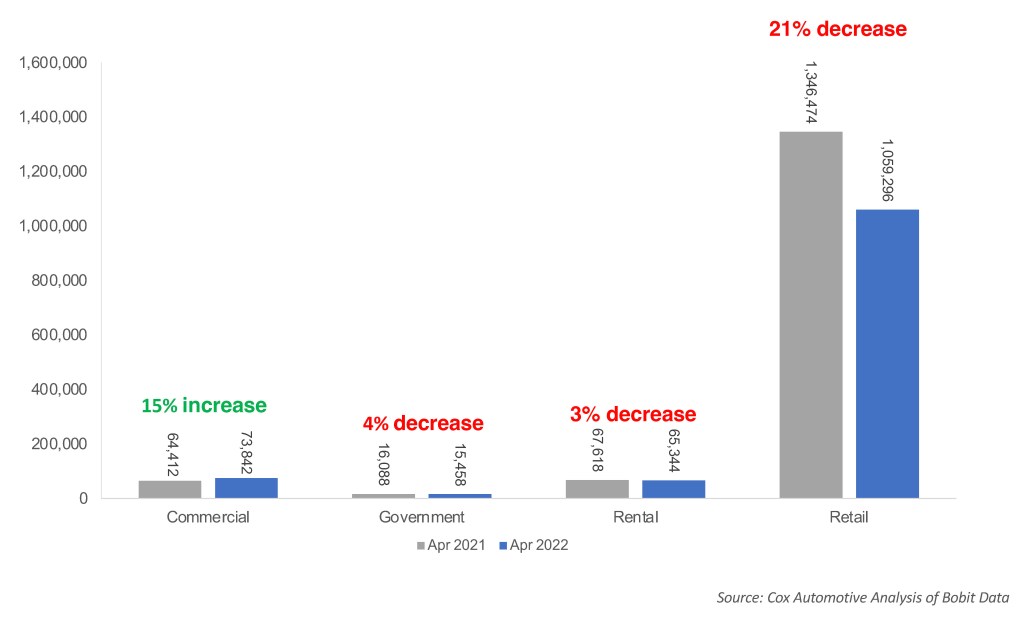

Combined sales into large rental, commercial, and government fleets increased 4% from April 2021. Sales into commercial fleets in April saw another impressive gain of 15% year over year. Meanwhile. sales into government fleets were down 4%, and rental fleet volume remains low, down 3% from last year.

Total April new-vehicle sales were down 19% year over year with one more selling day than April 2021, and retail sales were down slightly more at 21%, leading to an estimated retail seasonally adjusted annual rate (SAAR) of 12.6 million. The April sales rate was down 21% from 16.0 million last April but up 9% from last month’s 11.6 million rate. After including dealer and manufacturer fleet sales, the total fleet share of all sales was 14%, up 2% from last April’s fleet share.

Among manufacturers, Stellantis saw the most significant increase in fleet sales of nearly 70% over last year, while Nissan was down 38%.