Data Point

Robust August Fleet Sales Reflect Month-Over-Month Gains in Commercial and Government Sectors

Wednesday September 6, 2023

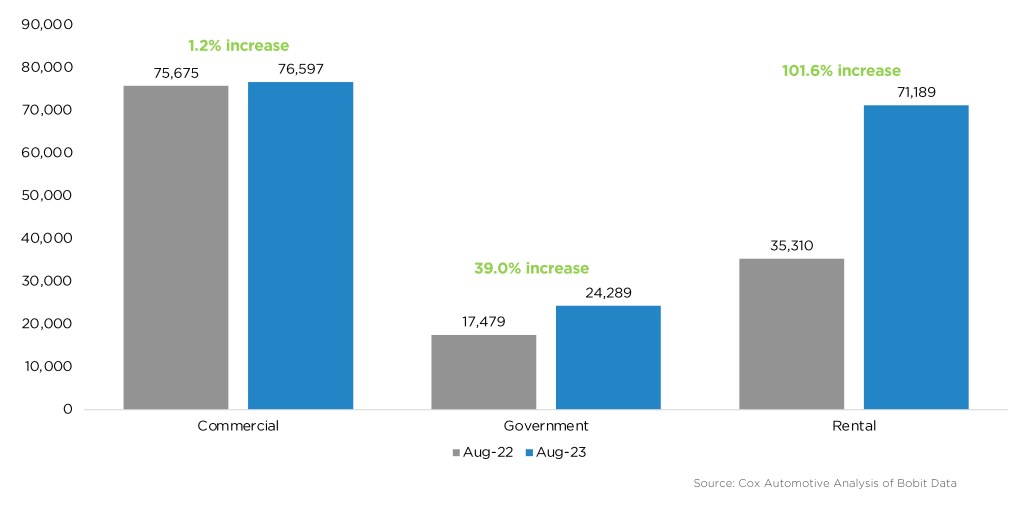

In August, sales into large rental, commercial, and government fleets increased compared to the previous year. According to a Cox Automotive analysis of Bobit data, there was a 33.9% rise in sales to large fleets (excluding dealer and manufacturer fleets), with 172,075 units sold. Sales to rental fleets saw a 101.6% increase, while sales to government fleets rose by 39.0%, and sales to commercial fleets were mostly flat, increasing by 1.2%.

“Although retail sales were weak, fleet sales in the U.S. for August were strong and reached levels for the month not seen since 2019,” said Cox Automotive Senior Economist Charlie Chesbrough. “The month-over-month increase in fleet sales was mainly due to the commercial and government segments. While the rental fleet segment had the largest year-over-year increase, it was down slightly compared to July.”

August 2023 Fleet Sales

General Motors had the largest increase of large-volume automakers in August, followed by Stellantis. Ford had the largest decrease in sales into fleet.

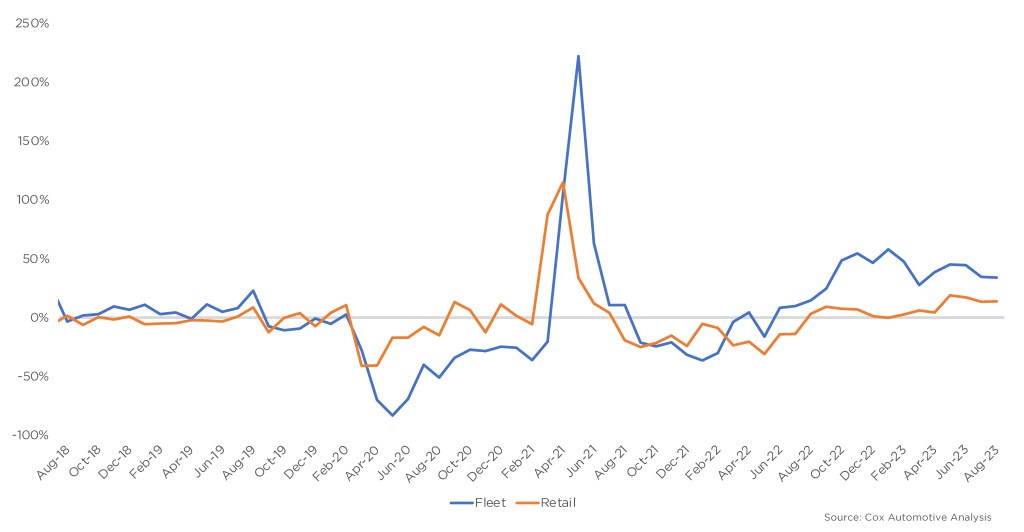

Fleet Sales Recovery Continues Outpacing Retail

Including an estimate for fleet deliveries into dealer and manufacturer channels, the remaining retail sales were estimated to be up 13.9%, leading to an estimated retail seasonally adjusted annual rate (SAAR) of 12.6 million, up 0.9 million from last year’s 11.5 million pace and down 0.6 million from last month’s 13.2 million pace. The fleet market share was estimated to be 15.6%, a gain of 2.2% over last year’s share but a decrease from July’s 16.0% market share. For comparison, nearly 22% of all vehicles sold in 2019 were through fleet channels.

Monthly Year-Over-Year Change / Fleet Versus Retail