Smoke on Cars

Auto Loan Defaults Are Increasing, But We Are Not Heading Into A Repo Crisis

Wednesday August 3, 2022

As I noted after their July meeting, the Federal Open Market Committee has moved the target rate more in the past two months than at any point since 1981, and they are not done yet. The Fed’s aggressive stance on tackling inflation has resulted in increased borrowing rates that will likely move to 3.5% or higher by year-end. The higher rates are designed to cool the hot economy, and there are signs that is happening. That’s the good news.

The bad news? High inflation in the U.S. economy is impacting lower-income households the most, as those households are least likely to be able to absorb the higher cost of energy, food, and shelter. For example, households in the lowest income quintile spend about half of their monthly expenses on energy, food, and shelter. While overall inflation was at a 41-year high of 9.1% year over year in June according to the CPI, the inflation rate for energy, food, and shelter was 11.7%.

With stressed household finances, many industry watchers are looking for a rapid increase in loan defaults and an increase in vehicle repossessions that would be of crisis proportions. Fortunately, so far, that is not what we are seeing on the ground. In fact, the data clearly show both defaults and repos are currently well below historical averages.

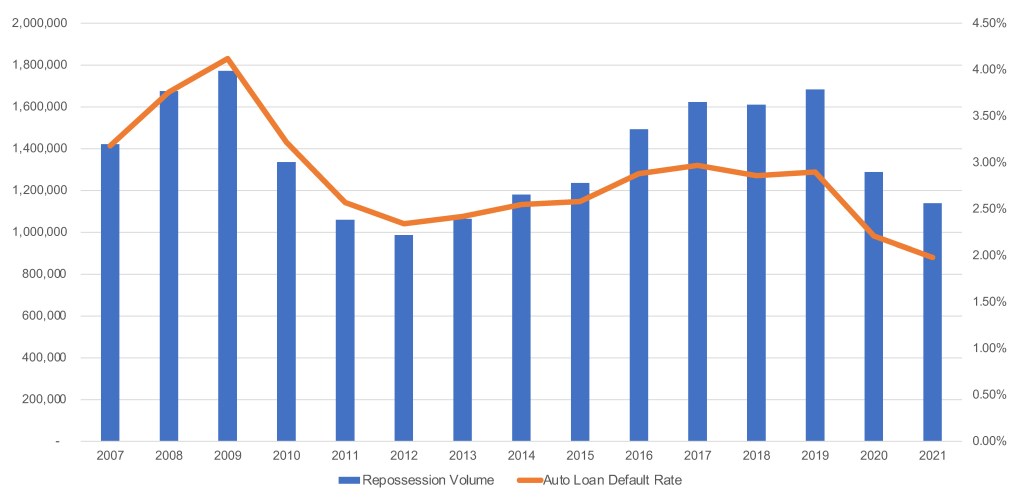

Unfortunately, there is no government or third-party source that officially and accurately tallies repossession volumes. As the country’s largest auto auction, Manheim repossession volume trends serve as one proxy for the overall market. Working with Equifax data, Cox Automotive has also established a view of auto loan defaults to track the basis for repossessions. We define defaults as auto loans that are beyond 120 days past due but exclude loan accounts in bankruptcy proceedings.

Historically, the default volume is larger than the actual repo volume, as approximately 20% of auto loans in default never become a repossession. There are many reasons for this, including situation when the lender chooses not to pursue a repossession, such as when the vehicle value or default amount may not be worth the effort or when the consumer and lender work out some other plan.

To put current loan default and repossession volume in perspective, consider calendar year 2019, the last “normal” year before the global COVID-19 pandemic. In 2019, our estimates indicate there was a decade-high 2.1 million auto loan defaults, pushing the loan default rate to 2.9% of all loans. In 2020, thanks partly to loan accommodation and government stimulus, auto loan defaults dropped to 1.6 million, or 2.2% of loans. Last year, the loan default rate was less than 2%, the lowest in at least 16 years. Default volume was near 1.5 million.

Cox Automotive estimates that the share of defaults ending up as repossessions declined from the more typical 80% in 2020 to below 78% in 2021. As a result, 2021 likely saw approximately 1.1 million repos, down from an estimated 1.3 million in 2020 and 1.7 million in 2019.

Historical Repossession Volume and Auto Loan Default Rate

We believe that in 2021, and continuing in 2022, a larger share of auto loans in default are not producing repossessions. Therefore, due to a very low default rate and a smaller share of defaults turning into repossessions, the likely repossession rate in 2022 is currently, and will likely remain, very low by historical standards.

In 2020, Manheim observed a 22% decline in repossession volumes at wholesale auction sites across the U.S. That is consistent with the 24% loan default decline observed in Equifax data in 2020 and the 24% decline in estimated repossessions. Last year, repossession volumes at auction fell another 7%, while we estimate the U.S. saw a decrease of 12% in total repossession volumes to 1.1 million.

At 1.98%, the loan default rate in 2021 was particularly low – far from the more historically normal level of 2.9% seen in 2019. In the first quarter of 2022, the loan default rate jumped up to 2.27%, higher than in 2021 but still below historic norms. The rate declined in the second quarter, averaging 2.02%. With high used-vehicle values, low unemployment, historically high wage and income gains, and a still-elevated level of loan accommodations, the loan default rate year to date in 2022 remains very low at 2.14%.

We expect the default rate to increase through the remainder of 2022 and reach 2.3% for the year, thanks to 42-year high inflation and growing concerns about recession. An auto loan default rate of 2.3% would be a 16% increase from 2021 but would still be among the lowest levels in the past 15 years.

Leading credit indicators point to higher-than-normal delinquency rates but still low default rates. Cox Automotive analysis of Equifax data indicates that in June 2022, 1.49% of auto loans were severely delinquent. That was an increase from May’s 1.40% rate. Subprime loan severe delinquencies were at 5.75% in June, which was also an increase for the month, up from 5.36% in May 2022. For comparison: The aggregate severe delinquency rate was 1.32% in June 2019, and the subprime rate was 4.58%.

Importantly, even with higher delinquencies, default rates in 2022 remain well below 2019 levels. The June 2022 aggregate annualized default rate was 1.87%, and the subprime rate was 6.52%, compared to an aggregate rate of 2.48% and a subprime rate of 7.93% in June 2019.

High used-vehicle values provide more options for consumers who have fallen behind. Limited supply, higher prices, and lower rates also limit alternatives for consumers who go into default. As a result, consumers are likely to prioritize auto credit payments over other forms of credit. Finally, defaults and repossessions are heavily influenced by the share of subprime in the loan pool, as subprime accounts are responsible for more than 60% of defaults even though historically, they represent about 20% of auto loans. With fewer subprime originations since the pandemic started, the subprime share of the loan base has fallen to a low of 18%.

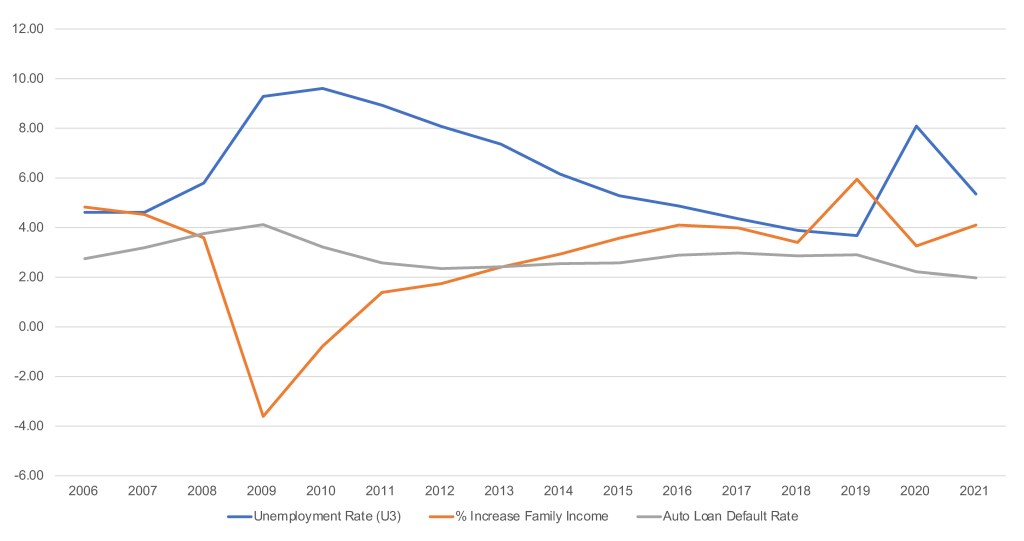

Unemployment Rate, Income Growth and Default Rate

When analyzing and forecasting auto loan defaults and repossessions, it is important to consider the unemployment rate and change in household incomes. During the Great Recession, when unemployment grew, incomes fell, and loan defaults increased to the highest point in the data series.

By contrast, the sudden rise in unemployment during early months of the pandemic coincided with large gains in income and a decline in the auto loan default rate.

Most recently, the default rate remains historically low as is the unemployment rate, while incomes are now transitioning into steady year-over-year gains.

These factors suggest that loan defaults and repossessions are likely to remain well below historic norms, even though volumes are growing as we see some attributes of the auto market normalize. Bottom line, there is no repo crisis. Repo volumes will likely be below normal for the next several years, contributing to a very supply-constrained wholesale vehicle market.

Jonathan Smoke is chief economist at Cox Automotive.