Data Point

Auto Sales Remain Healthy Even With Incentive Spending at 5-Year Low

Friday April 30, 2021

Article Highlights

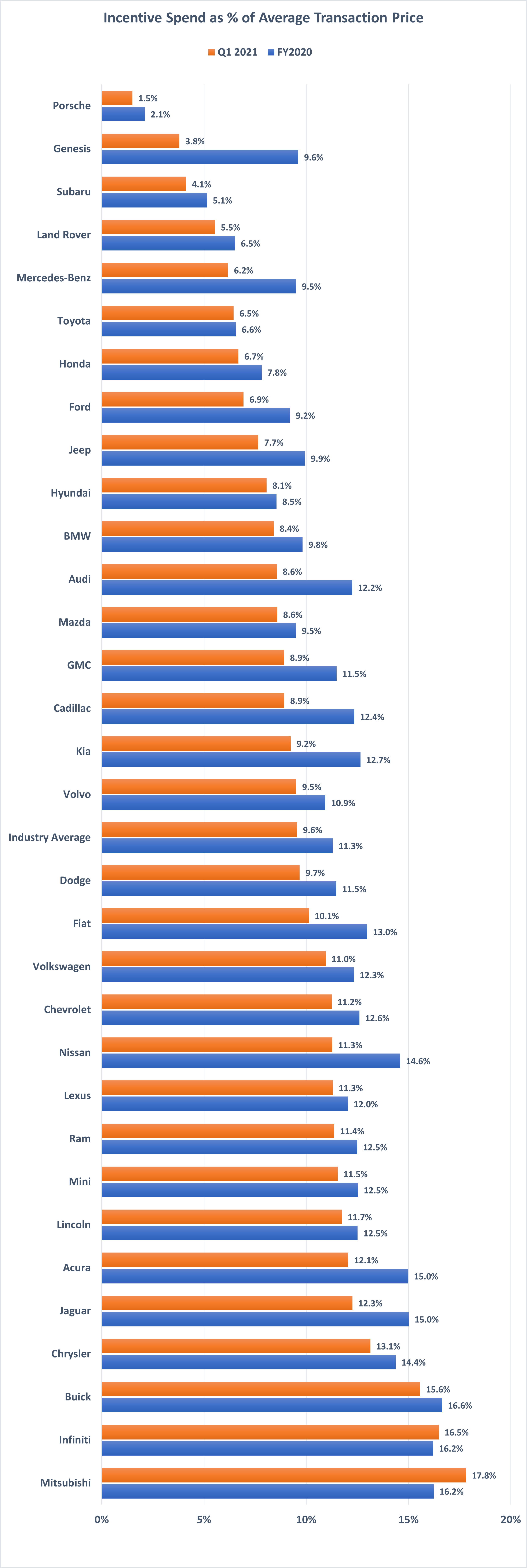

- As measured by a percent of average transaction price (ATP), incentive spending until this year had been steadily increasing.

- Through the first quarter of 2021, incentives spending has been tracking at 9.6% of ATP, the first time the measure has been below 10% since 2016.

- Overall, though, industry spending on incentives in the first quarter dropped 1.75 percentage points, or 15.5%, compared to 2020.

Cox Automotive is forecasting healthy auto sales in April, despite tight new-vehicle inventory limiting consumer choice. The forecast calls for sales of 1,360,000 vehicles in the month, a 90% jump from the pandemic-stricken sales volume of last year and up more than 2% from April 2019. Volume of 1.36 million will push the seasonally adjusted annual rate (SAAR) of sales to a healthy 16.5 million.

Charlie Chesbrough, senior economist at Cox Automotive, has noted the sales pace is showing signs of normalizing after a turbulent year. But things are hardly back to normal. Inventory levels were down approximately 25% year over year at the start of April and will be lower still when the month is over. Lower inventory is driving incentive spending down as well.

As measured by a percent of average transaction price (ATP), incentive spending until this year had been steadily increasing. In 2017, the spending level finished the year at 10.7%. It jumped to 11.1% by the end of 2019 and increased again to 11.3% in 2020.

Through the first quarter of 2021, incentives spending has been tracking at 9.6% of ATP, the first time the measure has been below 10% since 2016. The math here is simple: Low inventory plus healthy demand equals lower incentives and higher profitability. For new-vehicle shoppers, the deals are harder to find. A year ago, dealers were worried about finding buyers. This year, they’re worried about finding vehicles to sell.

“The market is being driven by inventory right now, not incentives, and it is only getting worse as the chip shortage continues,” says Brian Finkelmeyer, senior director of new-vehicle sales strategy at Cox Automotive. “Most dealers are scrambling to secure inventory in any way they can. Those who aren’t paying close enough attention are losing out to those who are managing it more efficiently.”

There have been many big shifts in incentive spending this year, particularly with the luxury makers, but the pullback in spending is nearly universal across all brands. Only two – Infiniti and Mitsubishi – have increased spending according to our analysis. Toyota and Hyundai have come down only slightly. Overall, though, industry spending on incentives in the first quarter dropped 1.75 percentage points, or 15.5%, compared to 2020. Until inventory levels recovery, incentive spending will remain down.

The Cox Automotive Rates & Incentives (CAR&I) team has developed a methodology for measuring the accuracy of data used to calculate pricing and payment information presented through dealer service provider tools (e.g., dealer websites, inventory management, digital retailing & advertising, desking, equity, etc.). Approximately 17,500 individual dealerships – rooftops, in automotive parlance – in the U.S. rely on CAR&I incentive data for powering 5 different software applications through Cox Automotive native software/sites and our many industry partners. In all, an estimated 90,000 applications are relying on CAR&I data in a given month, providing valuable information to 40 million shoppers.